Money-Saving and Making Apps that Should be on Every Millennial’s iPhone

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Your smartphone can cost up to a grand or more. Isn’t it time for it to start earning its keep?

While your phone can’t exactly get a job, it can give you access to some amazing apps that will actually save you money. Download them all, and your phone bill just might start paying itself!

There are so many important things in life that saving more money can help you to achieve. Whether you’re thinking of taking an Instagrammable trip, buying a new set of wheels, or putting a down payment on a home, having strong savings is essential to helping you get the things you want out of life.

Plus, experts recommend always having a fully-stocked emergency fund containing three to six months of your expenses to protect you in case of unforeseen bills or even job loss.

So, are you ready to start using your phone to save big? Time to start downloading these apps and saving/making money today.

1. A Legit Way to Earn $750 This Week

You can get $750 direct deposited into your bank account and all you have to do is try out some deals. The catch? You can only do this once a year!

Seriously, anyone 18+ can participate in Flash Rewards, a rewards program that’s been around since 2016 and has rewarded $12 million to participants over time.

So how do you get the money? Answer: You just have to follow the instructions carefully!

Flash Rewards work by showing you “deals” they think you would like. This includes mobile apps and games, subscriptions, financial services, etc. Each type of deal you choose has its own mini task to complete.

- Head over to Flash Rewards and fill out basic info (Email, Name, etc.)

- Take a quick Survey (it helps figure out the optional offers & required deals to recommend)

- Complete deals by shopping Flash Rewards’ great brand name partners.

- Important: Follow the instructions on completing the specific number of deals for each level and get to Level 5 to get the maximum reward! (there are plenty of deals to try – some are free trials or app downloads, others require a purchase!)

- Claim the reward and get it in about a week!

You won’t get your reward if you don’t complete the required amount of deals. Sure, it takes a little more effort but it’s legit. Get your $750!

2. Get Up to $55 Per Win Popping Bubbles

Make consistent extra money playing Bubble Cash, where you match 3 bubbles of the same color until you clear the board. It’s popular, too, since the game is frequently ranked within the Top 10 in the App Store with a 4.6/5 star rating with over 120K+ reviews!

Win free cash when you collect enough gems to enter practice tournaments, and then win MORE when you enter the higher stakes tournaments (there’s a small entry fee for the bigger tournaments).

“Finally, a game that isn’t a scam! I won $71 yesterday on Sunday, and today on Monday, it was already in my Paypal” – Mzmari

Play for free now, and then switch to cash games to increase your winnings whenever you want. Obviously, this won’t make you rich, but 100% worth it compared to other games that don’t pay.

3. Ask This Company To Pay Off Your Outstanding Credit Card Debt

It’s 2024, and you want to body slam that debt down and keep it down. You just need a little help doing it.

MyLendingWallet can help if you have under $35,000 in debt. They’ll offer a personal loan that pays off all your balances and consolidate them into one balance to make it easier on yourself.

Regardless of credit status, you can quickly determine if you qualify for a loan with APRs ranging from 5.99% to 36% max. Since their network has over 100 vetted lenders, you’ll be able to compare with no obligation either.

You can get funds as fast as 24 hours, and they have flexible repayment periods (61 days to 72 months!). Even better? There’s no credit score impact to check, so see how LoansUnder36 can help now! It only takes 2 minutes.

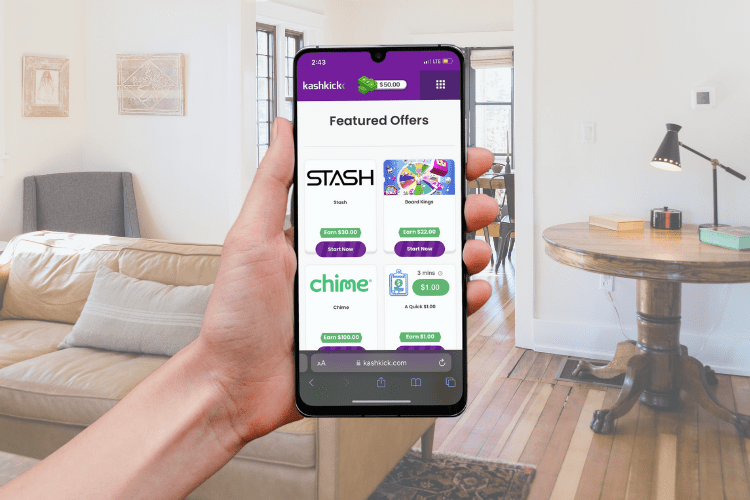

4. Hustle like a Mother and Earn Up To $1,000!

Easy, effortless options on the go for those who hustle. Join the over 3M hustlers earning extra on KashKick while doing things they love! It’s free to join, and signing up is easy.

Like to cook? Earn while trying new recipes! Waiting to pick up kids in the car line? Play a mobile game and start earning! Some games pay over $180 to play and complete!

