CapWay: How This Personal Finance App Is Paving The Way To Fair Financial Success

These days, there seem to be so many emerging financial platforms that all try to capture our attention. But it’s truly rare to find a dynamic financial platform that helps you save, budget, and take control of your finances that’s both minority and woman-owned: until now! Let’s talk about CapWay and how it’s changing the game when it comes to personal finance.

What is CapWay?

Sheena Allen is the CEO and founder of CapWay, an African American woman-owned, fintech start-up working to help financially underserved communities get access to the banking and finance resources they need. Growing up in a financially illiterate community, Sheena saw a need to develop a platform like this, and so CapWay was born. You can access the platform both on iOS and Android.

What Are CapWay’s Best Features?

The CapWay platform is comprised of a number of features:

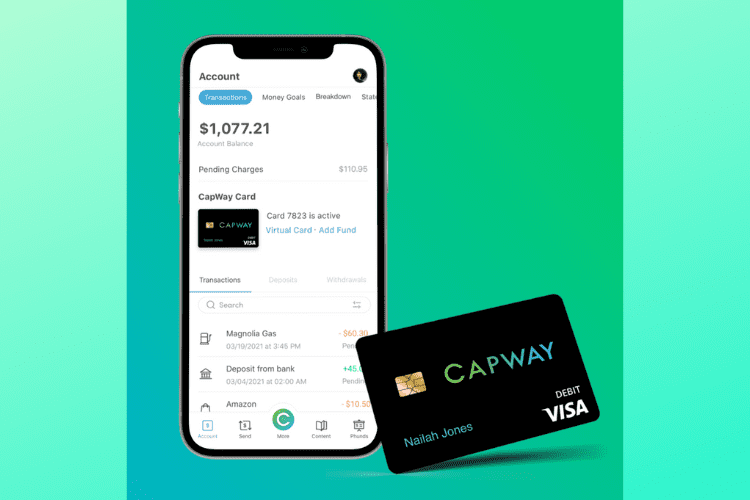

1. CapWay Debit Card: When you sign up for CapWay, you’ll get access to a physical and virtual card with your CapWay Money Account.

2. Money Goal Buckets: You can save for purchases, to invest, or other specific financial goals and place each in its own “bucket.”

- Save To Reach Your Money Goals: You can “round-up” your transactions (similar to Acorns Round-Ups® feature), or transfer money from your Money Account to your Money Goal Buckets.

- Money Help: If you find yourself falling short on a money goal that you set a due date for, you can ask friends and family for help via social media, SMS, or e-mail.

3. Track Your Transactions: See all of your recent transactions, check on your cash balance, and even receive notifications when withdrawals or deposits hit your account.

4. Track Spending Categories: Check out exactly how much you’re spending with a full breakdown of your spending categories.

5. Send and Receive Money: Instant deposits allow you to send and receive money to someone else with a CapWay account instantly! If not, you can still send and receive money to anyone with other bank accounts, it just might take a bit longer.

6. Deposit and Withdraw Funds from your CapWay Money Account: Easily set up direct deposit or transfers from another bank account. Or, withdraw money from your account for free from any of the 30,000+ MoneyPass ATMs.

So, how does CapWay truly ensure fair financial success for its users? Well, CapWay members have exclusive educational access to:

- Learn Money: A library of content to help educate you on all things taxes, budgeting, cryptos, and more! The below programs and features all fall under CapWay’s “Learn Money.”

- Phunds: CapWay’s six week financial literacy program designed to help whip you into financial shape. It’s a free program to subscribe to if you’re a CapWay member.

- The Money Room: “Master classes of money,” taught by financial influencers, experts, and brands highlighted on CapWay’s homepage and featured within the CapWay app.

- Money Talk: A fun and interactive way to “vote” on trending financial topics. See what other CapWay users are thinking when it comes to topics like rising rental prices and how to handle inflation.

- Money Meanings: A dictionary to help you define the simplest and most complex financial terms.

Is CapWay Free To Use?

The best part? There are no fees to get started on the platform. CapWay currently makes money off paid partnerships, sponsored content, and advertising. All in all, CapWay is a great financial platform that’s leading the way when it comes to empowering underserved communities to take control of their financial futures. Sign up today!

The Bottom Line

CapWay is leading the way when it comes to women minority-owned businesses in the competitive finance space. If you’re looking to get your finances in shape and better manage your money, no need to look further!

Read More: 50 Legit Ways to Make Extra Money Online This Month for Beginners