Stash Review: Invest in Google, Microsoft, Spotify and More

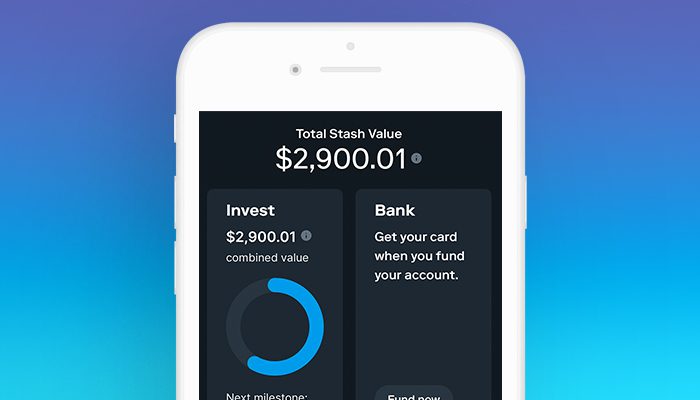

Stash is an investment app that helps new investors build their portfolios and currently has over 5 million members.10 The six-year-old company based out of New York City also offers an online bank account and a debit card1 which includes Stock-Back® rewards from merchants on qualifying purchases.2

- No Investing Minimum8

- Fractional investing lets you buy pieces of expensive stocks8

- Smart Portfolios option offers hands-off stress-free investing12

- Attend virtual Stock Parties to get a piece of offered stock(s) reward

- $10 welcome bonus after the initial deposit of $5 in Invest Account4

- The fees can add up, especially for small accounts

- ETF expense ratios eat into returns

- Primarily for ETF and stock investing

How Stash Works

Unlike a robo-advisor, which directly invests money for you in a diversified portfolio, Stash is a micro-investing app that aims to guide you in the process of picking investments in ETFs and individual stocks. The platform grants access to thousands of single stocks and ETFs.

Stash renames existing funds into easy-to-comprehend themes sorted by risk tolerance, goals, interests, and values and also offers individual stocks. For example, Stash renames the iShares Global Clean Energy ETF as “Clean & Green.” The app also offers automated features such as a Round-Ups which allows a user to round up their purchases to the nearest dollar from their linked external bank account and the money is deposited into their investment account.

Smart Portfolios

Members with Growth and Stash+ plans have access to the new Smart Portfolio feature which provides hands-off stress-free investing.9

All you need to do is add cash and Stash will utilize their financial research to pick ideal investments for you based on your risk level as well as rebalance the mix on a quarterly basis.

This automation makes investing even easier!

Earn Stock While You Shop

Stash also has a debit card service1 that boasts “Stock-BackⓇ” rewards on purchases at more than 11 million locations11. Users in the program can earn 0.125% Stock-BackⓇ on all purchases and, at times, as much as 5% at certain merchants with bonuses.2

Basically, when you shop at participating merchants with your Stash debit card, they’ll reward you with stock in that company. These include big brands like Walmart, Starbucks, Amazon, and more.

If you use your debit card merchant that doesn’t have a matching investment, for instance, your local hair salon, they’ll reward you with an investment of your choice from a predetermined list instead.2

Stock Parties Gives Bonus Stock

Members can claim bonus stock when attending a virtual Stock Party which is held at random times to allow more people to join in on the fun.

Typically, you’ll have an hour from the start time to claim the stock. The more people that attend the party, the bigger your share of the total pot can be!

Some of the recent bonus stock they’ve given out include Nike, Southwest Airlines, Home Depot, and Peloton just to name a few.

Why Stash Might Be Worth Your Time

Stash can be great for investors who want more control over their portfolios than robo-advisors offer but need hands-on assistance.

Users can also buy fractional shares of popular companies such as Amazon or Facebook without spending thousands of dollars.8

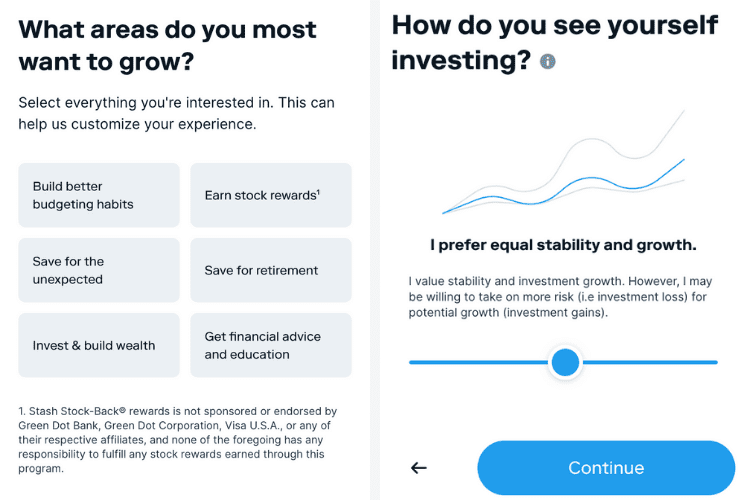

How to Get Started

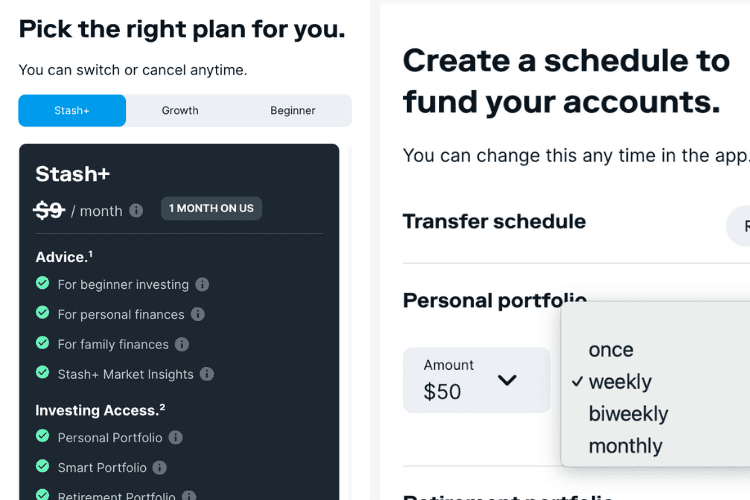

To sign up, users need to create an account. The Stash Growth Plan starts at $3.00 and includes an Investment account, a no hidden fees bank account3, and access to Smart Portfolio, which provides hands-free investing.

You’ll also get a $10 welcome bonus after the initial deposit of $5 in an Invest Account.4

After answering a few questions to determine risk tolerance and goals, you’ll then be prompted to link your personal, non-business bank account either by logging in to your bank account or using an account & routing number. You can also link a debit or credit card as well when signing up.

How Does Stash Make Money?

Stash has two different monthly plans9 ranging from $3 for Growth and $9 for Stash+ depending on your preference.3

You can switch as your life changes or cancel at any time.

Is Stash Legit & Safe?

Stash has been around a while in robo-advisor years. In addition to having been around for 6 years and with 5 million+ clients,10 Stash has lots of other things going for it.

- Stash is a registered investment adviser with the SEC.6

- Stash also offers FDIC-insured bank accounts7 through Green Dot Bank

So yes, Stash follows federal regulations to protect you, the investor.

Financial, #1 Investing Pick

Fractional investing lets you buy into expensive stocks

Stash aims to guide you in the process of picking investments in ETFs and individual stocks

With an entire section dedicated to educational content, you can better understand your portfolio

Final Thoughts on the Stash App

New investors who want guidance on selecting their investments should consider Stash, as well as those seeking assistance finding thematic or impact investing opportunities. For those who do not need that guidance, you’re better off finding the ETFs that Stash offers through commission-free online brokers. Others who want to build their own diversified portfolio may find the app attractive as they can do so with very little money via fractional shares.

Sign up for Stash today using this link and receive a $10 bonus to invest after your first deposit of $5 or more into your Invest account.

Paid non-client endorsement. See Apple App Store and Google Play reviews. View important disclosures.

The paid partner received cash compensation of up to $150.00 (per cost per action) for providing this endorsement. Compensation creates an incentive for the individual to recommend Stash. Endorsements are not representative of the experience of all clients and are not guarantees of future performance or success. For a representative sample of client testimonials, refer to Apple App Store or Google Play reviews To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account (“Personal Portfolio”).

