Zilch Review: Buy Now, Pay Later With Zero Interest

With an average credit card APR hovering around 20%, most buyers should think twice before using one. But life happens, and you may be unable to afford to get something when you need it.

So what are the alternatives to a high-interest credit card?

Buy now, pay later (BNPL) programs like Zilch are the perfect compromise. Use the platform’s virtual card wherever Mastercard is accepted and pay it off over time with no interest.

Our quick guide will give you an overview of Zilch and help you determine if it’s right for you!

What Is Zilch?

Founded in 2018, Zilch is an app-based virtual card on a mission to make credit more accessible to today’s consumers.

The world is changing rapidly, and traditional credit institutions haven’t kept up with their customer’s experiences or spending habits. Seeing this, Zilch is one of many BNPL card companies that wanted to offer money-minded consumers a chance to build credit without the rising rates or punitive late fees.

Aside from giving you more flexibility, Zilch offers transparent payment plans with no hidden costs!

How Does Zilch Work?

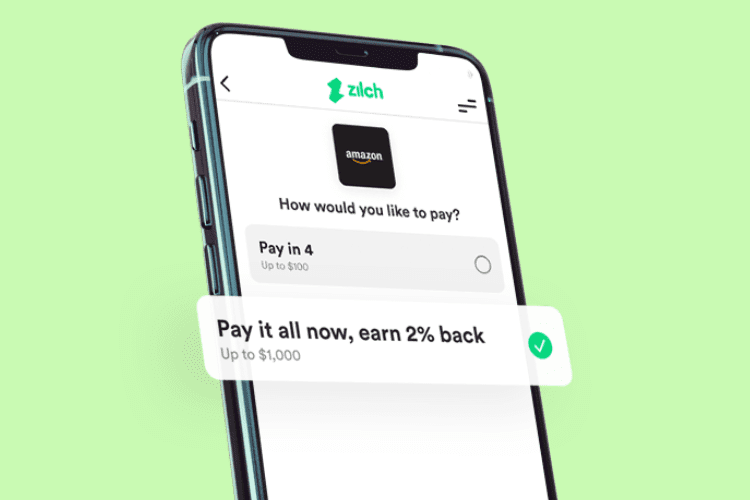

Zilch gives you a virtual Mastercard that’s tied to your bank account. Once you make your purchase, you can pay it back in ways:

- Pay in full: When you use your card and pay everything off in one go, you get a 2% cashback. And rewards you earn can be applied to your next purchase!

- Pay in 4: You can pay 25% or 50% upfront, then make three bi-weekly payments over six weeks.

Both methods won’t require paying extra interest or late fees if you miss a payment with any of their partner brands. It will only charge you a small fee if you use it with a company that’s out of its network.

Zilch is affiliated with over 1,000 stores, including major brands like:

- Amazon

- Sephora

- Nike

- River Island

- Costco

- Apple

- Best Buy

And so many more!

Is Zilch Legit?

Yes, Zilch is a legit site with the latest security features to ensure your information is secure. The app also routinely conducts vulnerability scans and penetration tests to protect your credit card data.

Zilch members also love using the app, and it has an impressive 4.6 on Trustpilot.

“App is super easy to navigate. The sign up process was as easy as they made it seem, and I was approved in seconds! I made my first pay in 4 purchases with no problem!,” says Karyn from Trustpilot.

How To Sign Up For A Zilch Card

Signing up for a Zilch account is a straightforward process. As long as you’re a US resident and over 18, you’re good to go!

Here’s what you need to do to get started:

- Download the Zilch app or visit the site to sign up.

- Enter your personal information, including your name, email address, phone number, and date of birth.

- Verify your account via the confirmation email.

- Once your account is approved, you’ll receive an email showing your available spending limit for pay in 4 transactions.

One thing to note is that Zilch runs soft credit checks to determine your spending limit. While the app doesn’t report anything to credit bureaus, Zilch recently partnered with Experian and may change this policy.

Zilch: Pros And Cons

Pros

- Interest-free payments

- Generous reward program

- Partnered with many major brands

- No late fees

- Virtual card you can carry anywhere

Cons

- Can damage your credit score if you miss payments

- Extra fees if you use the card at a non-partner retailer

The Bottom Line

Having something to help you when money’s tight can make a huge difference. At the same time, traditional credit cards can often be an even bigger financial burden and out of touch with today’s financial climate.

Luckily, Zilch’s virtual card can fill the gap by giving you flexible payment options without going deeper into debt. If you want to try it, visit the platform’s website or download the app to sign up today!

Read More: