Bitcoin vs. Ethereum: Comparing the Two Biggest Cryptocurrencies

Since Bitcoin emerged in 2009, more than 1,600 cryptocurrencies have been created. There have been joke cryptos like Dogecoin and Coinye, based on an internet meme and rapper Kanye West respectively. There were also promising currencies like PayCoin that excited the crypto community but failed nonetheless. (PayCoin probably failed because the creator was a con man.)

All this is to say that cryptocurrencies have quickly risen and fallen in the decade since bitcoin was developed, and few have managed to last more than a few years. Bitcoin, naturally, has stood the test of time and has not fallen below $1,000 per coin since it broke that benchmark in early 2017. The only other cryptocurrency with a fraction of Bitcoin’s staying power is Ethereum, which launched in 2015.

While both coins are based on blockchain technology, they function very differently. Knowing what sets bitcoin and ethereum apart from all other cryptos – and from each other – is important for anyone considering investing in cryptocurrency.

For starters, most people instinctively compare bitcoin and ethereum as competitors, like Rafael Nadal vs Roger Federer. In reality, it’s more accurate to think of these coins like Federer vs Serena Williams. They’re both important, prominent and successful, but operate in different ways and should not be thought of as head-to-head rivals. Read on to see why.

What Is Blockchain?

Before we dive into the specifics of Bitcoin and Ethereum, it would help to explain the technology that drives them. We have an in-depth explanation of blockchain and its applications, but for now, a brief overview will suffice.

At the most basic level, blockchain is exactly what it sounds like: a chain of blocks. Each “block” is a digital store of records for all of the transactions within a part of the chain. Any time a block is “full,” a new block is created and placed directly after it on the chain. To help visualize this, imagine pages in a notebook. Each line contains unique information, and when a page is full you turn and start a new one. In the same way that notes cannot be edited when written in pen, the blockchain is uneditable.

The “blocks” of the blockchain are also like pages in a ledger or account book. Each block records the history of all transactions and is copies across all the computers that maintain the blockchain. (This is known as a distributed ledger.) No single person can control the chain or currency, but changes are approved by a majority of the network.

Read about micro-investing and how to get started with our complete guide: Micro-Investing: What It Is, Why It’s for You and How to Start.

What Is Bitcoin?

Bitcoin is the granddaddy of them all, the original cryptocurrency and the first major application of blockchain. The currency launched in 2009 and gradually grew in value until 2017. After topping $1,000 per coin for the first time that year the price began to rally until it hit a high of nearly $20,000 on December 18.

The white sheet published by Satoshi Nakamoto, the mysterious creator of bitcoin, explains the goals and purposes of the electronic currency in detail.

Nakamoto writes “A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution”. In design, bitcoin is a currency intended to cuts out third parties like banks or credit card companies. It can do that because the system of storing information on the blockchain removes the need for a third party to verify transactions.

