Legit Ways to Help Pay For Rent

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Note: These suggestions are meant to help supplement your finances. If you’re in a more dire situation, we suggest speaking with your landlord immediately, calling 211 for organizational assistance, applying for industry grants, and asking friends/family for help.

Blink, and it’s already the next month. Yup, rent is due.

Even though every time that chunk of rent payment leaves your bank account and into someone else’s, it hurts…a lot. But it’s the price to pay for having your own living space, and, really, who can afford a house right now?

Hopefully, we’re making it a little bit easier by suggesting some things you can do to earn some side cash for rent as well as manage your money more efficiently.

1. Get Paid Up to $225/Month While Watching Viral Videos and Taking Fun Surveys

Founded in 2000, Inbox Dollars has been paying customers for their opinions for over 24 years and counting! They are one of the most trusted survey sites with fun, multiple ways to earn extra cash that set them apart.

“Fast and easy. Love that I can cash out to my PayPal and easily transfer money to my bank account.” – Tefanie P

Take surveys, watch videos, play games, and even read emails for extra cash. Who wouldn’t want to watch viral videos for money and get paid up to $225/month?

Inbox Dollars is a great platform to make a little side money. It’s free to sign up, so give it a try today!

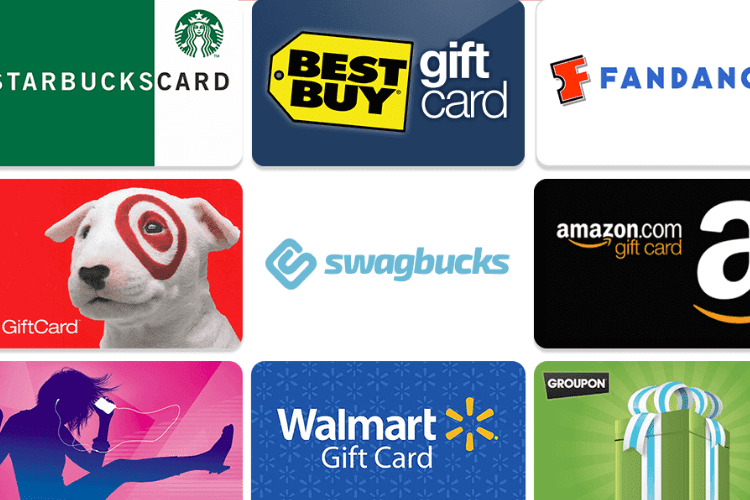

2. Take Surveys & Play New Games to Earn Extra Cash

Join over 15 million other members already completing surveys, playing games, and shopping from Swagbucks, a free rewards program where you’ll earn cash for your time. With consistent use, members can earn about $50 a day having fun! Plus, they’ve already paid over $600 million in gift cards and PayPal cash to their members.

Taking surveys is the best way to make money on Swagbucks. They can take 10 minutes or more and topics can revolve around food, beverages, household products, cars, and more. The next best way is to play new-to-you games! As you collect Swagbucks Points (SB) from completing tasks, redeem them for gift cards and cash!

New members can get a free $5 just for signing up, so join Swagbucks and start earning free rewards!

3. Ask This Company To Pay Off Your Outstanding Credit Card Debt

It’s 2024, and you want to body slam that debt down and keep it down. You just need a little help doing it.

MyLendingWallet can help if you have under $35,000 in debt. They’ll offer a personal loan that pays off all your balances and consolidate them into one balance to make it easier on yourself.

Regardless of credit status, you can quickly determine if you qualify for a loan with APRs ranging from 5.99% to 36% max. Since their network has over 100 vetted lenders, you’ll be able to compare with no obligation either.

You can get funds as fast as 24 hours, and they have flexible repayment periods (61 days to 72 months!). Even better? There’s no credit score impact to check, so see how LoansUnder36 can help now! It only takes 2 minutes.

4. Earn Up to $750 Trying Out Offers

Try out offers and get rewarded. That’s the gist of Earn Big Rewards, a fun program where you can earn up to $750 (or even $1,000 if you’re ambitious) just by checking out sponsored offers from their partners.

Over 1 million members have gone through and got their rewards, and you can too! It’s simple.

Offers and deals vary, but the most important thing to know is that different levels have different rewards. Lower levels yield smaller rewards, while Level 5 will get you $500, $750, or $1,000.

You’ll be able to choose from mobile games, free trials, subscriptions, streaming services, and more after answering some quick questions.

Once you complete the levels you want, you can cash out and get the reward in a week!

5. When It’s 2024, and You Still Have Credit Card Debt Under $100,000

Stop the anxiety attacks by getting rid of your debt. If you owe $100,000 or less, AmONE can help by matching you with a low-interest loan to pay off all your balances. Problem solved.

