Capital One Venture Rewards Card: Easy to Earn, Even Easier to Redeem

With so many credit cards on the market, finding the right one for you can be tricky! There are many factors to consider when applying for a new credit card, and your travel habits are definitely one of them.

If you’re a regular or moderate traveler but aren’t loyal to any particular airline, hotel, or travel brand, then the Capital One Venture Rewards Credit Card might be the one for you. This card offers a sweet early spend bonus for a nominal annual fee if you can meet the spending requirements.

Let’s go through the highlights in this Capital One Venture Rewards Credit Card review so you can determine if it’s the right one for your wallet:

How Does the Capital One Venture Rewards Card Work?

The Capital One Venture Rewards Credit Card has quickly become another popular travel rewards credit card- and for plenty of reasons!

Not only can you earn 2X miles per dollar spent on every purchase and 5X miles per dollar spent on hotels and rental cars booked through Capital One Travel, the card currently comes with a fabulous new early spend bonus of 75,000 miles when you complete the minimum qualifying spend of $4,000. This card is excellent for moderate travelers looking to leverage a significant early spend bonus to redeem for free travel.

Let’s break down the details:

Annual Fee: $95

New Member Early Spend Bonus Offer: 75,000 miles after spending $4,000 within the first three months or 90 days of account opening. That’s equivalent to $600 worth of free travel when redeemed through Capital One Travel. (1 mile = 1 cent via the Capital One Travel portal)

Rewards Rates and Categories:

- Unlimited 2X miles per dollar on all purchases

- 5X miles per dollar on hotel and rental car purchases through Capital One Travel

Credit Score Required: 700+ (Not sure if you have a good credit score? Check it for free here.)

What are the Best Benefits of the Capital One Venture Rewards Card?

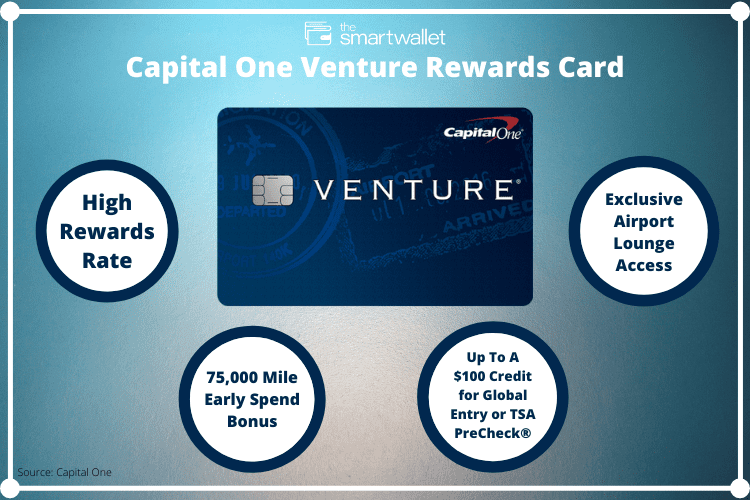

A High Rewards Rate: Most branded travel cards only offer 1 point or 1 mile per dollar on most purchases, but the Capital One Venture Rewards card keeps it quite simple. You’ll earn a cool 5X miles per dollar spent on hotels and car rentals booked through Capital One Travel and an unlimited 2X miles per dollar spent on all of your other purchases: pretty sweet!

A 75,000 Mile Early Spend Bonus: The Capital One Venture Rewards card will give new members a 75,000 mile boost towards your next vacation or trip. All you’ll have to do is spend $4,000 within the first three months or 90 days from account opening.

Receive up to a $100 credit for Global Entry or TSA PreCheck: When you use your new card to pay the $100 Global Entry or $85 TSA PreCheck application fees, you’ll receive reimbursement directly to your credit card statement!

Exclusive Airport Lounge Access: This card allows you two complimentary visits annually to Capital One lounge locations. Afterward, it costs just $45 per visit. A small price to pay for some privacy and a more luxurious place to sprawl out before boarding your next flight!

Note: Currently, only one Capital One Lounge is open, located at Dallas Fort Worth International Airport (DFW). Two more lounges are slated to open in 2022 at Washington Dulles International Airport (IAD) and Denver International Airport (DEN).

