S.A.D. is Coming – Here’s How to Beat the Winter Blues (And Make Money Too)

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.The season of S.A.D. is coming, which stands for seasonal affective disorder where the winter blues just get to you.

For the most part, you feel listless and everything feels like a chore dampening the holiday’s cheer. One of the most popular ways to beat it is light therapy, lamps that mimic outdoor light if you can’t physically soak in the sun.

Another way is to just preoccupy yourself, particularly with FUN things to do. Even better when fun activities double as money-making activities, which we’ve listed out below. Don’t let the season get to you, have fun with these apps, and come out on the other side with some extra spending money.

1. School Competitors in Solitaire and Ca$h In

Solitaire Cube is like regular Solitaire, except you get to play for real cash.

The free game matches you with players of the same skill level, so all is fair. Even casual players like Amanda, a stay-at-home mom from IL, won a 55″ TV, $6,000, and more prizes.

It’s easy to start:

- Tap now to download from the Samsung Galaxy Store

- Follow the instructions on screen to install

- Open the app and play!

- Practice playing for free and when ready, play for cash!

So if you think you can handle playing some Solitaire Cube to win legit cash, definitely download this game for free to play on your Samsung.

BONUS: When you deposit $12 for the first time, you can get up to $30 bonus cash!

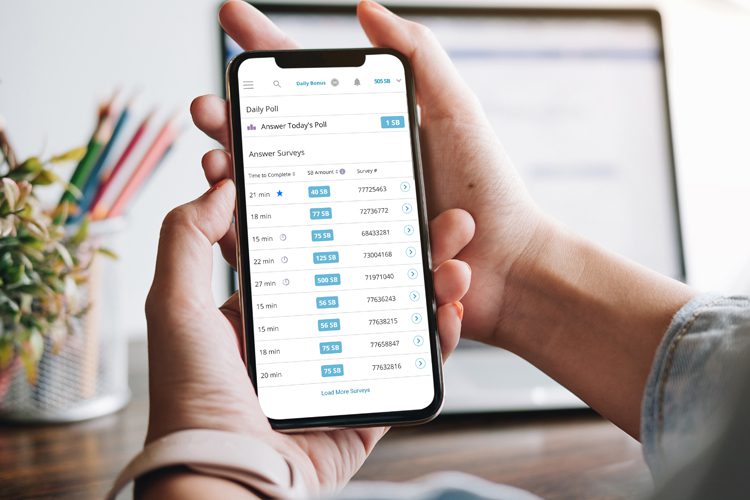

2. Take Surveys & Play New Games to Earn Extra Cash

Members can earn an average of $50 a month in popular Swagbucks, a free rewards program where you can earn cash for your time and opinions.

Get rewarded for doing surveys, online shopping, uploading receipts, and playing fun games, but the one activity that earns you the most points is completing surveys. Redeem points for free gift cards, cash, and crypto vouchers. There are hundreds of different offers to explore and complete!

New members can get a free $5 just for signing up, so join the other 10 million members already part of Swagbucks and start earning free rewards!

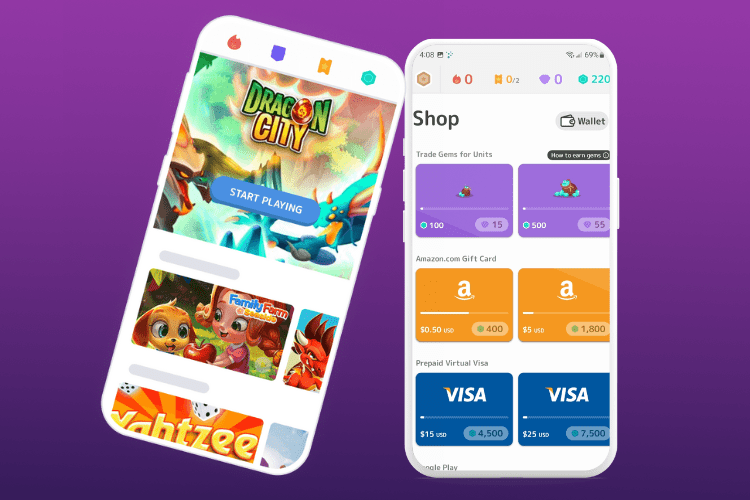

3. Play New Games and Earn Branded Gift Cards

The more you play, the more rewards and gift cards you can get. That’s the gist of Mistplay, an app where you can try out new Android games to earn units/gems and make optional in-app purchases. Redeem units/gems for real gift cards, including Uber, VISA, Spotify, and more!

