Weird (but Totally Legal) Ways To Pay Rent in 2022

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Note: These suggestions are meant to help supplement your finances. If you’re in a more dire situation we suggest speaking with your landlord immediately, calling 211 for organizational assistance, applying for industry grants, and asking friends/family for help.

It’s a fresh new year. We should be grateful for our health and definitely, a place to live.

Even though every time that chunk of rent payment leaves your bank account and into someone else’s, it hurts just a little bit. But it’s the price to pay for having your own living space and basically, a non-negotiable.

So keep making those rent payments and we’re making it a little bit easier by suggesting some things you can do to earn some side cash as well as manage your money more efficiently. Even better when you can get paid for doing stuff you already do!

1. Get $35,000 Worth of Debt Paid Regardless of Your Credit

Owe $35,000 or less on credit cards? Find a personal loan using MyLendingWallet to pay off all your balances and consolidate them into one balance to make it easier on yourself.

It takes 2 minutes to find loans regardless of your credit status, with APRs from 5.99% up to 36% max. Their network has over 100 vetted lenders, and you’ll be able to compare side-by-side with no obligation quickly.

There’s no credit score impact by checking and the repayment periods are flexible, ranging from 61 days to 72 months (6 years). Plus, you can get the funds as fast as 24 hours!

2. Get Free Cash Back Every Time You Get Groceries, Gas, or Meals

Why not get free money back any chance you can get? That’s why we like Upside, a free cash back app that partners with 100,000+ businesses to bring you great offers you can’t get anywhere else.

On average, frequent users earn an extra $340 a year for just getting things they already buy!

“Easy money back without a catch. I’m getting cash back on stuff I would’ve had to buy anyway. Upside gives you easy savings that you actually see!” – alicejpark90

Wherever you are, just use the app to see where you can get cash back! You can get up to 25¢ per gallon, up to 30% back on groceries, and up to 45% back at restaurants.

Easily cash out via bank transfer, Paypal, or gift card; there’s no limit to how much you can earn. Download Upside for free to earn cash back, and new members can use a welcome code: TSW25 to get an additional 25¢ a gallon on their first gas purchase!

Gas offers are not currently available in NJ, WI, or UT.

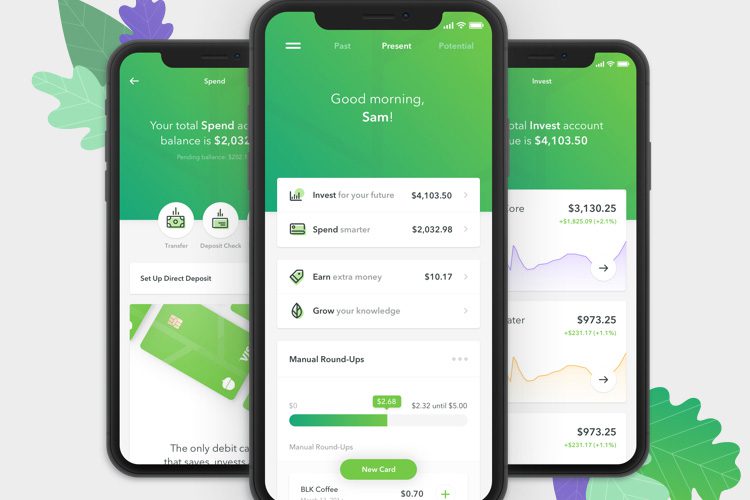

3. The Money App That’s Backed by Paypal, Dwayne Johnson, Ashton Kutcher, and More

Celebrities and leading investors can be particular about where they put their money, but Acorns has caught the attention (and their investments) of Blackrock, Paypal, and major names like Dwayne Johnson and more. Not to mention, they already have 4.7 million+ customers!

That’s because Acorns Banking does more than other types of accounts as it automatically saves and invests for you. Every time you purchase with your new metal debit card, the spare change gets invested into an expert-designed, diversified portfolio of stocks and bonds.

You can get started in under 3 minutes with no financial experience or expertise needed. You’ll also get access to retirement, investing for families, rewards, and more, all in one app.

With no hidden fees, Acorns makes it easy to invest in your future with your spare change.

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.