How To Save Money on The Immediate Costs Of Having a Baby

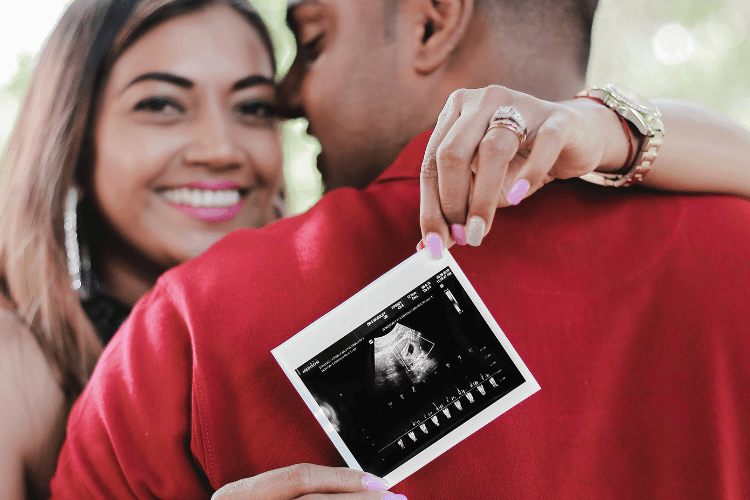

I’ve often heard couples say they want to wait to have a baby when their finances are better. Then some years later, they end up having a baby, and their finances aren’t much better than they were from the start. In fact, in some cases, finances were even worse. The point is that things may never be as perfect as we’d like regarding our finances. But what we can do is make sure we take steps that will get us a little closer to where we would like to be.

When it comes to having a baby, there couldn’t be a more accurate statement because the minute you find out you’re expecting, you find yourself in a financial whirlwind, wondering how you’re going to do all these things that come with having a baby – and relief from anywhere is welcomed. Adding a child to the mix will cost a fortune over the long term. The best way to get through the costs of having a child is to take one step at a time. This article will help us prepare for the immediate costs of having a baby.

Immediate Costs That Come With Having a Baby

Having a baby is a major life change and a substantial financial investment – possibly for life. As parents, we never stop meeting our children’s needs, even in their adulthood. But some immediate expenses need to be met right away.

- The average cost to give birth is approximately $2,000 with insurance and over $18,000 without insurance.

- Many families utilize fertility services to have children. This can cost anywhere from $6,000 to over $70,000.

- In the first year, parents spend over $10,000 on baby formula, diapers, nursery items, and other supplies babies need (this does not include food and clothing).

- Each year, inflation rises, driving the costs of everything your baby needs up. You can expect to spend nearly $1,000 more than the previous year.

- The average cost of child care can be around $10,000 per year per child. The average cost of an in-home nanny can be close to $30,000 a year.

- Clothing can run about $56 monthly over the first two years ($1,344), and food can run roughly $100 monthly. These figures only get higher as the child grows.

- Wellness visits are frequent, especially within the first twelve months. Costs associated with this can include transportation, time off from work, and co-pay if you don’t have insurance. Then you must include the costs of any tests, immunizations, and illnesses.

While the immediate costs associated with having a baby will not go away, there are some things you can do to help offset them.

Ways To Save Money When Having a Baby

Know What Your Insurance Will Pay

Don’t assume the insurance will pay for everything because you have health insurance. When you know you’re expecting a child, contact your insurance provider to determine what they cover. The language in health insurance plans can be tricky. Here are some good questions to start out asking.

- Will you have to pay a deductible or a copayment?

- Will you have to pay a deductible or a copayment for the wellness visits?

- What procedures or tests are covered by the insurance during pregnancy, at birth, and for the baby after birth?

- What should you expect to pay out of pocket to have your baby?

Check Every Bill for Errors

Ensure you thoroughly review every doctor’s bill, even if you have insurance. Hospitals have been known to make human errors when it comes to billing. Examples of some of these errors include being charged more than once for the same procedure or being charged for medications or procedures you didn’t have. Dispute any errors and have them corrected.

See if You Can Negotiate Prices

If you lack insurance and must pay out of pocket, sometimes you can negotiate better prices. For instance, can you receive a discount if you prepay all the fees beforehand? You may need to check multiple hospitals to get the best prices.

Ask Questions

If you’re being told to take tests and don’t understand why, ask questions. Before you have any medical tests or procedures, you should understand why you must do them. Some doctors request the same tests and labs for all their patients. But if these unnecessary tests cost you, you should know why they’re needed. After getting your question answered, you don’t have to agree to the tests if you don’t feel the tests are warranted. Find out which tests are routine during pregnancy and which are not required.

Ask for Generic Brand Prenatal Vitamins

Sometimes, your doctor must write you prescriptions; a generic brand may not do the trick. But you shouldn’t need a prescription for prenatal vitamins. Most pregnant women can take generic, over-the-counter prenatal vitamins without issues during pregnancy. These cost less, which eventually saves you money.

Consider Your Birthing Options

If you are a low-risk pregnancy, you have more options. One of the options is using a midwife. Midwives are becoming more common and cost a fraction of what practitioners charge. There is also the choice of using a birthing center or having an at-home birth. These options are all less expensive than having a hospital birth.

Baby Shower Registry

When friends or family throw you a baby shower, they’re trying to help offset the costs of many supplies and clothing the baby will need within the first year of living. This will be a huge help and could give you the cushion you need to save money. Should they throw you a baby shower, register the items you need to ensure you can check many expenses off your list. Don’t be shy about listing a car seat and other necessities for the baby.

Accept Hand Me Downs

If you have friends and family with bigger kids who insist on passing their things down to you, I have three words for you – gladly accept them. Babies outgrow clothes very quickly; within a few months, you’ll find they need more. Accepting hand-me-downs that have been gently used is a sure way to save money that will be needed elsewhere. There will be plenty of opportunities to purchase new baby gear, as they will continue to outgrow things quickly and always require more.

Consider Child Care Options

We’ve already mentioned how expensive child care is. Consider all your options when deciding on child care for your baby. If you know of a friend or family member who may offer you a reduced rate for caring for your child, you may want to take them up.

Live a Lifestyle You Can Afford

Lastly, if this is your first child, you’ll quickly learn that life, as you once knew it, has changed. You must adjust to it and not live above your means. Consider all the new expenses that will come every month with this little one, factor them into your budget, and adjust your lifestyle as needed so you can afford your new baby.

The Bottom Line

The immediate costs of having a baby will exist whether you’re ready. Do your part to ensure all needs are met by saving where you can whether you have insurance or not.

Read More: