Capital One Venture vs. Capital One VentureOne Rewards Card: What’s the Difference?

Disclosure: The Smart Wallet has partnered with CardRatings for our coverage of credit card products. The Smart Wallet and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Disclosure: The Smart Wallet has partnered with CardRatings for our coverage of credit card products. The Smart Wallet and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

There always seems to be a new credit card to apply for, and finding the right one for you can be challenging! While there are many factors to consider when applying for a new credit card, your travel habits are definitely one of the most important.

Capital One has become a popular provider of travel reward credit cards. If you’re more of a moderate traveler who’s looking for perks and added bonuses, then the Capital One Venture Rewards Credit Card might be the right card for you. If you consider yourself a light traveler and want to avoid an annual fee, then the Capital One VentureOne Rewards Credit Card might be a better fit for your wallet.

First, I’d recommend taking a look at my in-depth review of the Capital One Venture Rewards card. You’ll get a better idea of how that card works before learning about the Capital One VentureOne Rewards card and the key differences between both cards and what they share below.

Trust me, I know it can be easy to get these two cards confused because of the similar names, but let’s make it simple: it’s the Venture Rewards card versus the VentureOne Rewards card.

What Are The Main Differences Between Both Cards?

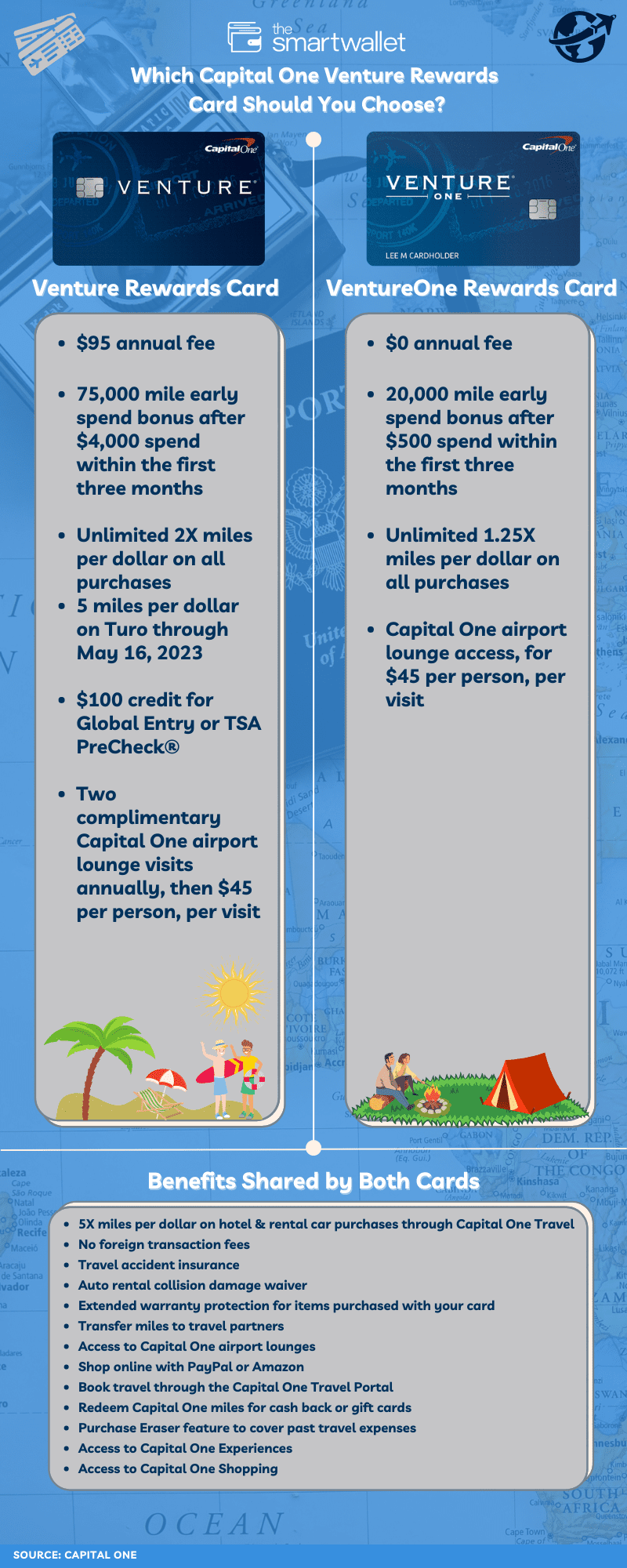

While the Capital One Venture Rewards Credit Card and Capital One VentureOne Rewards Credit Card are pretty similar, here are the main differences between both:

The Capital One Venture Rewards card offers:

- $95 annual fee

- 75,000 mile early spend bonus after $4,000 spend within the first three months

- Unlimited 2X miles per dollar on all purchases

- $100 credit for Global Entry or TSA PreCheck®

- Two complimentary Capital One airport lounge visits annually, then $45 per person, per visit

Meanwhile, the Capital One VentureOne Rewards card offers:

- $0 annual fee

- 20,000 mile early spend bonus after $500 spend within the first three months

- Unlimited 1.25X miles per dollar on all purchases

- Capital One airport lounge visits for $45 per person, per visit

What Benefits do Both Cards Offer?