Some great additional benefits include:

- No foreign transaction fees

- 24-hour travel assistance services

- Travel accident insurance

- Auto rental collision damage waiver

- Extended warranty protection for items purchased with your card

- Achieve Hertz Five Star® Status: Cardholders can access a wider selection of rental cars and upgrades when they book through Hertz.

- Access to Capital One Experiences: Cardholders get early and exclusive access to premium entertainment experiences such as concerts, sporting events, restaurants, and more.

- Access to Capital One Shopping, a browser extension that automatically applies coupon codes for you when you shop online!

How Can You Redeem Miles with the Capital One Venture Rewards Card?

Cardholders have several options when it comes to how to redeem their miles:

- Book Travel Through the Capital One Travel Portal: The Capital One Travel Portal offers flights, hotels, rental cars, and even vacation packages!

- Cover Past Travel Purchases: You can redeem miles for past travel purchases made with your Venture card within the last 90 days. This can include anything travel-related, including the purchase of a flight, hotel, rental car, etc. You could essentially pay for travel purchases from your most recent trip with enough miles. So, using miles in exchange for a cash back credit! While similar to cash back, it’s important to note that miles are valued at double the amount when redeeming through this feature versus the cash back feature (1 cent per mile versus just 0.5 cents per mile for cash back).

- Easily Transfer Miles to Partners: Capital One allows cardholders to transfer miles to 15+ different travel partners, allowing for greater flexibility to redeem your Venture miles through partner airlines and hotels.

- PayPal: Simply add your Venture card to your “wallet” on PayPal and you’ll be able to use miles to pay for all or part of your purchase.

- Amazon: Easily link your Venture card to your Amazon account and you’ll be able to use miles towards your purchases.

- Gift Cards: If you want, you can even use your miles to redeem gift cards to popular retailers like Barnes & Noble or Best Buy.

- Cash Back: While this card is designed for travel, you can still redeem your miles for cash back, which will be applied as a statement credit (we love that free money!)

We know that point valuations can be confusing, so here’s a reference chart for you to understand how much your miles are worth in each redemption category:

Capital One Venture Rewards Card Miles Valuation By Category

| Redemption Option | Miles Values |

|---|---|

| Book Travel through Capital One Travel | 1 cent per mile |

| Cover Past Travel Purchases | 1 cent per mile |

| Transfer Miles to Travel Partners | Starting at a 1:1 transfer ratio, with a minimum of 1,000 miles |

| Shop Online with PayPal or Amazon | 0.8 cents per mile |

| Gift Cards | 0.8 - 1 cent per mile |

| Cash Back | 0.5 cents per mile |

As you can see from the above, you get the most value from your miles when redeeming for travel, whereas you get the least when redeeming for cash back. Overall, you have plenty of options when it comes to how you choose to redeem your miles.

What Are The Pros and Cons of the Capital One Venture Rewards Card?

Pros:

- A nominal $95 annual fee gets you a pretty hefty 75,000 miles early spend bonus if you can meet the $4,000 minimum spend requirement in the first three months.

- Flexible options for reward redemption

- A healthy list of extra “added value” incentives

- Access to a growing number of airport lounges

Cons:

- Having to pay an annual fee

- Requires a higher credit score to qualify

- Miles are valued at half the amount when redeeming for cash back versus travel.

The Bottom Line

If you’re a moderate traveler and you’re looking to give yourself a nice miles boost, then the Capital One Venture Rewards Credit Card should certainly be a consideration. It offers one of the highest early spend bonuses of any comparable travel rewards credit card, for a chewable $95 annual fee, and it provides an appealing unlimited 2X miles per dollar on all purchases.

Overall, I found the Capital One Venture Rewards Credit Card landing page to be somewhat lacking in terms of detailed information about card features and benefits, especially when compared to the landing page for the Chase Sapphire Preferred Card.

Additionally, we don’t recommend this card for anyone looking to earn significant cash back or a cash bonus. As you can see from the above, you’ll earn half the amount of cash back when redeeming your miles as you will when you redeem for just about any other category.

All of that being said, this card is definitely a winner if you’re looking for travel rewards, a simple way to redeem your miles and to earn double the miles on every purchase. If you think this is the card for you, then act now!

The Smart Wallet has partnered with CardRatings for our coverage of credit card products. The Smart Wallet and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.