Capital One Venture X Rewards Card: Premium Travel Benefits With A Bonus

There seem to be more credit cards on the market than ever before. Finding the right one can seem daunting, but not to fear. We’re here to help you pick the right card for your wallet!

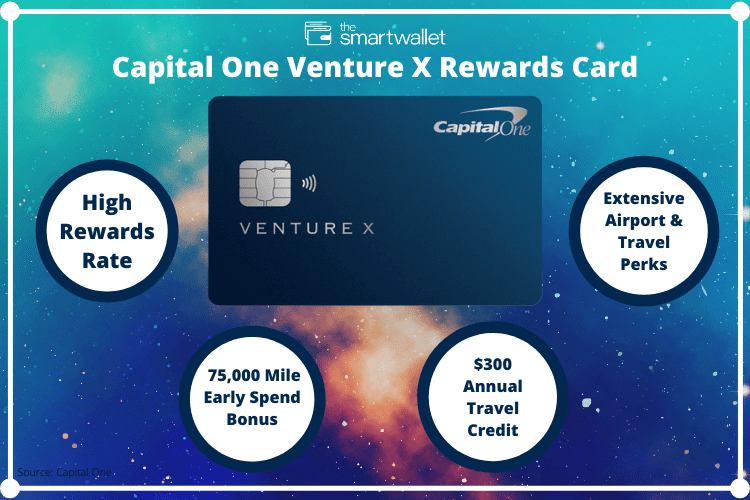

If you’re a frequent traveler with high expenses and you aren’t loyal to any particular airline, hotel, or travel brand, then the Capital One Venture X Rewards Credit Card might be the one for you! This card currently offers a 75,000-mile early spend bonus if you can meet the $4,000 spending requirement.

Let’s go through the highlights in this Capital One Venture X Rewards Credit Card review so you can determine if it’s the right card for you:

How Does the Capital One Venture X Rewards Card Work?

The Capital One Venture X Rewards Credit Card has become comparable to other premium travel cards. Still, it’s a bit more budget-friendly with a lower annual fee than competitors like the Chase Sapphire Reserve Card.

You’ll earn 2X miles per dollar spent on every purchase, every day, 5X miles per dollar spent on flights booked through Capital One Travel, and fabulous 10X miles per dollar spent on hotels and rental cars booked through Capital One Travel. This card currently comes with an early spend bonus of 75,000 miles when you complete the minimum qualifying spend of $4,000. This card is perfect for frequent travelers with high spending habits!

Let’s break down the details:

Annual Fee: $395

New Member Early Spend Bonus Offer: 75,000 miles after spending $4,000 within the first three months from account opening. That’s equivalent to $750 worth of free travel when redeemed through Capital One Travel. (1 mile = 1 cent via the Capital One Travel portal)

Rewards Rates and Categories:

- 2X miles per dollar on all purchases

- 5X miles per dollar on flight purchases through Capital One Travel

- 10X miles per dollar on hotel and rental car purchases through Capital One Travel

Credit Score Required: 700+ (Check your credit score for free here.)

What are the Best Benefits of the Capital One Venture X Rewards Card?

- A Higher Than Average Rewards Rate: While you’ll earn at least 2X miles per dollar on every purchase, you’ll earn 5X miles per dollar on flights booked through Capital One Travel

- A 75,000 Mile Early Spend Bonus: After you spend $4,000 within the first three months from account opening, you’ll get an early spend bonus of 75,000 miles: equal to $750 of free travel when redeemed through Capital One Travel. Pretty sweet!

- A $300 Annual Travel Credit: Receive up to $300 back as statement credits annually for any travel bookings through Capital One Travel.

- Extensive Airport and Travel Perks

- Access to Capital One Lounges: Venture X Cardholders enjoy unlimited free visits, plus you can bring 2 free guests per visit. Each additional guest costs $45.*

- Complimentary Priority Pass™: Enjoy unlimited visits to over 1,300+ participating VIP lounges in more than 600 cities and 148 countries worldwide with Priority Pass™. This is a great added perk, while Capital One is still working on expanding its airport lounge footprint.

- Receive up to a $100 credit for Global Entry or TSA PreCheck®: When you use your new card to pay the $100 Global Entry or $85 TSA PreCheck® application fees, you’ll receive reimbursement directly to your credit card statement!

Some great additional benefits include:

- No foreign transaction fees

- Miles never expire, and there are no blackout dates when booking on Capital One Travel.

- Earn a 10,000-mile bonus each year upon your account anniversary.

