10 Apps To Try When You’ve Got Nothing to Do

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

So you’ve finished your binge-watch list, your queued up books and games, and are tired of looking at the news. Maybe you achieved a puzzle or two while sipping on some homemade cocktails.

Or maybe you just don’t feel like doing anything at all. That’s fine too!

So when you’re ready to add some more things to do on your currently blank list, check out our suggestions below. It’s a well-rounded mix of apps that are fun, productive, relaxing, and even some will help earn you some money.

1. Have Fun Trying and Playing New Games for Cash

Take a break from scrolling through your infinite feed for updates and relax with some games that actually let you play both for free and for earning cash.

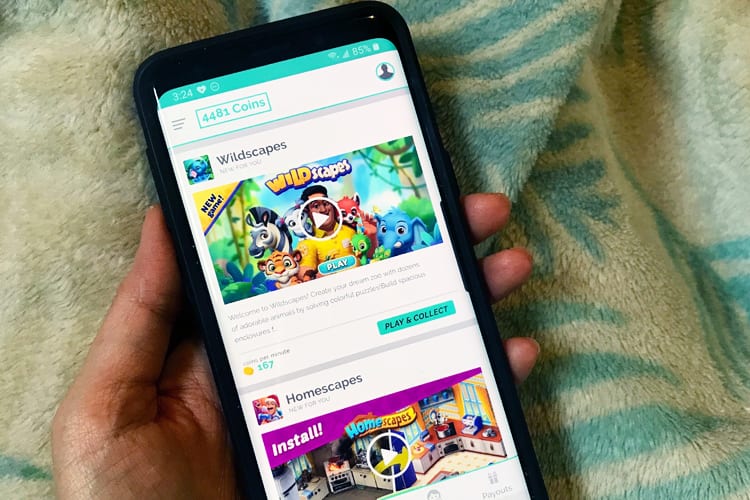

Appstation: Try out new games, earn gift cards. It’s that simple with this game platform where you can redeem for PayPal Cash, Amazon, Game Stop gift cards, and more when you play their featured games!

Mistplay: The more time you spend playing their wide variety of games, the more money you can earn. You’ll automatically get 200 welcome points upon sign up but use promo code Bonus_100 to get an additional 100 points for a total of 300 total points!

Rewarded Play: Popular games include Yahtzee, Wheel of Fortune, Words with Friends, mystery games, fantasy games, puzzle games, and a lot more. The more you play, the more you can get gift cards from 20+ retailers including favorites like Target, Amazon, Walmart, Best Buy, etc.

Pro-tip: Install all 3 above and maximize getting paid to play mobile games!

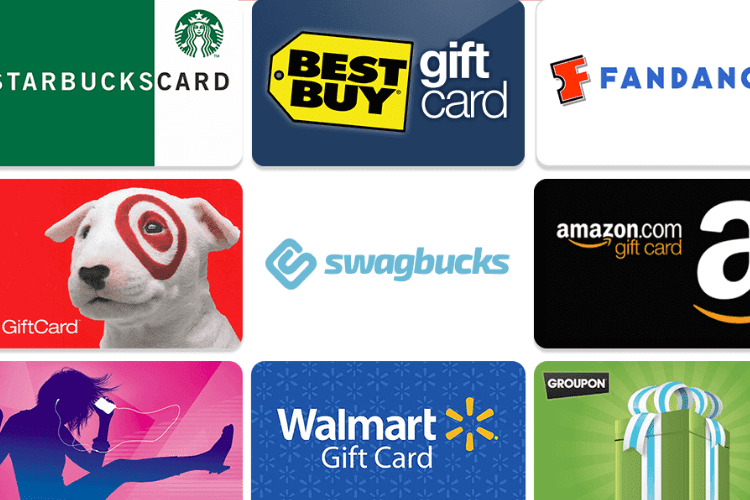

2. Take Surveys & Play New Games to Earn Extra Cash

Join over 15 million other members already completing surveys, playing games, and shopping from Swagbucks, a free rewards program where you’ll earn cash for your time. With consistent use, members can earn about $50 a day having fun! Plus, they’ve already paid over $600 million in gift cards and PayPal cash to their members.

Taking surveys is the best way to make money on Swagbucks. They can take 10 minutes or more and topics can revolve around food, beverages, household products, cars, and more. The next best way is to play new-to-you games! As you collect Swagbucks Points (SB) from completing tasks, redeem them for gift cards and cash!

New members can get a free $5 just for signing up, so join Swagbucks and start earning free rewards!

3.

4. Spin to Win - Earn Coins to Build Adventurous Villages (And Raid Others)

Note: You can’t make any money off this game but we’re adding it in just because it’s fun and a good way to distract yourself when you want to.

Coin Master is a free casual game that’s amassed over 81 million downloads and has earned the rep of being one of the most interactive games on the market.

Spin to earn coins, chances to raid other villages, and build up your own village to move to the next level. There are over 200 uniquely themed villages to build including Steampunk Land, LA Dreams, Magical Forest, Hell’s Village, and more. Pets can also be raised to help you get more coins.

When you need a little break from the real world, head into Coin Master to play for free!

5. Yes, Yet Another Streaming Service You Need in Your Life

Disney fans are already on the new Disney+ streaming service and binging the good stuff.

But if you’re a Marvel, National Geographic, Star Wars, The Simpsons, and Disney Channel fan too, the new streaming platform is worth checking out as well. Heck, even just to see Baby Yoda, it’s worth it.

Especially since it’s only $6.99 a month that includes 4K streaming for Ultra HD goodness.

Get access to scope out the new originals, TV series (7,500 episodes!), and movies (100 freshly released from the theaters and 400+ from the library). This includes stuff from “The Vault” too, movies that have been locked away and only see the light temporarily years later.

You’ve got room for both Netflix and Disney+ in your life. Even better, you can simultaneously stream on 4 screens and download unlimited content on Disney+ too.

6. Customized Workout Classes Whenever You Want

Relieve some of that stir craziness at home with fitness classes you can access anytime, anywhere, along with customizing it to your own schedule and mood.

Do 10 minutes today, and 30 minutes tomorrow. Choose between Beginner, Intermediate, or Expert. There are thousands of live and on-demand workouts ranging from bootcamp, high-intensity interval training (HIIT), dance, barre, strength, yoga, stretching, and more.

NEOU Fitness (pronounced “NEO YOU”) is great for those that miss their group fitness classes, for people who like a variety of classes every day, and want more control over their routine.

Stream on any device screen and filter classes by type, duration, body focus, and more.

For a limited time, new members get 50% off the annual membership for just $49.99 (basically less than $5/month). You can try it out for free for 7-days to see how you like it!

7. Get Access to Doctors and Wellness Coaches 24/7 Even When Homebound

We know we shouldn’t leave the house but what happens when it’s 10 PM and you’re feeling ill? What if you don’t have insurance either?

With 4 Your Health, you can get access to doctors and nurses 24/7 with options to call, email, or video chat. There’s no limit on usage and the physician(s) are licensed in the state you’re calling from. You don’t need insurance (if you don’t have any) and your prescriptions will get sent to your local pharmacy. It’s quick and reliable diagnoses of over 70% of common ailments.

Not only will you have doctors on demand, but it’s also a major health resource for meal plans and streaming workouts, in addition to Wellness coaches where you can email board-certified psychologists, dentists, pharmacists, dieticians, fitness trainers, and alternative medicine specialists.

Get a free 14-day trial to see if it works for you. If you love the convenience and 24/7 access, then it’s just $14.95 a month for you and your entire family. Since 4 Your Health isn’t medical insurance, there are no copays, deductibles or insurance claims to worry about either.

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.