How to Make a Budget Spreadsheet for Free

It’s easy to feel discouraged when you sit down to plan your budget. It’s a lot of information to deal with at one time! In fact, it can be so tough that tons of people use paid software to help them with their budget. That’s kind of an oxymoron though, isn’t it? Spending money on a service that helps you get smarter at saving your money is a little counterintuitive.

If you want to really be frugal, you can put together your entire budget in a spreadsheet, and if you have a free Google sheets account, you can do it without spending a penny.

Before You Start Your Budget Spreadsheet

If you have a PC you may already have Microsoft’s Excel pre-installed, but if you don’t you can get a free month, buy it for $70 for the year or $6.99 per month. Microsoft also has a free “teams” app and comes with a web-based spreadsheet similar to Google Sheets. Apple computers and iOS devices come with Numbers, the Steve Jobs version of a spreadsheet. For the sake of this exercise, we’ll stick with Google Sheets.

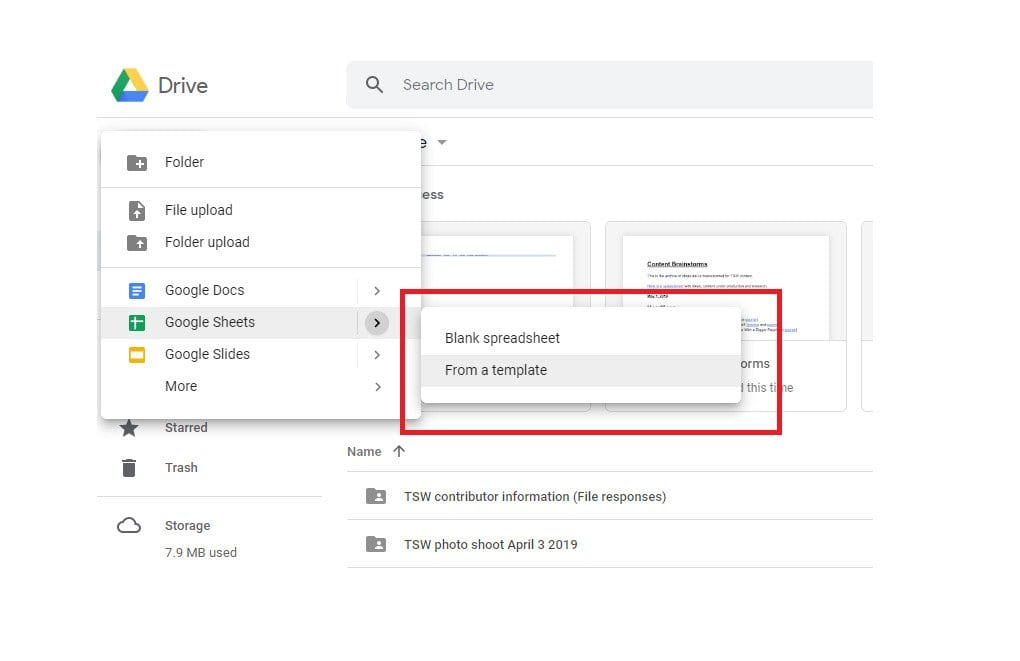

There are several pre-made budget templates available through Google Sheets, and you can download more for free from Google’s Chrome web store. If you want to use the built-in Sheets template, you open a new Sheet from your Google drive, hover over the arrow to the right, and choose “From a template.”

There are templates for personal finance including the “Annual budget tracker” that has pre-made fields for basic expenses. Some of the free plug-ins for Google Sheets have more advanced functions like importing info from your bank to auto-populate the spreadsheet.

At this point, you may be asking yourself, why bother with all this old fashioned spreadsheet stuff when I can probably download an app that does it for me? Two reasons. First, by putting the information into a spreadsheet, you will become more aware of exactly how much you’re spending. And second, once you learn your way around the spreadsheet, you can customize it any way you like – which puts you totally in control.

1. Setting Up Your Budget Spreadsheet

The key to a good budget spreadsheet is organization. A well-managed spreadsheet can make all the difference when it comes to sticking to your plan or falling back into your old ways.

Start by deciding if you want to tackle your budget in weeks, months, or years. Going on a monthly basis while tracking overall spending for the year is the simplest method, but do whatever works for you.

Once you have decided on the time periods you will use to arrange your budget, think about your strategy. Are you saving for retirement or the down payment on a car or house? Do you need to use the snowball or avalanche method for reducing your debts? Keeping track of your income and spending is the first step, but feeling good about why you’re budgeting is also crucial.

For more, see our Complete Step-by-Step Guide to Get Out of Debt.

2. Money In, Money Out

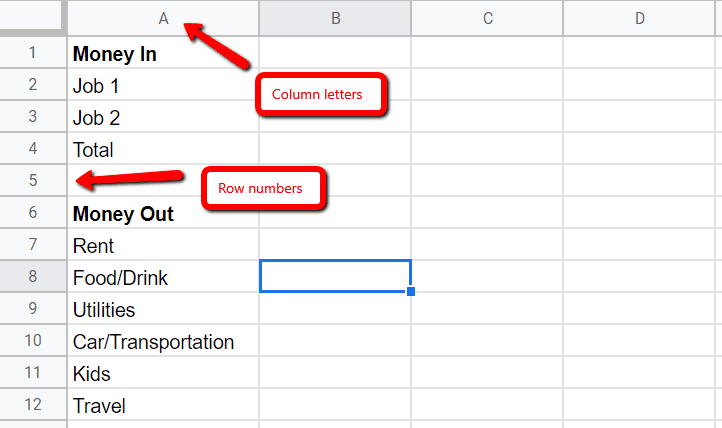

For those who haven’t used a spreadsheet before, sheets are laid out in rows that go from left to right and columns that go from top to bottom. Rows are numbered (one to infinity) and columns are lettered (A, B, C, and so on). In the first column, list your sources of income and all your expenses. So far, you should have something like this:

If it would help you track your spending better, you can keep dividing your costs into smaller items. For example, under utilities list your gas, water, and electric bills separately.

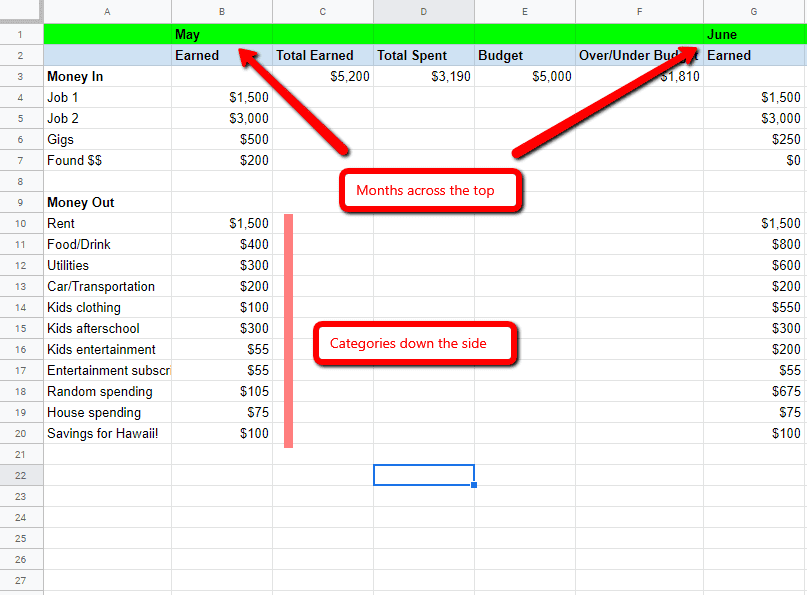

The columns are for the kinds of spending you do, and the rows are for tracking those categories over time. In this case, we’re tracking months, so we’ll put months across the top row of our spreadsheet, like this:

Now fill in your income and expenses and tally them up. If you’re planning your monthly budget, put in your monthly salary and bills, and if you’re tracking weekly or annually just divide as necessary.

You can use the SUM tool to save yourself from having to set up the calculations manually. The beauty of an online spreadsheet is it does all the math for you – after you take a few minutes to familiarize yourself with how formulas work. This is a great guide to get you started.

Organizing your expenses is a great way to identify areas you might be overspending. If you see, for instance, that you’re spending more on food and drink relative to your other costs, you might want to cut down on dining out.

3. Tracking Your Budget

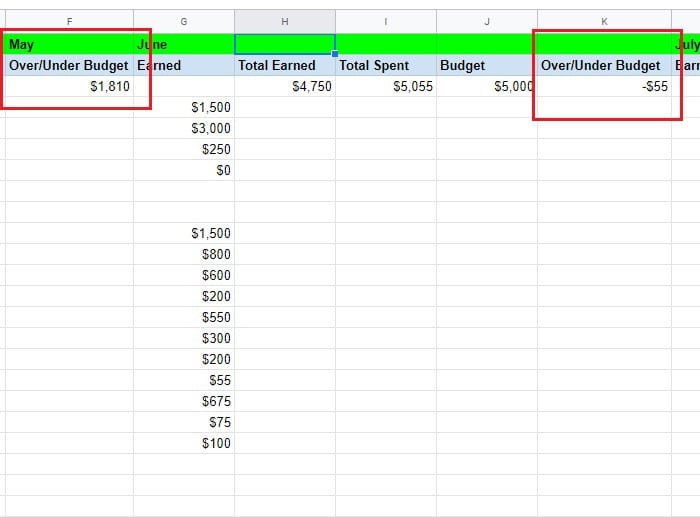

Now that you have an overview of your overall finances, it’s time to get serious about budgeting. Analyze your spending compared to your earnings and set a hard cap on monthly spending.

Put that number in a column next to your income, and set the third column to track spending. Here’s where you’ll do the nitty gritty of budgeting. Each month should have a cell that looks like this:

4. Stay Diligent

To spare yourself the hassle, you can set functions to automatically add up your expenses and track them, so every time you update your spending your budget should update itself.

Staying on top of things is the most important part of the process, so make sure you’re constantly updating your spending and income as they change.

5. Focus On Your Goals

Remember that budgeting is a long term process, and not every month is going to be perfect. Unexpected expenses pop up from time to time that hurt your budget one month – but don’t let that discourage you.

Your budget isn’t meant to scare you, it’s supposed to help. Even if you find yourself over budget one month, stay calm and look for solutions. With a well-constructed budget spreadsheet, all the answers you need will be right in front of you.