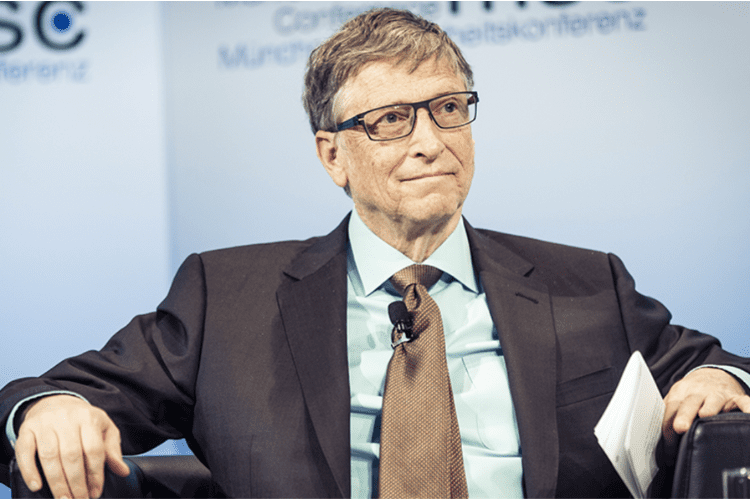

How To Invest Like Bill Gates In 2022

When it comes to investing, it’s essential to follow a well-defined strategy. If you don’t, you’re almost certain to lose money in the long run. A wise choice is often to follow the strategies of successful investors before you and one of the most well-known investors and business magnates is none other than Bill Gates.

Although he’s best known for Microsoft, Bill Gates doesn’t really invest heavily in technology companies. In fact, tech represents a small portion of his overall investment portfolio. In this scenario, we have to follow the actions of Gates, not so much his words or what he is known for.

So, what does Bill Gates invest in, and how can you invest like him too?

Bill Gates Portfolio

First of all, Bill Gates doesn’t just open his personal investment accounts for anyone to look in. However, we can look at the Bill & Melinda Gates Foundation. This has been the core focus of Gates since he left the helm at Microsoft in 2008.

Since this foundation has assets totaling $50B+, a lot of this money is invested in order to protect the buying power and potentially grow the fund. Based on filings with the SEC dated May 16, 2022, here are the top five holdings.

1. Berkshire Hathaway (BRK.B) – 28,700,000 Shares

Bill Gates and Warren Buffett have been close friends for decades. Their relationship spreads beyond just friendship and into the business realm. The single largest investment the foundation has made is in Berkshire Hathaway. This is Warren Buffett’s company.

This is a conglomerate, meaning it owns many different separate businesses within it. Beyond that, Berkshire purchases shares of other publicly traded companies.

Wholly owned companies by Berkshire include GEICO, Duracell, Dairy Queen, BNSF Railway, and more. Berkshire has significant holdings in publicly traded companies such as Kraft Heinz, Pilot Flying J, American Express, Bank of America, The Coca-Cola Company, and Apple.

Through ownership of Berkshire Hathaway, Gates owns a lot of all of the companies mentioned above as well as others.

2. Waste Management (WM) – 18,600,000 Shares

The second largest holding is this waste disposal and recycling company. Specifically, Waste Management is very focused on the future. This includes research into modern landfills and recycling efforts powering a renewable energy revolution.

Waste Management has their residential and commercial waste pickup business bringing in consistent monthly cash flow. This money is being invested into research and efforts for more sustainable waste and recycling practices in the future. It’s also a recession-proof and defensive investment.

Do you want to understand the stock market news easily and quickly? Subscribe to Daily Market Briefs 📈 to prepare for the investing day in just 1 minute, for free!

3. Canadian National Railway Company (CNI) – 13,070,000 Shares

We now see our first common theme here which is an investment in infrastructure. As mentioned earlier, Berkshire Hathaway wholly owns BNSF Railway. By revenue, BNSF is the second largest railway operator.

Canadian National Railway Company comes in at 7th. So, Bill Gates has large holdings in two of the biggest railway operators throughout the foundation. Simply put, Bill Gates really likes the rail business.

4. Caterpillar (CAT) – 7,350,000 Shares

Caterpillar is the most well-known company in the construction industry. All of those big yellow construction vehicles are designed, developed, sold, insured, and even maintained by them. That being said, this company is naturally susceptible to the boom and bust nature of the construction industry.

Bill Gates has large investments in the world’s largest construction equipment manufacturer.

5. Schrödinger (SDGR) – 6,900,000 Shares

There are numerous other holdings owned by the foundation, but we will finish off on the fifth largest holding which is this life and material science company. Specifically, Schrödinger develops software for computer-simulated chemistry experiments. In addition, they have a pipeline of drug discovery programs, both internal as well as collaborations with others. These programs seek to find new approaches for therapeutics, also known as medication.

Bill Gates And Farmland

Beyond the stock investments Bill has within the foundation, there is one other asset class he has become well known for. Believe it or not, Bill Gates is the top farmland owner in the United States with over 242,000 acres across 18 states (that translates into a lot of crops!)

Gates has been slowly accumulating acreages of farmland across America for years. Only recently did it come out that he was the single largest owner of the green stuff. If you’re curious why Bill Gates is buying so much farmland, check out the article below on my blog, Farmland Riches!

Read More: How To Buy Stocks With the Best Investment Apps & Why Is Bill Gates Buying So Much Farmland?