Promotion offer is subject to Terms and Conditions. *T&Cs.** You must complete within the specific time period included in this offer: (i) successfully complete (or already have completed, or re-apply for and complete) the registration process of opening an individual taxable brokerage account (“Personal Portfolio”), (ii) link a funding source to your account; AND (iii) deposit at least $5 from your funding source into your Personal Portfolio. *T&Cs

Nothing in this material should be construed as an offer, recommendation, or solicitation to buy or sell any security. All investments are subject to risk and may lose value. All product and company names are trademarks ™ or registered ® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

Stash Growth Plan starts at $3/ month. You’ll also bear the standard fees and expenses reflected in the pricing of the ETFs in your account, plus fees for various ancillary services charged by Stash and the Custodian. Please see the Advisory Agreement for details. Other fees apply to the bank account. Please see the Deposit Account Agreement.

1 Bank Account Services provided by and Stash Visa Debit Card (Stock-Back® Card) issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. Investment products and services are offered by Stash Investments LLC, not Green Dot Bank, and are Not FDIC Insured, Not Bank Guaranteed and May Lose Value. In order for a user to be eligible for a Stash debit account, they must also have opened a taxable brokerage account on Stash.

2 Program is subject to Terms and Conditions. Stash Stock-BackⓇ Rewards is not sponsored or endorsed by Green Dot Bank, Green Dot Corporation, Visa U.S.A., or any of their respective affiliates, and none of the foregoing has any responsibility to fulfill any stock rewards earned through this program. In order to earn stock through this program, the Stash Debit card must be used to make a qualifying purchase (What doesn’t count: Cash withdrawals, money orders, prepaid cards, and P2P payments. See Terms and Conditions for more details). In order for a user to be eligible for a Stash debit account, they must also have opened a taxable brokerage account on Stash. Stock-Back Rewards that are issued into a participating customer’s personal brokerage account via the Stash Stock-Back Program, are not FDIC Insured, Not Bank Guaranteed and May Lose Value.

3 The Stash Monthly Wrap Fee starts at $1/ month. You’ll also bear the standard fees and expenses reflected in the pricing of the ETFs in your account, plus fees for various ancillary services charged by Stash and the Custodian. Please see the Advisory Agreement for details. Other fees apply to the bank account. Please see the Deposit Account Agreement.

4 Promotion is subject to Terms and Conditions. To be eligible to participate in this Promotion and receive the Bonus, you must complete the following steps: (i) successfully complete the designated registration process of opening an individual taxable brokerage account (“a Personal Portfolio”), (ii) link a funding account (e.g. an external bank account) to your Personal Portfolio, AND (iii) initiate and complete a minimum deposit of at least five dollar ($5.00) into your Personal Portfolio. In the event you only complete the designated registration process to receive the Financial Counseling Service (as defined in your Advisory Agreement), as applicable to you, or do not otherwise complete the account opening process for an individual taxable brokerage account (“Personal Portfolio”), you will not be eligible to receive the Bonus.

5 To note, SIPC coverage does not insure against the potential loss of market value.

6 While such registration does not imply a certain level of skill, it does require us to follow federal regulations that protect you, the investor. By law, we must provide investment advice that is in the best interest of our client.

7 Stash Banking Account opening is subject to identity verification by Green Dot Bank. Stash does not offer an interest-bearing savings account.

8 For Securities priced over $1,000, the purchase of fractional shares starts at $0.05.

9 Stash offers two plans, starting at just $3/month. For more information on each plan, visit our pricing page.

10 This is not an endorsement or a statement of satisfaction by any Stash client and is defined by the number of clients who have e-signed.

11 The Nilson Report, 2019

12 Smart Portfolio is only available in the Growth ($3) and/or Premium ($9) Tier. This is a Discretionary Managed Account whereby Stash has full authority to manage according to a specific investment mandate. Diversification and asset allocation do not guarantee a profit, nor do they eliminate the risk of loss of principal. Stash does not guarantee any level of performance or that any client will avoid losses in the client’s account.

13 This Program is subject to terms and conditions. In order to participate, a user must comply with all eligibility requirements and make a qualifying purchase with their Stock-Back® Card. All funds used for this Program will be taken from your Stash Banking account. This Program is not sponsored or endorsed by Green Dot Bank.

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.