30 Lazy Ways Moms Can Make an Extra $2,000

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.Hey moms, we know your time is precious. Even 5 minutes away from a preoccupied little one can make a major difference in your sanity and yes, your bathroom time is sacred.

So potentially making some side money even in the shortest amount of time, could be really helpful. Five minutes here and there can add up to savings as well as extra cash.

What’s even better is that some are from activities you already do, like grocery shopping, etc! Maximize on your spare time from the below lazy and simple ways and you could have a nice sum when you’ll need it eventually.

1. This Bubble Game Already Paid Out Millions to Players This Year

Pop some bubbles & win some cash in 3-minute iOS games.

Check out Bubble Cash , where you can go on a popping frenzy against real players online to win actual cash. Drop a bunch of bubbles at once and get those high-scoring combos. No joke, they’ve already paid out millions so far this year. And with over 36,000 reviews at a 4.6-star rating, it’s legit.

Play for free, and then switch over to cash games whenever you want. Seriously though, cash game winners can win thousands of dollars…by popping bubbles.

2. Get $35,000 Worth of Debt Paid Regardless of Your Credit

Owe $35,000 or less on credit cards? Find a personal loan using MyLendingWallet to pay off all your balances and consolidate them into one balance to make it easier on yourself.

It takes 2 minutes to find loans regardless of your credit status, with APRs from 5.99% up to 36% max. Their network has over 100 vetted lenders, and you’ll be able to compare side-by-side with no obligation quickly.

There’s no credit score impact by checking and the repayment periods are flexible, ranging from 61 days to 72 months (6 years). Plus, you can get the funds as fast as 24 hours!

3. Get Free Money Back on All Your Shopping Hauls

Check your pockets; check your purse. And keep receipts for your iPhone.

Just grab all your recent receipts from your coffee runs, grocery trips, restaurants, and gas station fill-ups, scan them into Fetch Rewards on iOS, and earn points for free money! Connect your email account, as well, to count DIGITAL receipts from Amazon, Instacart, and more.

Basically, snap a pic of your receipt from anywhere, and that’s it; you’ve got points for money. There’s no minimum spend, no need to select items manually, scan in any receipt from any store or gas station, and it’ll automatically reward you.

It’s free and easy to use and is a must-have iOS app for anyone who buys stuff!

4. Take Surveys & Play New Games to Earn Extra Cash

Join over 15 million other members already completing surveys, playing games, and shopping from Swagbucks, a free rewards program where you’ll earn cash for your time. With consistent use, members can earn about $50 a day having fun! Plus, they’ve already paid over $600 million in gift cards and PayPal cash to their members.

Taking surveys is the best way to make money on Swagbucks. They can take 10 minutes or more and topics can revolve around food, beverages, household products, cars, and more. The next best way is to play new-to-you games! As you collect Swagbucks Points (SB) from completing tasks, redeem them for gift cards and cash!

New members can get a free $5 just for signing up, so join Swagbucks and start earning free rewards!

5. Get Free Cash Back Every Time You Get Groceries, Gas, or Meals

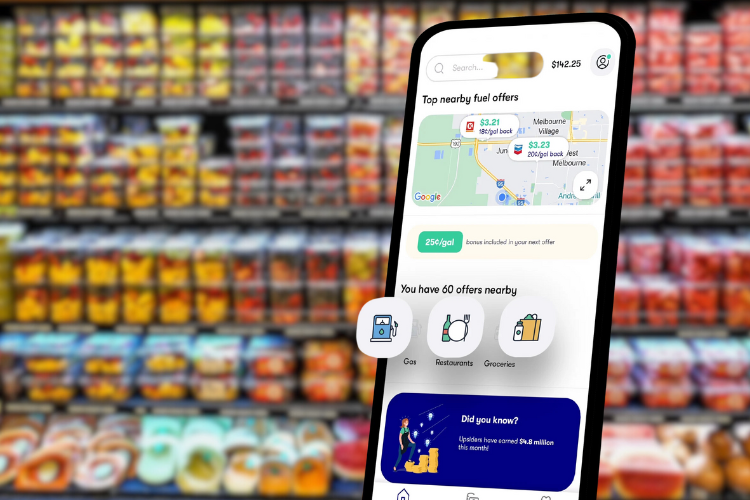

Why not get free money back any chance you can get? That’s why we like Upside, a free cash back app that partners with 100,000+ businesses to bring you great offers you can’t get anywhere else.

On average, frequent users earn an extra $340 a year for just getting things they already buy!

“Easy money back without a catch. I’m getting cash back on stuff I would’ve had to buy anyway. Upside gives you easy savings that you actually see!” – alicejpark90

Wherever you are, just use the app to see where you can get cash back! You can get up to 25¢ per gallon, up to 30% back on groceries, and up to 45% back at restaurants.

Easily cash out via bank transfer, Paypal, or gift card; there’s no limit to how much you can earn. Download Upside for free to earn cash back, and new members can use a welcome code: TSW25 to get an additional 25¢ a gallon on their first gas purchase!

Gas offers are not currently available in NJ, WI, or UT.

6. When It’s 2024, and You Still Have Credit Card Debt Under $100,000

Stop the anxiety attacks by getting rid of your debt. If you owe $100,000 or less, AmONE can help by matching you with a low-interest loan to pay off all your balances. Problem solved.

Their interest rates start at just 6.40% compared to credit cards, which can go as high as 36%! Plus, it’s only one monthly bill, making it way easier to manage.

There’s also no credit score impact to check, and repayment periods are flexible. Take 2 minutes to check, and you can get funds as quickly as 48 hours to wipe that credit card debt!

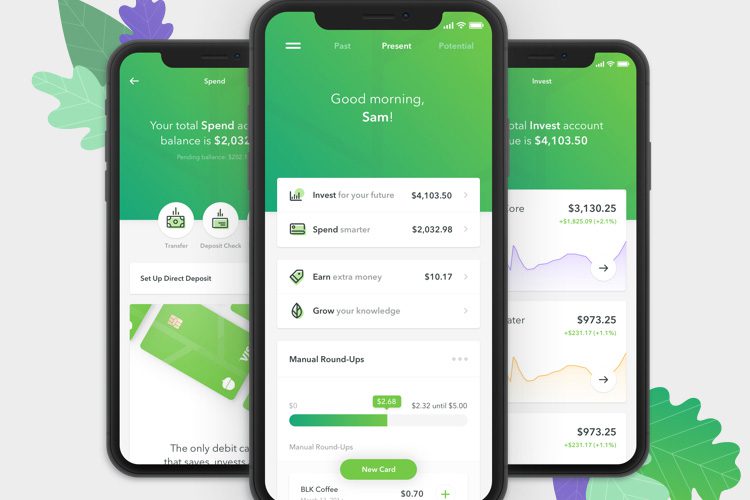

7. The Money App Backed by Celebrities That Saves AND Invests for You

Acorns has caught the attention (and their investments) of Blackrock, Paypal, and major names like Dwayne Johnson and more. Plus, they have about 10 million all-time customers!

That’s because Acorns automatically saves and invests your spare change from every purchase with the Round-Ups® feature. You’ll get a diversified portfolio picked by experts based on your investment profile.

You only need $5 to start investing, and when you set up recurring investments, you’ll get a $20 bonus!

Get started in under 5 minutes with no financial experience or expertise needed. You’ll also get access to retirement, investing for families, rewards, and more based on your subscription plan.

With no hidden fees, Acorns makes it easy to invest in your future with your spare change!

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.