- For a limited time, you’ll also receive $200 back in statement credits for vacation rentals charged to your account within your first year.

- Cell Phone Protection: Each month, you pay your cell phone bill with your Venture X card, you’re eligible for reimbursement up to $800 if your phone is lost or stolen; pretty sweet!

- Add up to 4 additional cardholders on your account for free; they’ll enjoy the same benefits, and you’ll earn rewards on every dollar they spend.

- You’ll receive 25,000 bonus miles per referral (up to 100,000 bonus miles per year) when your friends use your referral link to apply for the Venture X Rewards card.

- Achieve Hertz Five Star® Status: Cardholders can access a wider selection of rental cars and upgrades when they book through Hertz.

- Access to Capital One Experiences: Cardholders get early and exclusive access to premium entertainment experiences such as concerts, sporting events, restaurants, and more.

- Access to Capital One Shopping, a browser extension that automatically applies coupon codes for you when you shop online!

How Can You Redeem Miles with the Capital One Venture X Rewards Card?

Cardholders have several options when it comes to how to redeem their miles:

- Book Travel Through the Capital One Travel Portal: The Capital One Travel Portal offers flights, hotels, rental cars, and even vacation packages!

- Cover Past Travel Purchases: You can redeem miles for past travel purchases made with your Venture card within the last 90 days. This can include anything travel-related, including purchasing a flight, hotel, rental car, etc. You could essentially pay for travel purchases from your most recent trip with enough miles. So, using miles in exchange for a cash back credit! While similar to cash back, it’s important to note that miles are valued at double the amount when redeeming through this feature versus the cash back feature (1 cent per mile versus just 0.5 cents per mile for cash back).

- Easily Transfer Miles to Partners: Capital One allows cardholders to transfer miles to 15+ different travel partners, allowing greater flexibility to redeem your Venture miles through partner airlines and hotels.

- PayPal: Simply add your Venture card to your “wallet” on PayPal, and you can use miles to pay for all or part of your purchase.

- Amazon: Easily link your Venture card to your Amazon account, and you’ll be able to use miles towards your purchases.

- Gift Cards: If you want, you can even use your miles to redeem gift cards to popular retailers like Barnes & Noble or Best Buy.

- Cash Back: While this card is designed for travel, you can still redeem your miles for cash back, which will be applied as a statement credit (we love that free money!)

We know that point valuations can be confusing, so here’s a reference chart for you to understand how much your miles are worth in each redemption category:

Capital One Venture Rewards Card Miles Valuation By Category

| Redemption Option | Miles Values |

|---|---|

| Book Travel through Capital One Travel | 1 cent per mile |

| Cover Past Travel Purchases | 1 cent per mile |

| Transfer Miles to Travel Partners | Starting at a 1:1 transfer ratio, with a minimum of 1,000 miles |

| Shop Online with PayPal or Amazon | 0.8 cents per mile |

| Gift Cards | 0.8 - 1 cent per mile |

| Cash Back | 0.5 cents per mile |

As you can see from the above, you get the most value from your miles when redeeming for travel, whereas you get the least when redeeming for cash back. Overall, you have plenty of options regarding how you choose to redeem your miles.

What Are The Pros and Cons of the Capital One Venture X Rewards Card?

Pros:

- The $300 annual travel credit greatly subsidizes the high $395 annual fee.

After meeting the minimum qualifying spend requirements, you’ll earn a substantial early spend bonus. - You’ll also earn a miles bonus upon your account anniversary each year.

Cons:

- A very high annual fee, but still lower than the annual fee for the Chase Sapphire Preferred Card.

- Requires a high credit score to qualify.

- You need a consistently high level of spending to achieve the early spend bonus and to justify keeping the card for more than one year. Although, since you can add up to 4 additional cardholders to your account for free, they can quickly help you meet the qualifying minimum spending requirement!

The Bottom Line

The travel rewards credit card space continues to feature new cards all the time. But, the Capital One Venture X Rewards Credit Card is arguably one of the best cards Capital One has ever offered! The annual fee of $395 practically pays itself if you plan to book lots of upcoming travel.

As we emerge from this pandemic, travel is now once again at the forefront, with many people planning trips. If you’re a frequent traveler with high expenses, this is certainly the card for you!

If you’re looking for a Capital One travel rewards card with a lower or zero annual fee, check out my other card comparison: Capital One Venture vs. Capital One VentureOne Rewards Card: What’s the Difference?

The Smart Wallet has partnered with CardRatings for our coverage of credit card products. The Smart Wallet and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.