Mobills Review: Manage Your Money In One Place

Staying on top of your money can get stressful when you throw your monthly bills, bank accounts, and savings goals into the mix.

And while new personal finance apps can help you, most don’t have that all-in-one approach to make your life easier.

This is where a handy app like Mobills comes in. You’ll get a snapshot of your entire finances instead of juggling multiple accounts.

Let’s dive into what this app can do for you!

What Is Mobills?

In 2013, tech students David Mosiah and Carlos Terceiro had no idea where their money was going at the end of each month.

And then they realized that it wasn’t just them. Many people they knew didn’t keep track of their finances, which led to them missing their financial goals or carelessly spending everything they had.

To fix this problem, they launched the Mobills app in 2014, which has helped over 10 million users easily meet their financial goals. Once you register, you can analyze your finances and create budgets whenever you need to!

How To Manage Your Finances On Mobills

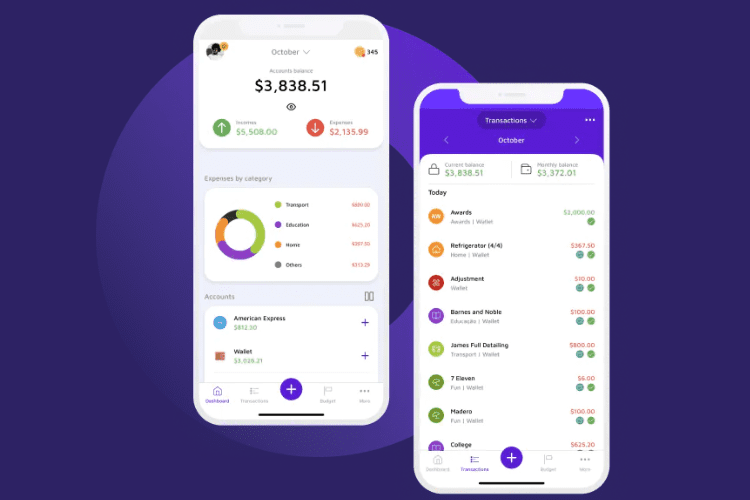

Mobills helps you manage your finances by integrating your bank accounts and credit cards, creating budgets, and giving you a complete view of your finances.

While you can’t make direct transactions from the app, it records your transactions on every account or card you integrate. It will also give you a quick 24-hour reminder whenever one of your bills is coming up, making it easier to pay everything on time.

Mobills’s best feature would have to be its Dreams Tool. This useful feature helps you create realistic savings goals that you can customize based on your needs.

Each of these features is there to help you plan out your monthly expenses and annual financial goals!

Is Mobills Safe To Use?

Yes, Mobills is a legit app, and they ensure your information will be safe. Any personal user data is encrypted and stored in one of their high-security servers.

However, the app has mixed reviews, with a 3.9 rating on the Google Play Store. Most negative comments come from loading time, ads, or paying a fee for premium features.

Still, those that give it positive reviews seem to enjoy their experience:

“Amazing. Every single detail I need to add to an expense, or edit it, twist it, flip it… so far, all of that works perfectly. I love the integration with banks because you don’t have to manually input everything. One thing that could be better is the time it takes for the integration to happen. Maybe we could force a refresh and have the data available. Sometimes I wished to pay something and add more details to the app, but I had to wait for a while for the sync to happen. Still, nice!” says Adriano Belfort from the Google Play Store.

Mobills: Pros And Cons

Pros

- Clean and easy-to-use design

- Easy to manage multiple accounts and expenses in one place

- Simple budget tracker option for your financial goals

Cons

- It’s not very useful if you only have one account

- The Premium recurring fee may be too expensive for some users

- No reward system for meeting financial goals

The Bottom Line

Managing your personal finance can be a hassle, especially if you have a lot of bills, credit cards, and other transactions at the end of each month.

Mobills makes tracking everything a lot easier. The app gives you a detailed overview of your finances without you needing to shuffle between accounts and expenses.

But if you only use one card for everything, the app’s features may be less helpful.

Still, the app can be a great way to analyze your finances and create savings goals, no matter how many transactions you have. If you want to try Mobills, sign up for free and start taking control of your finances!

Read More: