As Housing Costs Rise, More Americans Are Left Priced Out

Depending on where you live, there’s a good chance you’ve noticed the cost of housing change relatively dramatically in the past year. In some places, like New York City, commercial and residential real estate lost value, rent prices plummeted, and the housing market overall suffered. However, other areas, like the suburbs of Portland, Oregon, experienced rising prices over the year.

Homeowners got wealthier as their property value skyrocketed, but there’s a darker side to the housing “boom” in 2020. Millions of Americans are in mortgage forbearance, renters handling lost wages and increased costs are being priced out of their neighborhoods, and homebuyers need more money than ever to afford a home.

“The prices in Seattle became absurd where any dream of upsizing our starter home became obsolete,” said Dave F, who bought his first home in the Seattle suburbs in 2013 for $300,000. “The average starter home is over $700,000 and most offers are going for at least $50,000 over.”

Dave and his family, plus three other families they knew, left Seattle in 2020 as housing prices soared. Although he loved the area, Dave said he felt as if he had an impossible choice if he stayed in Seattle: shell out $750,000 for a slightly larger home, or remain “house poor” for 30 years.

“It was sad to leave the place I grew up and loved, but in order to provide my children a good life and keep my business afloat we knew we had to leave the booming market that Seattle has become,” Dave said.

Pricing Out in 2020-21

When housing costs rise as dramatically as they have in some regions, many residents become effectively priced out of the market. “Pricing out” can happen in any market, but most commonly applies to housing.

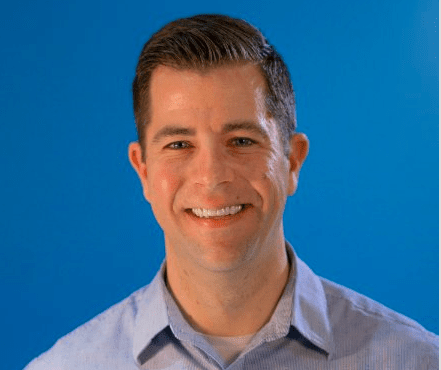

Home prices across the country have been skyrocketing for years, and Seattle is one of the prime culprits. Since Amazon settled in the region in 2016, home prices have become prohibitively expensive for many families. Typically, this kind of gentrification is a driving force behind pricing people out of their neighborhoods. But according to Vishal Gupta, a North Carolina real estate agent, the unique conditions of 2020 only furthered this growing crisis.

“The issue of being priced out of a neighborhood has been increasing, unfortunately,” Gupta said. “The current market is very competitive for home buyers due to a combination of factors.”

First off, mortgage rates have been at or near all-time lows for the past year. Prospective home buyers are looking at interest rates that are virtually half of what they were two years ago. Second, Gupta said, the housing supply is hitting historic lows. In the Raleigh-Durham region, Gupta said inventory is at its lowest point in 25 years. As a result of low supply and high demand, buyers are facing a far less friendly market than the mortgage rates might suggest.

“Although the buyers have been able to get lower interest rates, the neighborhoods they initially liked have increased in value more than their purchasing power,” Gupta said.

Young Home Seekers Face Obstacles

Millennials accounted for 38 percent of home purchases in 2020, according to Realtor.com. Older millennials (30-39) accounted for the majority of these purchases, as just 13 percent of homes were bought by younger millennials (22-29). As it stands, many young adults face nearly insurmountable obstacles when entering the housing market.

For instance, the average household income for first-time homebuyers in 2020 was $80,000, compared to just $68,703 in 2019. Homeownership is becoming increasingly less affordable, particularly for the generation bearing the brunt of the student debt crisis. These challenges, plus rising prices, are forcing Alexandra Lashner and her husband out of their hometown in Bucks County, PA.

“We are coming across so many roadblocks. We are millennials who have college debt, and we don’t have much money at the end of each month to squirrel away because life’s basic necessities take up so much of our income,” Lashner said. “Therefore, we don’t have a large monthly budget to spend on a mortgage, monthly HOA fees, and taxes.”

Lashner’s grandparents bought a home in Bucks County in the 60s – which was then a rural area growing as a suburb – and then her parents in the 90s. Now as she and her husband are looking to jump from renting to owning, they feel priced out of the market. She said her parent’s townhouse, for reference, has almost tripled in value in three decades.

“There aren’t as many farms around anymore, nearly all the land is developed, and the only new builds in the area are for the luxury market priced at $500k or above,” she said.

The median home price in Bucks County over the last year was $365,000, significantly higher than the statewide average of $211,000. Lashner said that some of the aspects that make staying in the region so attractive also make it unaffordable. The county has some of the best schools in the state, and Lashner would love her family educated where she was. However, the county has some of the highest property taxes in the country as a result, as the average Bucks homeowner pays about $5,000 annually in tax.

The Bottom Line

Prospective homeowners are walking into one of the least affordable housing markets in U.S. history. The market is expected to remain favorable for homeowners in 2021, while buyers may face more difficulty. Research from Fannie Mae shows that just one in three Americans aged 25 to 34 looking for a home thinks they’ll find one in their price range.

However, the lending institution is taking strides to help solve this crisis. Plus, President Joe Biden has spoken about expanding access to affordable housing, and there are actions you can take on your own to push back against pricing out.

“If you are starting to feel you are getting priced out of your neighborhood, make sure you ask your agent what techniques they are using to try to find you an off-market deal,” Gupta advised. “If your agent doesn’t have a plan, it is time to find one who does.”