Get Three Free Credit Reports Every Week Through April

Usually, you can only request a credit report three times per year. Each of the major reporting bureaus – Experian, Equifax, and TransUnion – offer one free credit report every 12 months. Your credit score is a major key to your financial security, and three reports per year are reasonable for keeping track of your credit in normal times. These, of course, are not normal times. As a result, the major bureaus have dramatically increased how often you can get a credit report.

Through April 2021, you can request a report from each of the three major bureaus, for free, every week. That means as opposed to three reports each year, you have access to three weekly, and 12 per month.

Why You Can Access Your Free Report

We talk about credit scores and reports a lot here at The Smart Wallet. Your score is one of the most critical pieces of your overall financial health, and a bad score can have negative repercussions across almost every part of your life. As a result of the recession caused by the coronavirus, credit bureaus realized that people need immediate, constant access to their credit reports now.

“These are unprecedented times facing the world. People are feeling scared and uncertain about the future. To help play our part and reduce some of that anxiety, we are uniting as an industry to help people know the facts about their financial data,” the CEOs of Equifax, Experian, and TransUnion said in a statement. “We are making credit reports more accessible more often so people can better manage their finances and take the necessary steps to protect their credit standing.”

How to Get Your Free Report

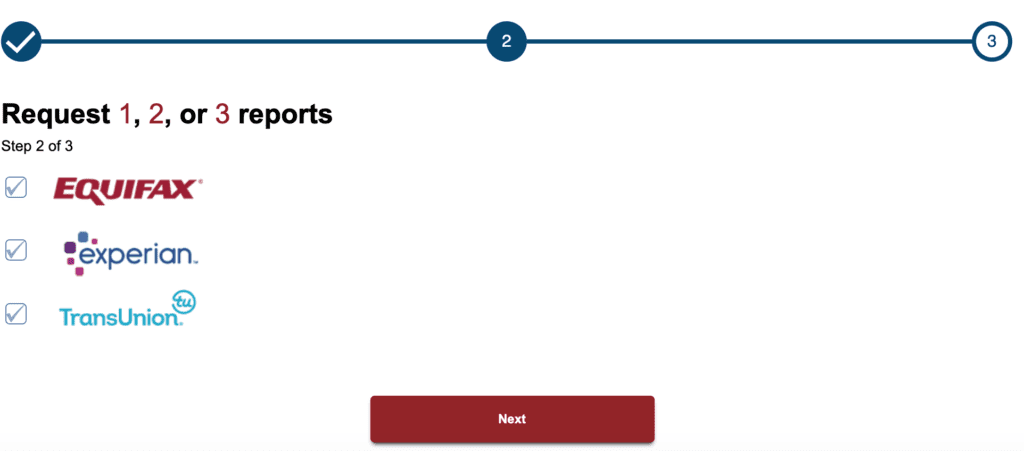

Head to AnnualCreditReport.com to request and see your free credit report. The process is really simple. All you need to do is select which bureau’s report(s) you’d like to see, and answer a few questions to verify your identity.

After you’ve gotten your credit report, the next step is understanding what it all means. Knowing what goes into your score and how much weight each factor carries can help you figure out exactly how you can boost your score. Getting your report regularly can help you spot any errors or mistakes that can hurt your score, too.

It’s worth noting that reports from these bureaus do not automatically include your credit score. Experian, however, does let you create a free account and see your FICO score. TransUnion also allows you to buy your score for just 99 cents. Otherwise, each report will show you your account balances, past inquiries, payment history, and more.

We strongly encourage checking your credit reports as often as you can between now and April!