Your Credit Score is Important – Here’s How It Gets Made

Your credit score, a three-digit number assigned to you by credit reporting bureaus, is more than your financial report card. It’s the gatekeeper to your financial success. Without a strong score, you can’t access financing for a car, a home or home improvements; you might not qualify for a personal loan, line of credit or even a credit card. Or you’ll be subjected to such high interest rates that you’ll find yourself running on a perpetual rat wheel of debt.

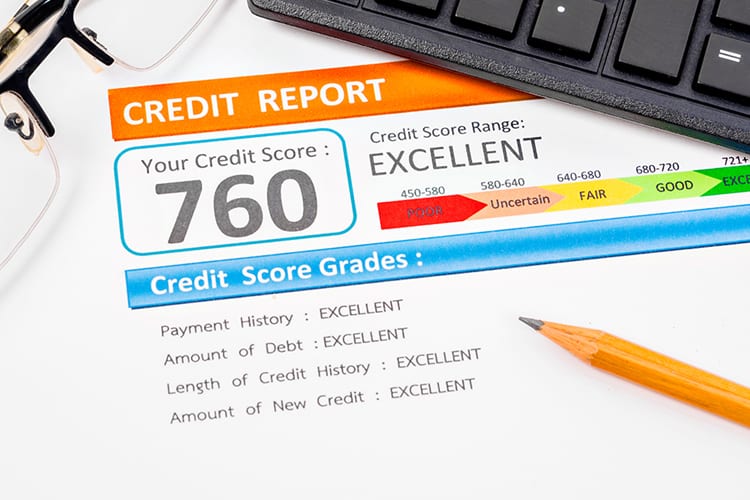

Though they keep the exact formula secret, the credit bureaus (Experian, Equifax, and TransUnion are the three major ones) do indicate what goes into the calculation of your credit score. Bear in mind, your score can fluctuate from month to month.

Payment History

Your payment history is the single most powerful statistic used to rate your credit score, counting for some 35% of it. Lenders want to know they can count on your paying bills in a timely fashion. Habitually delinquent payments won’t help lenders won’t feel good about letting you borrow money for a home or car.

The following factors may send your payment history rating (and your credit score along with it) up or down:

- Do you pay your bills on time, every month?

- How many 30, 60, and 90-day late payments does your credit show?

- How many accounts do you have in collections?

- Do you have bankruptcies, foreclosures, wage garnishments, liens, or public judgments against you? These are usually grounds for automatic denial.

- How long has it been since your last late payment? Time reduces the impact these late payments have on your score.

Credit Utilization Ratio

Your credit utilization ratio measures your amount of debt compared to your total available credit. If you have one credit card with a $1,000 line, then $1,000 is your total available credit. If you have spent $800 of that amount, then your credit utilization ratio is 80%.

This really matters since lenders prefer to see your credit utilization ratio at or below 30%. Your use of credit, and how efficiently you pay it down, counts for 30% of your credit score. This makes it only slightly less important than payment history.

Debt Level

Your debt-to-income (DTI) ratio divides your entire monthly debt payments by your gross monthly income. The result is a percentage that gives lenders an insight into your financial status and creditworthiness. The more debt you have, the higher your DTI will be.

You should aim for a DTI of 20% or less. This lets lenders know that you take care of your debts promptly and make good on your repayment promises without overleveraging your income. A DTI above 40%, on the other hand, screams, “I’m overloaded with obligations!”

Length of Credit History

The length of your credit history counts for 15%, which can be frustrating for young adults just starting to build their credit reports. This component looks at the length of time you’ve had obligations, your oldest account, and the average of all accounts combined.

You can’t make the years go faster, But, over time, try to make the right choices to extend your credit history of on-time payments. As you work to accomplish that goal, you can make sure your shorter credit history works in your favor by minimizing your debt load and paying on time, every time.

Here’s an easy trick to boost this part of your credit score rating: Bring a credit card balance down to zero, then keep it that way, not using the card but leaving the account open. The account’s age and low balance will boost your score over time.

Inquiries

It also matters how many people check your credit score. Every time a lender performs a “hard” inquiry, also known as a hit, to collect information about your credit history and score, it’s permanently recorded for up to two years. For example, if you apply for five credit cards in the next month, you’ll have five hard credit hits showing on your report.

For most people, each credit inquiry deducts five points (or less). Too many hits in too short a period of time, like the aforementioned five, will make you look reckless or desperate for money to lenders and decrease your score. Several hard inquiries are okay for the every-now-and-then purpose since overall inquiries account for just 10% of your total credit score, but it’s still an important factor to consider.

By understanding the most important components of your credit score, you can start to take control of it and take steps to strengthen it. Boosting your score will open doors you never even realized were closed!

Don’t wait to get out of debt! Read this: A Complete, Step-By-Step Guide to Get Out of Debt.