Play as many games as you want since you can earn more gift cards that way. Plus, there’s nobody to compete against! New members get a BONUS of 200 points just for signing up.

And yes, it’s legit and already has 10M+ downloads. Download the app for free and start racking up those gift cards!

4. Earn Up to $200 Every Time You Win This Viral Bingo Game

Bingo Clash is the free modern version of bingo that you can play on your Samsung to win cash and real-life prizes. There are daily cash prizes as well as weeklong tournaments with prize pools that can go up to $25,000!

You play against other people of similar skill in 1v1, tournaments, or multiplayer. It’s fair play as everyone gets the same card and the same numbers called out, but it’s how fast and accurate you are that will declare the winner!

Pro-tip: Don’t hit the Bingo button until almost the end of the game to rack up bonus points!

Bingo Clash is free to play and fun, plus you could win cash/prizes, so check it out!

5. Fetch All Your Receipts (Even Virtual) & Get Free Money Back

Grab all the recent receipts you have and scan them into Fetch Rewards to earn points towards free money. Even better? Connect your email inbox and it’ll count your email receipts too from Amazon, Instacart, Shipt, and more!

Basically, upload any receipt, snap a pic with the app, and boom, you’ve got points for money.

Be sure to grab 2,000 welcome points on us when you use promo code REWARD before scanning your first receipt!

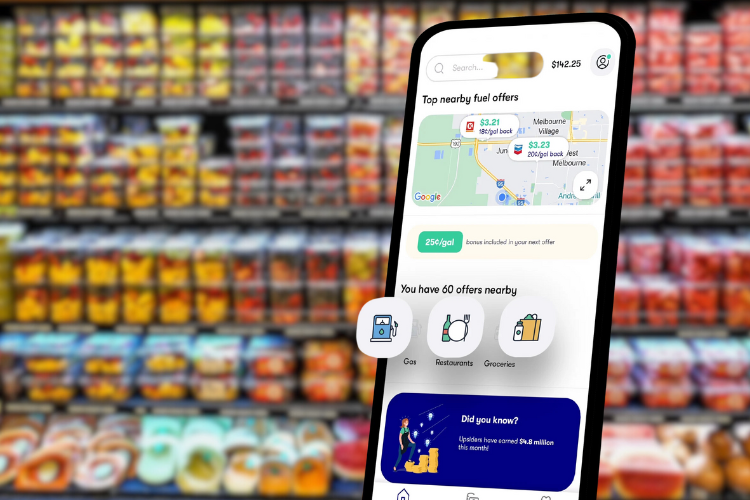

6. Get Free Cash Back Every Time You Get Groceries, Gas, or Meals

Why not get free money back any chance you can get? That’s why we like Upside, a free cash back app that partners with 100,000+ businesses to bring you great offers you can’t get anywhere else.

On average, frequent users earn an extra $340 a year for just getting things they already buy!

“Easy money back without a catch. I’m getting cash back on stuff I would’ve had to buy anyway. Upside gives you easy savings that you actually see!” – alicejpark90

Wherever you are, just use the app to see where you can get cash back! You can get up to 25¢ per gallon, up to 30% back on groceries, and up to 45% back at restaurants.

Easily cash out via bank transfer, Paypal, or gift card; there’s no limit to how much you can earn. Download Upside for free to earn cash back, and new members can use a welcome code: TSW25 to get an additional 25¢ a gallon on their first gas purchase!

Gas offers are not currently available in NJ, WI, or UT.

7.

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.