Well, I’m glad you asked! Now that you’ve already learned about the Capital One Venture card, I think it’d be helpful to highlight what both the Capital One Venture card and Capital One VentureOne card have to offer, plus their differences side by side:

- 5X miles per dollar on hotel and rental car purchases through Capital One Travel

- No foreign transaction fees

- Travel accident insurance

- Auto rental collision damage waiver

- Extended warranty protection for items purchased with your card

- Transfer miles to travel partners

- Access to Capital One airport lounges

- Shop online with PayPal or Amazon

- Book travel through the Capital One Travel Portal

- Redeem Capital One miles for cash back or gift cards

- Ability to use points to cover past travel expenses

- Access to Capital One Experiences: Cardholders get early and exclusive access to premium entertainment experiences such as concerts, sporting events, restaurants, and more.

- Access to Capital One Shopping, a browser extension that automatically applies coupon codes for you when you shop online!

Check out this infographic below, which highlights what each card will offer you, side-by-side, plus what both cards have in common:

Now that you understand their similarities and differences, let’s go through the highlights of the VentureOne Rewards card so you can determine which card is the right one for you:

What Are the Benefits of the Capital One VentureOne Rewards Card?

Now let’s switch gears: the Capital One VentureOne Rewards Credit Card has also become a pretty popular travel rewards credit card too. It can be easy to confuse the two because they’re both Capital One Venture cards, but the difference here is that this one is called the VentureOne Rewards card.

With this card, you’ll earn 1.25X miles per dollar spent on every purchase and 5X miles per dollar spent on hotels and rental cars booked through Capital One Travel. To sweeten the deal, this card currently comes with an early spend bonus of 20,000 miles when you complete the minimum qualifying spend of just $500. This card is excellent for light travelers looking to leverage a decent early spend bonus to redeem for free travel, all with no annual fee.

Let’s break down the details:

Annual Fee: $0

New Member Early Spend Bonus Offer: 20,000 miles after spending $500 within the first three months or 90 days of account opening. That’s equivalent to $200 worth of free travel when redeemed through Capital One Travel. (1 mile = 1 cent via the Capital One Travel portal)

Rewards Rates and Categories:

- Unlimited 1.25X miles per dollar on all purchases

- 5X miles per dollar on hotel and rental car purchases through Capital One Travel

Credit Score Required: 700+ (What’s your credit score? Check it for free here.)

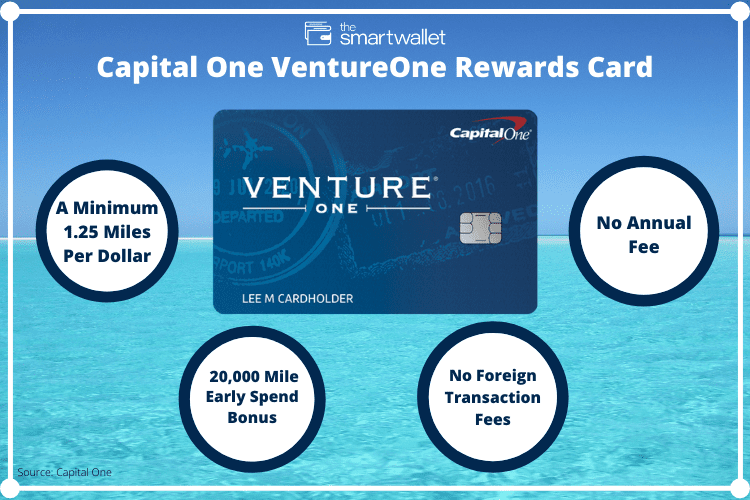

Capital One VentureOne Rewards Card Key Highlights

A Minimum 1.25 Miles Per Dollar Rewards Rate: Most branded travel cards only offer 1 point or 1 mile per dollar on most purchases, but the Capital One VentureOne Rewards card keeps it quite simple. You’ll earn a significant 5X miles per dollar spent on hotels and car rentals booked through Capital One Travel and an unlimited 1.25X miles per dollar spent on all of your other purchases: pretty sweet!