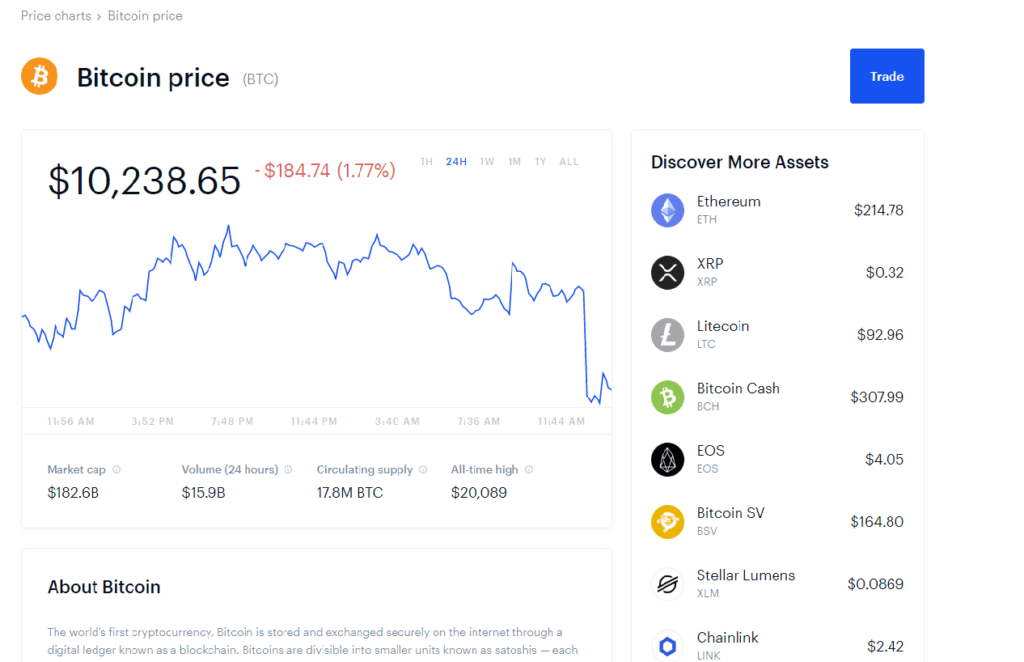

Some bitcoin statistics:

- Currency symbol: BTC

- All-Time High: $20,089

- Supply: 18.5 million BTC

- Current price: $18,000 per BTC

What Is Ethereum?

Ethereum is currently the second-largest cryptocurrency in terms of price and market cap, but it functions very differently from bitcoin. Bitcoin’s blockchain is used to keep a ledger of all transactions across the bitcoin network, while ethereum’s is used to run applications.

While ether (the actual coins within the Ethereum network) can be bought and sold like bitcoin, this trading functionality is not the central purpose of ethereum. Ether is also used by developers to pay transaction fees, so it serves to fuel the network as much as it serves as an independent crypto.

Hoe Lon Leng, a financial analyst with two decades of experience and the author of Decrypted: A financial trader’s take on cryptocurrency writes “Bitcoin is but one application of a blockchain, while Ethereum is a generalized blockchain that any app developer can use for their own purposes.”

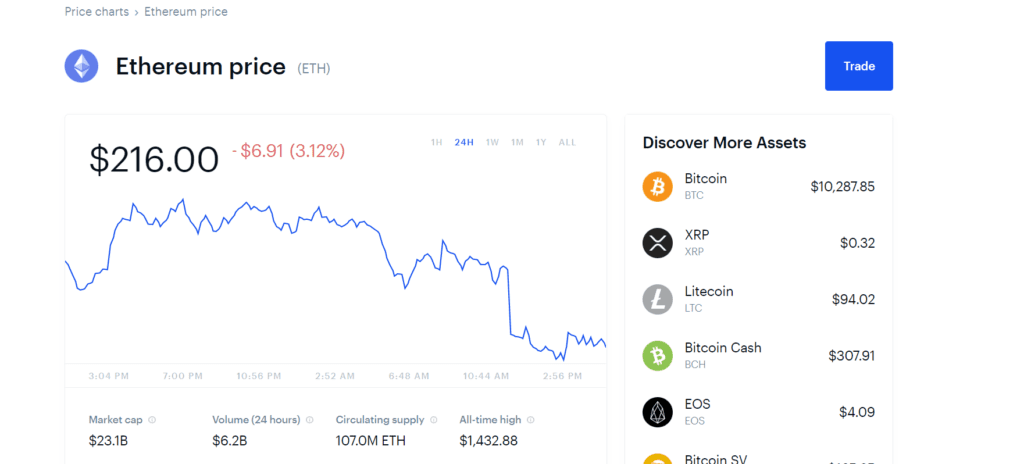

Some ethereum statistics:

- Currency symbol: ETH

- All-Time High: $1,432.88

- Supply: 113.5 million ETH

- Current Price: $475 per ETH

Bitcoin vs Ethereum: Comparing the Similarities and Differences

Both bitcoin and ethereum are decentralized blockchain networks, so at a high level they appear similar but in reality, they are very different. It’s helpful to think of ethereum as the successor to bitcoin – a next step and new application in blockchain technology – but not in the sense that ethereum will one day take over from bitcoin.

The two currencies “compete” on the open market, but serve different purposes. For most people, the ethereum vs bitcoin debate boils down to which crypto you’d rather invest in.