Cash App Is Rolling Out Personal Loans Up to $200

Peer-to-peer payment systems like PayPal, Venmo, and Cash App have become immensely popular, and partially phased paper money and checks further out of everyday life. These apps typically make consumer’s lives easier but can be a major headache for traditional financial institutions. As these platforms grow, that only becomes more true.

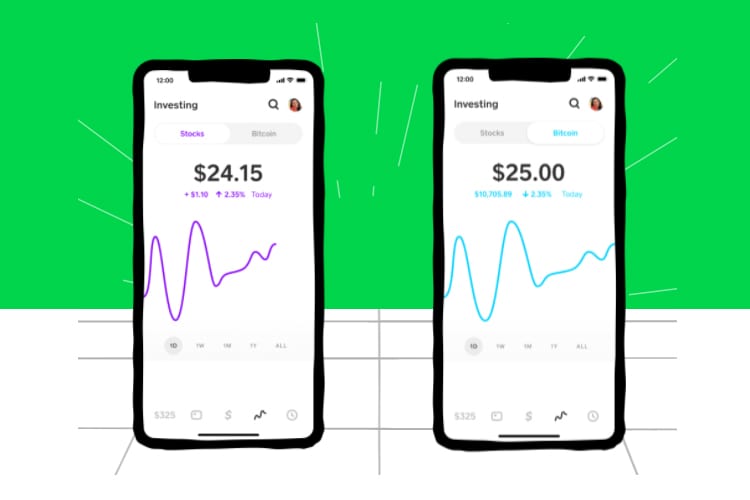

Recently, Square, the parent company of Cash App, launched a trial run of a new disruptive but useful service. Select Cash App users were made eligible for small personal loans, and the company is considering expanding the service according to TechCrunch.

Personal Loans Through Cash App

At a time when an unprecedented amount of Americans are dealing with financial uncertainty, Cash App is testing out short-term, low-principle loans. The offer was made available to 1,000 users but could become widespread if the test goes well.

Loans run from $20 to $200, plus a 5 percent flat fee, and are due back in four weeks. For instance, if you took out $100 from the app, you’d owe back $105 after four weeks. If you miss a payment, Cash App hits you with a 1.25 percent non-compounding interest fee for every week you’re late. After missing a payment once, users are no longer eligible for loans through the app.

Loans like these can be very useful, especially for people going through financial hardships, but that doesn’t mean they’re always a good idea. Unless you really need the money, the fees and costs of borrowing often make it too expensive to be worthwhile. Cash’s loans come with relatively low fees compared to other small-dollar loans like payday advances, but can still be costly.

It’s not certain that Cash App will expand the program at all, but it certainly has potential. Most small-dollar loans start around $200 and carry APRs as high as 600 percent. Low-principle, low-fee personal loans could be very valuable for borrowers wary of taking on too much risk. Currently, a majority of young Americans are struggling to manage their finances, and it’s unclear if or when government stimulus will come. If the Cash lending pilot goes well, it could become a really valuable service for Americans struggling to get by.