A 20,000 Mile Early Spend Bonus: The Capital One VentureOne Rewards card will give new members a 20,000 mile boost towards your next vacation or trip. All you’ll have to do is spend $500 within the first three months or 90 days from account opening. That’s going to be pretty easy considering the rising cost of just about everything nowadays.

No Foreign Transaction Fees: The Capital One VentureOne Rewards card has no foreign transaction fees on purchases made outside the U.S. So no need to worry about currency conversion fees when traveling abroad!

No Annual Fee: While most travel rewards cards with sizable early spend bonuses have an annual fee, this travel card will save you money! A 20,000 mile early spend bonus without an annual fee is a pretty sweet deal.

Additional Highlights:

- No foreign transaction fees

- 24-hour travel assistance services

- Travel accident insurance

- Auto rental collision damage waiver

- Capital One Airport Lounge Access for $45 per person, per visit

- Extended warranty protection for items purchased with your card

- Access to Capital One Experiences: Cardholders get early and exclusive access to premium entertainment experiences such as concerts, sporting events, restaurants, and more.

- Access to Capital One Shopping, a browser extension that automatically applies coupon codes for you when you shop online!

What Are The Pros and Cons of the Capital One VentureOne Rewards Card?

Pros:

- No annual fee gets you a decent 20,000 mile early spend bonus if you can meet the low $500 minimum spend requirement in the first three months.

- Flexible options for reward redemption

Cons:

- You won’t earn as many miles per dollar as with the Venture Card

- Requires a high credit score to qualify

How Can You Redeem Miles with Capital One Rewards?

Regardless of which card you choose, Capital One cardholders have many options when it comes to how to redeem their miles:

- Book Travel Through the Capital One Travel Portal: This includes flights, hotels, rental cars, and even vacation packages (woohoo!)

- Cover Past Travel Purchases: You can redeem miles for past travel purchases made with your Venture card within the last 90 days. This can include anything travel-related, including the purchase of a flight, hotel, rental car, etc. You could essentially pay for travel purchases from your most recent trip with enough miles. So, using miles in exchange for a cash back credit! While similar to cash back, it’s important to note that miles are valued at double the amount when redeeming through this feature versus the cash back feature (1 cent per mile versus just 0.5 cents per mile for cash back).

- Easily Transfer Miles to Partners: Need even more reward flexibility? Capital One allows cardholders to transfer miles to 15+ different travel partners, allowing for greater flexibility to redeem your Venture miles through partner airlines and hotels.

- PayPal: Once you add your Venture card to your “wallet” on PayPal, you’ll be able to use miles to pay for all or part of your purchases.

- Amazon: Easily link your Venture card to your Amazon account and you’ll be able to use miles towards your purchases.

- Gift Cards: If you’d like, you can even use your miles to redeem gift cards to popular retailers like Barnes & Noble, Best Buy, and more.

- Cash Back: While these cards are really designed for travel, you can still redeem your miles for cash back if you choose, which will be applied as a statement credit (we love that free money!)

We know that point valuations can be confusing, so here’s a reference chart for you to understand how much your miles are worth in each redemption category:

Capital One Rewards Miles Valuation By Category

| Redemption Option | Miles Values |

|---|---|

| Book Travel through Capital One Travel | 1 cent per mile |

| Cover Past Travel Purchases | 1 cent per mile |

| Transfer Miles to Travel Partners | Starting at a 1:1 transfer ratio, with a minimum of 1,000 miles |

| Shop Online with PayPal or Amazon | 0.8 cents per mile |

| Gift Cards | 0.8 - 1 cent per mile |

| Cash Back | 0.5 cents per mile |

As you can see from the above, you get the most value from your miles when redeeming for travel, whereas you get the least when redeeming for cash back. Overall, you have plenty of options when it comes to how you choose to redeem your miles.

The Bottom Line

To sum this all up, the Capital One Venture Rewards Credit Card is for those who are moderate travelers willing to pay that $95 annual fee. You’ll benefit from a high early spend bonus plus an unlimited 2X miles per dollar on all purchases.

Meanwhile, the Capital One VentureOne Rewards Credit Card is certainly the way to go if you travel infrequently and what you’re looking for is a decent enough early spend bonus, but without the annual fee and added perks.

We don’t recommend either of these cards for anyone looking to earn significant cash back or a cash bonus though. You’ll earn half the amount of cash back when redeeming your miles as you will when you redeem for just about any other category.

All of that being said, either of these cards is definitely a winner if you’re looking for travel rewards, a simple way to redeem your miles and the ability to earn lots of miles on every purchase. So go ahead: learn more about the Capital One Venture Rewards Credit Card or the Capital One VentureOne Rewards Credit Card and start earning rewards miles.

The Smart Wallet has partnered with CardRatings for our coverage of credit card products. The Smart Wallet and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.