Dave App: Not Your Ordinary Neobank

Overdraft fees are an ugly reality that happens to many of us. If you’ve had a bank account for an extended period of time, you’ve likely had to deal with at least one overdraft fee. The thing with overdraft fees is you may not even realize you have one. That can be problematic and expensive. You then go from having one to multiple overdraft charges because every time you don’t have enough money in your account to cover a transaction, the bank charges you. Banks make millions of dollars a year just from overdraft fees. While banks win, you lose.

The playing field isn’t always fair for customers with limited funds, and Dave was founded to help even out the financial playing field for the average consumer. Let’s discuss the product and why it might be smart for your wallet.

What is Dave?

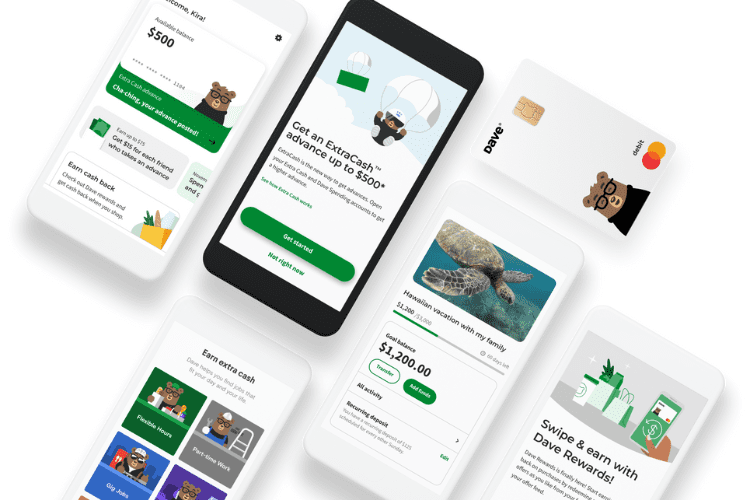

Launched in 2017, Dave is a money-management app to provide a digital banking experience for everyday people that makes their money go further. It’s named after the famous biblical story of David and Goliath. Just as little old David slayed that big, mean giant named Goliath, Dave the app can help you get rid of those big, bad overdraft fees the big banks are famous for! The average person is charged $34 – $38 every time they spend more money than they have in their bank account. If you’re not extremely careful with your money, you could spend way more than you have and owe the bank hundreds of dollars in fees.

The founders of Dave saw overdraft fees as a major pain point for most people and opted to start there when it came to improving the banking experience. Since then, Dave has put features in place, such as cash advances and income creation, in addition to overdraft protection.

What Features Does Dave Have?

- No Overdraft Fees: Dave is a great money manager in that it will track your money, so you’ll know when you’re coming close to being the subject of a negative balance. It sends an alert to let you know you’re about to be in the red. That way, you can take the necessary action to change the trajectory of your account. But even if you don’t, the app will loan you money interest-free if you need it. You do have to qualify to be able to borrow money. Dave just needs to confirm that you’re employed with a steady income. Dave will either repay itself from your direct deposit or allow you to pick an earlier date to pay.

- Money Management: If you’ve never been good at managing your money, Dave will do it for you. The baked-in budgeting feature tracks your deposits and expenses and can predict what’s coming for you financially. It can notify you of upcoming bills or if you’re in danger of being out of money before the end of the month.

- Bank Debit Card: Just as you would receive a debit card from a brick-and-mortar financial institution, Dave will provide you with a Visa debit card that you can use at up to 32,000 ATMs for free, regardless of how small the deposit is.

- Improve Your Credit: As long as you make utility bills on time and link them to your account, Dave can help use that payment history to boost your credit score.

- Get Extra Cash: Dave will advance you up to $500 to do whatever you need. They do this without credit checks because it’s your money; you’re just getting it early. The money is yours to pay instantly, with no waiting period or lengthy application process.

- Make Extra Money: Dave understands that so many people are left having to pay overdraft fees because they don’t have enough money. So, Dave has found a way to help people earn more money with the Side Hustle feature. Dave’s network of partners enables you to discover opportunities to grow your income with flexible jobs that are likely to fit your schedule.

What Are People Saying About Dave?

What started as a simple way to help everyday people grow their money has turned into a banking revolution. Since its launch, Dave has grown to 10 million users, and that number continues to climb.

Here’s what users are saying about Dave:

“[Dave] helped me find two gig jobs that make me $400 plus per week. This app has really paid off.” – Jessica; Bath, Ohio

“The new side hustle thing is really helpful. I didn’t know I could get paid to play with/walk dogs.” – Ian; Nashville, Tennessee

“I honestly thought this app was a scam or something for sure. But it has actually helped me a lot without having to pay back double the amount.” – Ines; Maine

How to Sign Up on Dave

Getting started on Dave is easy:

- Using your phone, go to your app store

- Join Dave

- Create an ID to sign-in

- Agree to the terms

- Complete your profile

- Enter your account information

The Bottom Line

Dave was certainly founded on a good premise. Many of us lack money management skills, making saving money difficult. That said, for those of us who fall short in that area, Dave can help. While using Dave is a better option than paying out miserably high overdraft fees to the big banks, what would be even better is if you use the tools baked into the app to help you manage your personal finance goals every month. My recommendation? If you’re going to use Dave, let it help you learn to manage your money better, grow your savings accounts, and build your emergency fund to limit borrowing as much as possible.

Read More: