LEX Markets: Commercial Real Estate For Everyone

With the rise of interest rates and property prices, getting started with real estate investing may seem harder than ever.

But not every project will cost a fortune, and there are many opportunities for everyone to get a slice of the pie. For example, commercial real estate marketplaces like LEX Markets lets you start with as little as $100!

While this sounds great if you’re looking for new investment opportunities, how exactly will LEX Markets help your investment portfolio? Let’s take a closer look.

What Is LEX Markets?

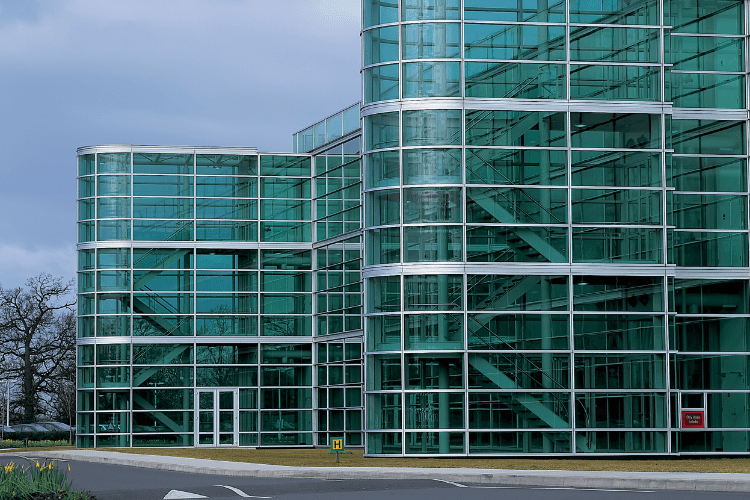

LEX Markets is a commercial real estate marketplace that wants to address significant problems surrounding real estate access and liquidity problems. They do this by turning individual buildings into public stocks, on which you earn interest when the property owner pays dividends.

Gone are the days when you had to keep your money locked into a commercial property to benefit. Since you’re essentially buying, selling, and trading stocks, you have much more flexibility with how much you’d like to invest. The platform even made history in 2021 when it took its first commercial building public via IPO, which was seen as a game changer in the industry.

Is LEX Markets Safe?

LEX Markets is a FINRA-affiliated broker and is entirely safe to use. Whenever you open an account, you also open one with Apex Clearing Corp., the custodian platform. Both are members of the SIPC, which protects your assets up to $500,000 and your cash up to $250,000. Aside from keeping your money safe, the platform uses advanced security features and regular testing to minimize data security breach risks.

Who Can Sign Up For A LEX Markets Account?

Signing up for an account on LEX Markets is pretty easy to do. Applicants must be U.S. citizens or permanent residents age 18 or older. One of the best parts about this platform is you don’t have to be an accredited investor to get started. All you need to do is fill out your personal information, complete the onboarding process, verify your account, and start investing!

How Do You Make Money On LEX Markets?

LEX Markets properties’ are already profiting from their tenants’ rent payments. They’re also screened before being available on the platform. You’ll be investing in high-quality projects that will likely generate a consistent passive income or rise in value over time.

According to the platform’s website, dividends are paid out quarterly. But markets can be volatile, and property prices can fluctuate over time. For this reason, liquidity, dividends, and returns aren’t guaranteed. You can also sell your stocks if you aren’t satisfied with the property’s ROI.

Who Owns The Properties On LEX Markets?

Individuals, family practices, REITs, or other entities can own a property on the website. Regardless of who owns the project, they go through strict screening before they are allowed to list their properties on the platform. LEX Markets also has a rule where property owners must hold at least 5% equity interest in the property to ensure both sides are motivated to see it succeed.

The Bottom Line

LEX Markets has been the latest platform to shake up the real estate world. Starting at $100, you can create your investment portfolio with high-end properties that will likely bring consistent passive income.

The platform’s flexibility lets you buy, sell, or trade your shares like in the traditional stock market. Whether a beginner or a seasoned investor, LEX Markets has attractive features that make commercial property investing more flexible than ever before. If you haven’t done it already, give it a try and sign up for a LEX Markets account today!

Read More: How to Invest in Real Estate for Passive Income Using HappyNest (+Get $10 Bonus)