Did You Submit Your 2022-2023 FAFSA Application Yet?

As most college students know, filing the Free Application for Federal Student Aid (FAFSA) form is key to affordable higher education. FAFSA allows students to qualify for scholarships, grants, and federal student loans with low or fixed interest rates. Although, navigating how to apply and submit your application can feel harder than organic chemistry.

For the 2022-23 FAFSA, applications opened on October 1st, 2021. But not to fear! Applications are still open until June 30th, 2023, so you have plenty of time to submit yours (and hopefully qualify for lots of grants!)

Whether you’re filling out FAFSA for the first time or just want a refresher on important info regarding financial assistance, here’s everything you’ll need to know.

What is FAFSA?

Since not everyone is eligible for federal student aid, FAFSA functions as an application for grants, scholarships, and other assistance. Pell Grants, Stafford Loans, and Federal Work Study job programs are all awarded due to FAFSA.

Financial need is based on income, which means most students will need their parents’ financial information and their own to file for FAFSA. The Department of Education laid out exactly how loans are disbursed on its website, but it boils down to this:

- Your cost of attendance (COA) for your school is calculated. COA includes tuition, room and board, books, and some other necessary costs.

- Your family’s income is used to calculate an expected family contribution (EFC), which determines how much you’ll need to pay yourself.

- The EFC is subtracted from the COA, and the resulting number is the maximum amount you’re eligible to receive in federal loans.

As an example, let’s say your cost of attendance is $25,000, and your expected family contribution is $20,000. That means you can get up to $5,000 in federal aid. The COA should be relatively simple to figure out based on costs listed online, but the EFC is a bit more complicated, so the Department of Education has an extended guide on how it’s calculated.

Am I Eligible to Receive Federal Aid?

To be eligible to receive federal aid, you must:

- Be a U.S. citizen with a valid social security number

- Have a high school diploma or GED

- Be enrolled in a degree program

- Maintain satisfactory academic progress (SAP)

The good news? Most students are eligible for at least some form of financial aid (woohoo!)

Should I File for FAFSA? Why?

The short answer? Yes! While FAFSA is a great resource that helps make college more affordable, millions of students neglect to file every year. Some are confident they can pay for college without federal aid, and others are concerned about taking on debt. The application is free, so you have nothing to lose financially. It’s always worth a shot to apply regardless of your financial situation.

But unfortunately, one study showed that nearly a quarter of students who chose not to file for FAFSA said they didn’t have enough information about how to complete it.

In fact, billions in grants are left on the table every year because students do not file for FAFSA. Even if you think your family doesn’t need the assistance, it’s still worth discovering your financial eligibility. Don’t be a part of this statistic!

How Do I File for FAFSA?

You can file online at fafsa.gov, and the online portal is easy to navigate. Before you start the FAFSA application, you’ll need some information on hand:

- Your social security number

- A Federal Student Aid ID

- Your driver’s license number (if applicable)

- Your 2020 income tax returns

- Records of all other fixed assets and income

As long as you have everything you need, filing for FAFSA is pretty straightforward. If you’re applying as an incoming freshman, you’ll need to send your information to every school you’re considering attending. If you’re already in school, simply choose your current college or university.

You’ll need to answer some questions on your demographic and dependency information, as well as electronically sign your FAFSA before it’s officially complete.

As of last year, you can even file FAFSA from your phone. Overall, the FAFSA is a bit time-consuming but well worth the work. Any loans you receive can help lighten some of the financial stresses of college.

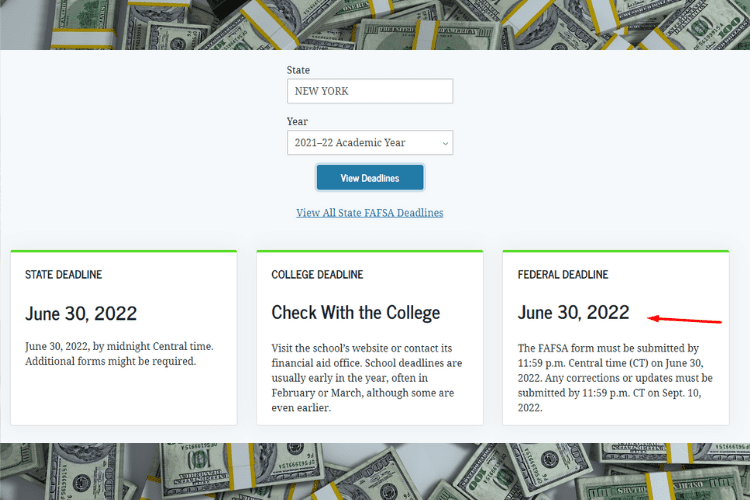

Financial Aid for the 2021-22 Academic Year: There’s Still Time

Planning for the 2022-23 academic year is key, but have you submitted your FAFSA application for the 2021-22 academic year yet? If not, you still have time! Luckily, the Federal deadline to qualify for aid is June 30, 2022. So It’s not too late to apply and qualify for financial aid for both the 2021-22 and the 2022-23 academic years!

So, what are you waiting for? Get started now and make sure the cost of your college education is right within your budget.

Read More: New Year, New You: 11 Money Moves To Make Before 2022