Paying for gas? Get cash back! So many different ways to earn a little extra cash without much effort. You can also shop now and pay later, complete surveys, play mobile games, or try new services and get a cash back reward.

“Kashkick saved my life! I lost my job, and thanks to KashKick, I get a little side income to pay a couple of bills.” – Shanice, New Orleans

5. Earn Up to $750 Trying Out Offers

Try out offers and get rewarded. That’s the gist of Earn Big Rewards, a fun program where you can earn up to $750 (or even $1,000 if you’re ambitious) just by checking out sponsored offers from their partners.

Over 1 million members have gone through and got their rewards, and you can too! It’s simple.

Offers and deals vary, but the most important thing to know is that different levels have different rewards. Lower levels yield smaller rewards, while Level 5 will get you $500, $750, or $1,000.

You’ll be able to choose from mobile games, free trials, subscriptions, streaming services, and more after answering some quick questions.

Once you complete the levels you want, you can cash out and get the reward in a week!

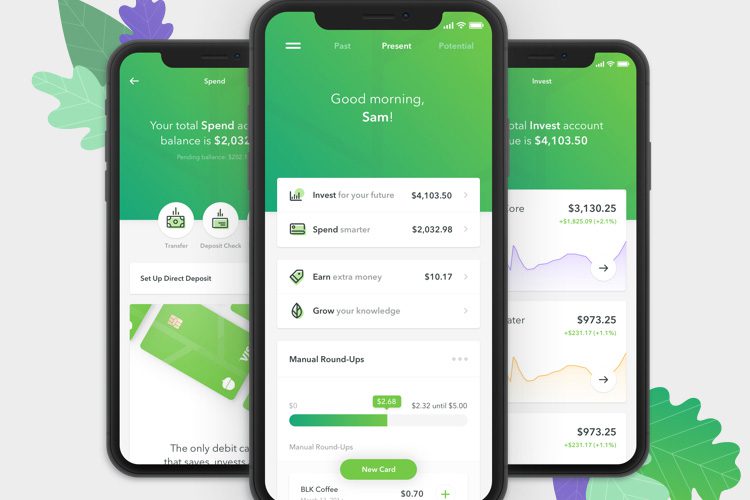

6. The Money App Backed by Celebrities That Saves AND Invests for You

Acorns has caught the attention (and their investments) of Blackrock, Paypal, and major names like Dwayne Johnson and more. Plus, they have about 10 million all-time customers!

That’s because Acorns automatically saves and invests your spare change from every purchase with the Round-Ups® feature. You’ll get a diversified portfolio picked by experts based on your investment profile.

You only need $5 to start investing, and when you set up recurring investments, you’ll get a $20 bonus!

Get started in under 5 minutes with no financial experience or expertise needed. You’ll also get access to retirement, investing for families, rewards, and more based on your subscription plan.

With no hidden fees, Acorns makes it easy to invest in your future with your spare change!

7. Here’s How to Legally Bet On Games

If you can read this, it means you can legally bet on your favorite team and players.

Do it with FanDuel Sportsbook, America’s #1 online sportsbook, where you can safely, legally, and securely bet on sports.

It’s simple to get started:

- Create an account with FanDuel Sportsbook & deposit at least $10

- Find your game and the outcome you want to bet on

- New users get an amazing promo: bet $5 and get $200 in bonus bets guaranteed

Don’t be a sideline sitter; dive into the games with some bets. Just bet $5, and you’ll get $200 in bonus bets guaranteed, WIN OR LOSE.

21+ in select states. First online real money wager only. $10 Deposit req. Refund issued as non-withdrawable bonus bets that expire in 14 days. Restrictions apply. See full terms at fanduel.com/sportsbook. FanDuel is offering online sports wagering in Kansas under an agreement with Kansas Star Casino, LLC. Gambling Problem? Call 1-800-GAMBLER or visit FanDuel.com/RG (CO, IA, MI, NJ, OH, PA, IL, TN, VA), 1-800-NEXT-STEP or text NEXTSTEP to 53342 (AZ), 1-888-789-7777 or visit ccpg.org/chat (CT), 1-800-9-WITH-IT (IN), 1-800-522-4700 or visit ksgamblinghelp.com (KS), 1-877-770-STOP (LA), visit www.mdgamblinghelp.org (MD), 1-877-8-HOPENY or text HOPENY (467369) (NY), 1-800-522-4700 (WY), or visit www.1800gambler.net (WV).

