11 Money Apps That Everyone in Their 30s Should Use

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

You may think you wasted a bit of time in your 20s not managing your money as well as you’d like, but time is still on your side. Even small investments will grow in the long run and planning now will save you from stressing later.

You can definitely balance finances and a social life, especially with the help from these apps that we think are essential to everyone. Try them out, and build better habits to manage your money!

1.

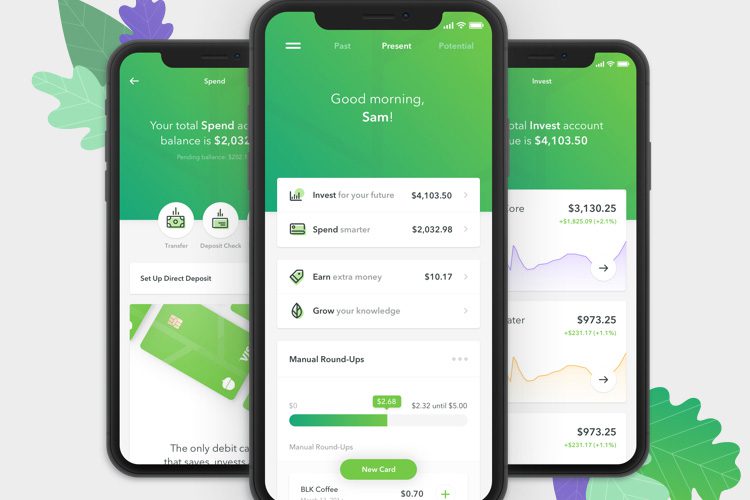

2. The Money App Backed by Celebrities That Saves AND Invests for You

Acorns has caught the attention (and their investments) of Blackrock, Paypal, and major names like Dwayne Johnson and more. Plus, they have about 10 million all-time customers!

That’s because Acorns automatically saves and invests your spare change from every purchase with the Round-Ups® feature with no hidden fees. You’ll get a diversified portfolio picked by experts based on your investment profile.

You only need $5 to start investing, and when you set up recurring investments, you’ll get a $20 bonus!

Get started in under 5 minutes with no financial experience or expertise needed. You’ll also get access to retirement, investing for families, rewards, and more based on your subscription plan.

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.