Status Money Review: How Your Money Compares to Others

Talking to your family or friends about money can be difficult, but very rewarding and eye-opening. It can be embarrassing to talk about topics like debt or excessive spending, but open discussion is often one of the best ways to gauge our own financial health.

While money is not a competition, it’s healthy to compare certain things. For instance, you might be spending way more than the average person at your age and income on car payments. However, you might never realize that unless you get into deep conversations about cash with your friends.

Status Money helps bridge the gap between the need for financial information and the difficulty of talking about it. The platform offers an anonymous, free community for you to share your financial decisions with peers and analyze theirs. Status Money can help you boost your savings, adopt better financial habits, and build your net worth. Here’s how it works.

What is Status Money?

Status Money can be a super powerful financial tool, but it’s actually really simple to use. Status, like almost every other financial management app, tracks your spending and habits. The app can link with your bank account and credit report to give a complete picture of your financial life.

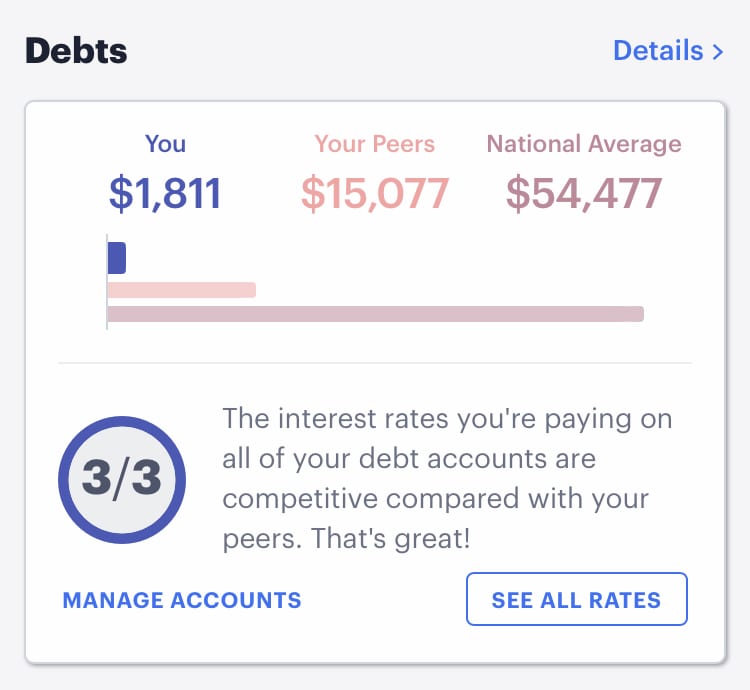

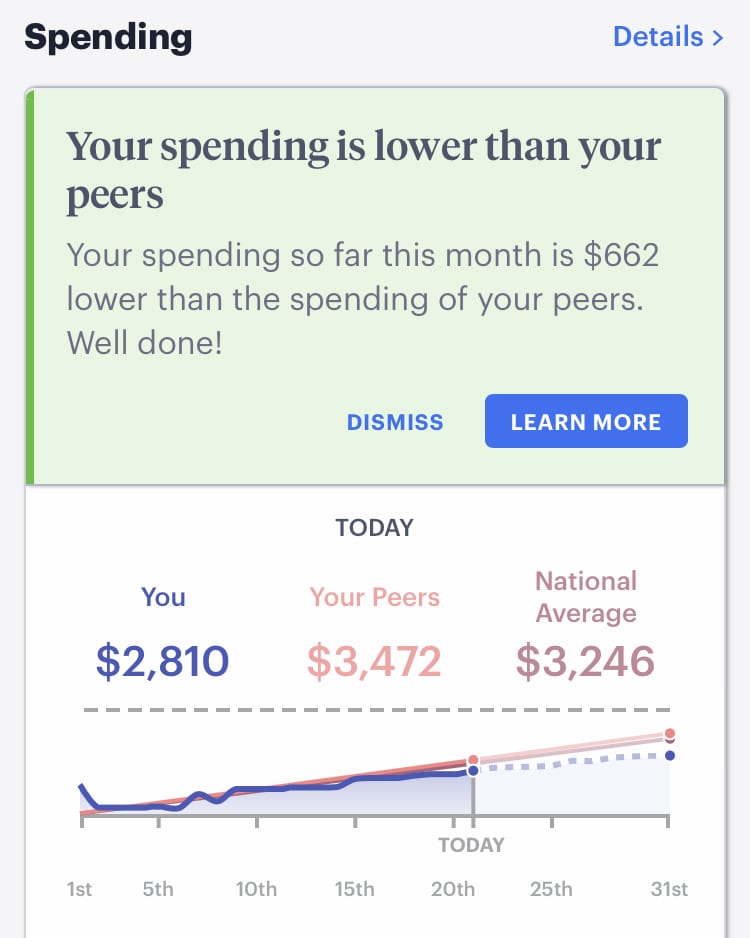

Unlike almost any other competitor though, Status shows how you stack up against your peers. You can compare your spending, net worth, debt, etc. to hundreds of thousands of other Status users, and get a better sense of where you stand compared to the average. You can sort using different filters, too. For instance, you can compare yourself to the overall national average, or refine your search by location, age range, income range, or virtually anything else.