Their interest rates start at just 6.40% compared to credit cards, which can go as high as 36%! Plus, it’s only one monthly bill, making it way easier to manage.

There’s also no credit score impact to check, and repayment periods are flexible. Take 2 minutes to check, and you can get funds as quickly as 48 hours to wipe that credit card debt!

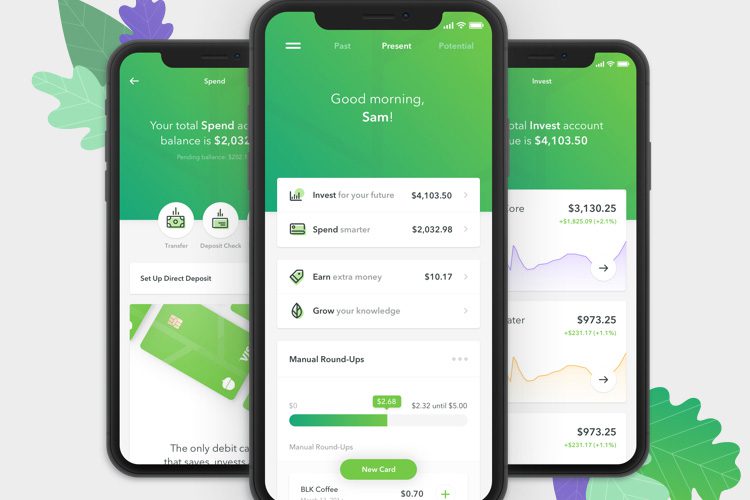

6. The Money App Backed by Celebrities That Saves AND Invests for You

Acorns has caught the attention (and their investments) of Blackrock, Paypal, and major names like Dwayne Johnson and more. Plus, they have about 10 million all-time customers!

That’s because Acorns automatically saves and invests your spare change from every purchase with the Round-Ups® feature. You’ll get a diversified portfolio picked by experts based on your investment profile.

You only need $5 to start investing, and when you set up recurring investments, you’ll get a $20 bonus!

Get started in under 5 minutes with no financial experience or expertise needed. You’ll also get access to retirement, investing for families, rewards, and more based on your subscription plan.

With no hidden fees, Acorns makes it easy to invest in your future with your spare change!

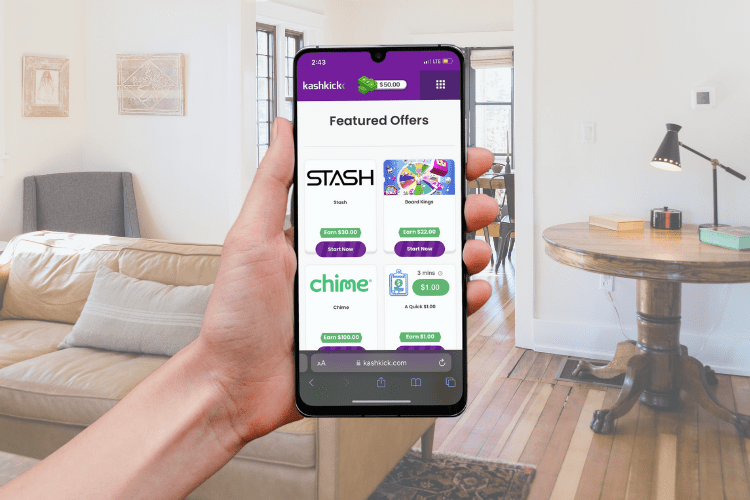

7. Hustle like a Mother and Earn Up To $1,000!

Easy, effortless options on the go for those who hustle. Join the over 3M hustlers earning extra on KashKick while doing things they love! It’s free to join, and signing up is easy.

Like to cook? Earn while trying new recipes! Waiting to pick up kids in the car line? Play a mobile game and start earning! Some games pay over $180 to play and complete!

Paying for gas? Get cash back! So many different ways to earn a little extra cash without much effort. You can also shop now and pay later, complete surveys, play mobile games, or try new services and get a cash back reward.

“Kashkick saved my life! I lost my job, and thanks to KashKick, I get a little side income to pay a couple of bills.” – Shanice, New Orleans

8. How to Treat Yourself Despite Inflation Costs

Prices are rising everywhere, but it doesn’t mean you still can’t have nice things. Use Opinion Outpost, a free, online market research program that pays you up to $5 per survey.

It’s easy:

- Take short surveys on topics that interest you.

- Earn PayPal cash or gift cards for brands like Amazon, Texaco, Southwest, Target, Grubhub & more!

On average, Opinion Outpost pays its members $390K a month for their opinions. Why not make extra cash in your spare time?

And yes, they’re legit. They’ve been around since 2009 and are members of the ESOMAR & the Marketing Research Association, so your info will stay safe and confidential.

Join over 2M+ happy earners sharing their thoughts for awesome rewards. It’s free!

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.