Mint Review 2021: Fresh Money Budgeting

If you’re searching for an effective way to track your money without spending that money, you’ve probably come across Mint in your Google searches.

Mint has become one of the most popular online financial tools and now boasts more than 20 million users. Let’s delve into the details so that you can decide if Mint is the right match for you, too.

What Is Mint?

Mint is a completely free budgeting app. Hop on from your iPhone, Android, or Google device to access all of your bank, credit card, PayPal, and investment data in one place. This simple tool is ideal for beginners or hands-off budgeters seeking an effortless way to track and manage money.

Mint also offers the increasingly popular perk of access to your credit scores at no additional cost.

How Does Mint Work?

Mint offers a few features that work together to create the ultimate budgeting tool. Most importantly, it creates a financial hub where you can visually connect with all of your financial information. It does this by linking into your other accounts (with your permission, of course). This means that every time you open Mint, you are connected to your credit card accounts, loan accounts, and investments. Even your home value and free credit score are included!

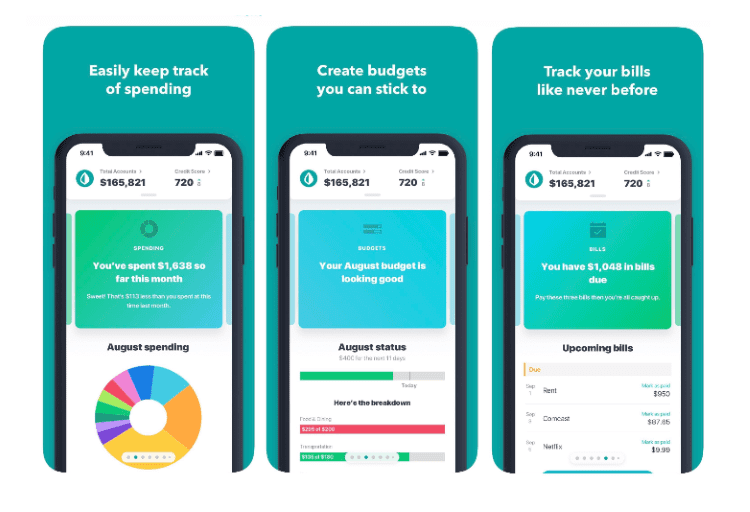

This allows Mint to list your account balances, recent transactions, and bill due dates. Using all of this information, Mint auto-creates a budget that shows exactly how much you have spent, made, and saved. This budget is completely customizable, so you’re in control of your goals.

You can also look to the Trends tab for a quick overview of how you’ve been spending your money since Mint splits your spending between shopping, groceries, dining, entertainment, taxes, utilities, and other labels.

Finally, Mint offers customizable alerts to notify you when your budget is exceeded, a bill comes due, or unusual activity occurs in your account. You can also opt-in to personalized tips designed to help you maximize your money.

Is Mint Legit?

Yes, Mint is legit. It has earned a reputation as one of the most robust online budgeting tools available without a monthly subscription. Since Mint is part of the highly-trusted Intuit line of products, you can rest easy knowing that you’re not entering your financial data into an app developed by scammers in another country.

Mint also uses financial institution-level security measures like 128-bit SSL encryption and third-party TRUSTe and VeriSign to ensure the safety of your data. You log in using multi-factor authentication, passwords, and Touch ID for added security.

The Bottom Line

Mint doesn’t take the place of a financial advisor, but it gives you an easy and user-friendly way to access all of your financial information and make better decisions with your spending. It’s often the choice for reluctant budgeters who know they should take control of their finances but don’t want the process to feel complicated.

Don’t wait to get out of debt! Read this: A Complete, Step-By-Step Guide to Get Out of Debt.