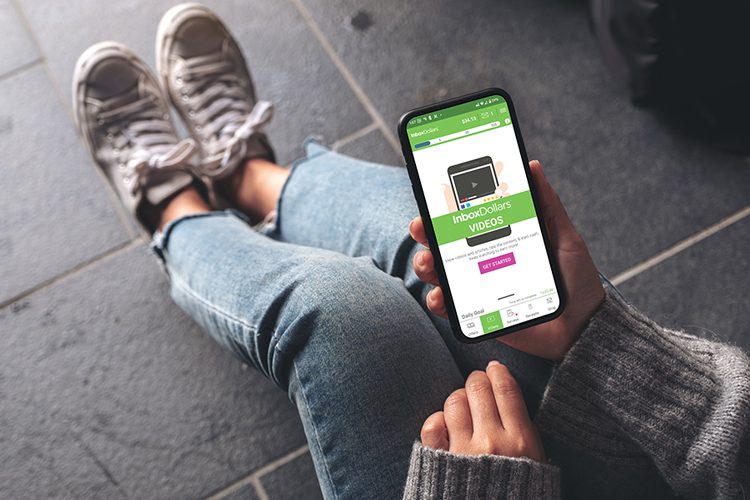

8. Get Paid Up to $225/Month While Watching Viral Videos and Taking Fun Surveys

Founded in 2000, Inbox Dollars has been paying customers for their opinions for over 24 years and counting! They are one of the most trusted survey sites with fun, multiple ways to earn extra cash that set them apart.

“Fast and easy. Love that I can cash out to my PayPal and easily transfer money to my bank account.” – Tefanie P

Take surveys, watch videos, play games, and even read emails for extra cash. Who wouldn’t want to watch viral videos for money and get paid up to $225/month?

Inbox Dollars is a great platform to make a little side money. It’s free to sign up, so give it a try today!

9. Get Free Cash Back Every Time You Get Groceries, Gas, or Meals

Why not get free money back any chance you can get? That’s why we like Upside, a free cash back app that partners with 100,000+ businesses to bring you great offers you can’t get anywhere else.

On average, frequent users earn an extra $340 a year for just getting things they already buy!

“Easy money back without a catch. I’m getting cash back on stuff I would’ve had to buy anyway. Upside gives you easy savings that you actually see!” – alicejpark90

Wherever you are, just use the app to see where you can get cash back! You can get up to 25¢ per gallon, up to 30% back on groceries, and up to 45% back at restaurants.

Easily cash out via bank transfer, Paypal, or gift card; there’s no limit to how much you can earn. Download Upside for free to earn cash back, and new members can use a welcome code: TSW25 to get an additional 25¢ a gallon on their first gas purchase!

Gas offers are not currently available in NJ, WI, or UT.

10. Take Surveys & Play New Games to Earn Extra Cash

Join over 15 million other members already completing surveys, playing games, and shopping from Swagbucks, a free rewards program where you’ll earn cash for your time. With consistent use, members can earn about $50 a day having fun! Plus, they’ve already paid over $600 million in gift cards and PayPal cash to their members.

Taking surveys is the best way to make money on Swagbucks. They can take 10 minutes or more and topics can revolve around food, beverages, household products, cars, and more. The next best way is to play new-to-you games! As you collect Swagbucks Points (SB) from completing tasks, redeem them for gift cards and cash!

New members can get a free $5 just for signing up, so join Swagbucks and start earning free rewards!

11. Get Free Money Back on All Your Shopping Hauls

Check your pockets; check your purse. And keep receipts for your iPhone.

Just grab all your recent receipts from your coffee runs, grocery trips, restaurants, and gas station fill-ups, scan them into Fetch Rewards on iOS, and earn points for free money! Connect your email account, as well, to count DIGITAL receipts from Amazon, Instacart, and more.

Basically, snap a pic of your receipt from anywhere, and that’s it; you’ve got points for money. There’s no minimum spend, no need to select items manually, scan in any receipt from any store or gas station, and it’ll automatically reward you.

It’s free and easy to use and is a must-have iOS app for anyone who buys stuff!

12. Earn a $200 Cash Bonus with this Capital One Credit Card

The Smart Wallet has partnered with CreditCards.com for our coverage of credit card products. The Smart Wallet and CreditCards.com may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

The Capital One Quicksilver Cash Rewards Credit Card makes an excellent option for those who want to earn rewards with every swipe.

Perks:

- Earn unlimited 1.5% cash back on all purchases

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months of account opening

- $0 annual fee and no foreign transaction fees

- No limit to how much you can earn, and cash back won’t expire for the life of your account

With this unlimited flat rate rewards type card, you won’t have to worry about using the “right card” for the “right purchases!”

13. How to Treat Yourself Despite Inflation Costs

Prices are rising everywhere, but it doesn’t mean you still can’t have nice things. Use Opinion Outpost, a free, online market research program that pays you up to $5 per survey.

It’s easy:

- Take short surveys on topics that interest you.

- Earn PayPal cash or gift cards for brands like Amazon, Texaco, Southwest, Target, Grubhub & more!

On average, Opinion Outpost pays its members $390K a month for their opinions. Why not make extra cash in your spare time?

And yes, they’re legit. They’ve been around since 2009 and are members of the ESOMAR & the Marketing Research Association, so your info will stay safe and confidential.

Join over 2M+ happy earners sharing their thoughts for awesome rewards. It’s free!