What Status Does For You

For lack of a better word, Status Money shows you your financial “status.” Not only do you get a full sense of what your finances look like in a vacuum, but you also get the chance to see what those numbers mean in context. You might spot some red flags immediately, and thus have clear financial goals to start tackling.

Your spending is broken down across 16 categories, including housing, health, utilities, and travel. Your debts, income sources, and assets are also all divided and available on Status, so you really get everything consolidated into one place. As you view your own information, you can see bar graphs of how you stack up against national and other averages on your dashboard.

In addition to comparing your finances to others, the platform also analyzes your information and creates personalized money-saving suggestions. You’ll get tips on where to cut costs or find deals, as well as advice on investment tools that make sense for your portfolio.

When you act on the recommendations or complete certain tasks, you’ll often get rewarded with cash or bonuses too! For instance, within 5 minutes of signing up, I earned $7. When you get to $10, you can cash out.

Status Money even tracks and compares your net worth and offers free credit monitoring. The platform really is a financial catchall and is very valuable for anyone who needs a bit more motivation and organization in their life.

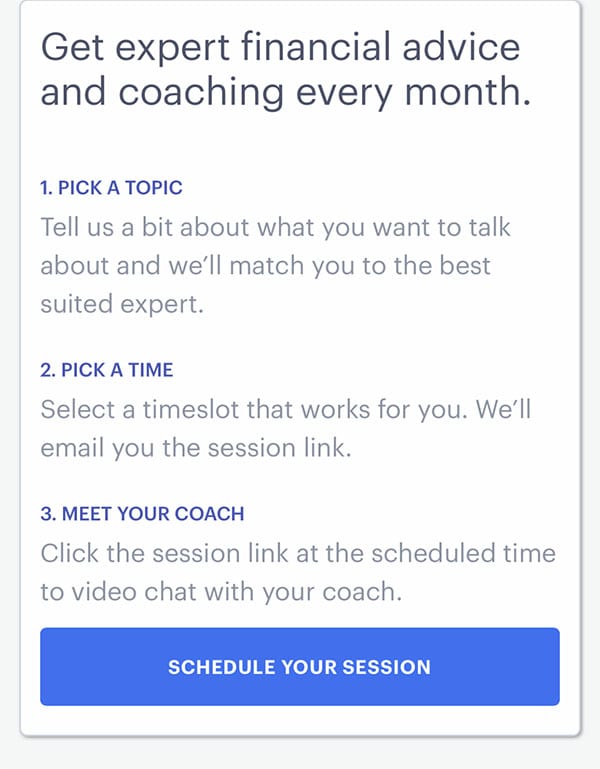

Video Chat with Certified Financial Planners

An exciting new feature that Status Money launched is member access to Certified Financial Planners that you can video chat with on a monthly basis. Whenever you need expert advice for your financial questions (budgeting, investing, taxes, debt, etc.), your personal coach can be there to help.

This access is part of the Premium membership, and you can set your own monthly contribution amount ranging from $3 to $20. It’s up to you!

In addition to financial coaches, Premium membership also includes:

- More financial analyzations

- Goals setting

- A Credit report updated weekly

- Ability to customize peer groups and filters

Considering that financial coaches on average cost $100 – $300 an hour, Status’ maximum $20 monthly cost is extremely generous.

Plus, financial coaches will have your best interests in mind as members can publicly review each coach after each call.

Is Status Money Worth Trying?

We always recommend trying free platforms, and since Status Money costs nothing to use (unless you upgrade to Premium), it’s worth a shot for everyone. The app does, of course, collect data, but offers bank-grade security, 256-bit data encryption, and a guarantee that your personal data will never be sold.

Status is also currently offering a $5 free bonus for new members, so you’ll be getting paid to try it out. With all that in mind, almost anyone could find some value in Status so it’s certainly worth trying. Even if it doesn’t work for your needs, you’ll at least take away some valuable insight on how you compare to your peers.

The Bottom Line

Status is a unique and versatile money management platform. By immersing yourself within a community of savers and spenders, you get access to massive amounts of financial data that you can use to inform your decisions. In addition, you keep your privacy and anonymity and don’t need to disclose your financial worries to anyone. Status Money gives you the tools to boost your finances and improve your financial health at no cost!

While some might find it unsettling to see how they stack up financially to their peers, it can actually be a major relief. The devil you know is worse than the devil you don’t, and you can’t fix any of your financial issues until you address them head-on. Status can help you do that, and help you ace your goals!

Read More: 5 Things to Cut Out if You’re Serious About Your Budget