Toggle Renters Insurance Review: Affordable and Customizable Coverage Starting at $5/Month

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Along with life and health insurance, renters insurance is one of the most important policies for many people. Nearly half of all adults rent the place they live as opposed to owning it.

Without renters insurance, anyone who doesn’t own their home or apartment could lose all their possessions in a crisis and get no monetary relief. Renters insurance is critical to have, and Toggle is one of our favorite providers because of their affordable prices and flexible policies.

What is Renters Insurance?

In short, renters insurance protects people’s belongings in case of a disaster or emergency. Most insurers cover anything from theft, fires, water backup damage, and natural disasters.

Even if your landlord has property insurance, it doesn’t cover the renter’s property. Imagine your laptop, your camera, your phone, your jewelry, anything else you find valuable, stolen, or destroyed. Then think about the costs it’ll be to replace them.

Renters insurance covers your assets directly, and policies often allow you one of two options: getting the costs of your replacement stuff covered, or reimbursing you for the value of what was lost.

What Makes Toggle Stand Out for Renters Insurance?

Renters insurance policies can get pretty expensive in some states and is generally upwards of $120 per year. Toggle, on the other hand, has policies starting as low as $5 per month, or what they like to compare it to – a price of a latte.

Toggle, a Farmers Insurance® company, offers customizable and affordable renters insurance plans that adjust to your needs. Every policy comes with standard coverage, and the option to cover any of your valuables. Then, everything you include on your policy is protected, whether you’re at home or on the road. As you pick up or lose assets, you can adjust your policy over time so it always covers exactly what you need.

If you move within your state, you can keep your coverage without any issues. If you cross state lines, the same goes as long as you’re somewhere that Toggle is available.

Your policy also covers your possessions whether you’re at home or away from home. For instance, if your phone got stolen in Barcelona or if you lost your camera at Zion National Park, you’re covered!

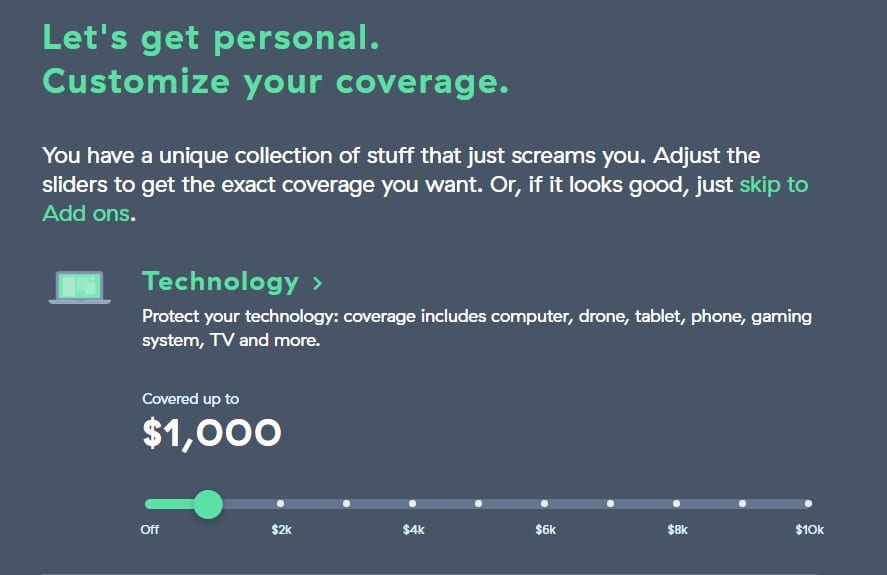

Customizing Coverage

As you add more coverage based on the types of categories that are most important to you (tech, furniture, jewelry, collectibles, etc) your price per month will naturally adjust.

You can choose from $100 up to $1,000 deductible, meaning the amount you have to pay before your renters insurance starts covering the rest.

Liability coverage options are $100K, $200K, and $300K. This covers any legal fees and related expenses if a guest is injured in your home.

And all plans come with a $1,000 blanket coverage meaning that amount can cover anything in your possession, regardless of category.

Who Can Use Toggle?

Toggle is currently available in these 25 states and expanding to more soon:

| Arizona | Arkansas | California | Colorado | Georgia |

| Illinois | Indiana | Iowa | Kansas | Kentucky |

| Louisiana | Michigan | Minnesota | Mississippi | Missouri |

| Ohio | Oklahoma | Oregon | Pennsylvania | South Carolina |

| Tennessee | Texas | Utah | Virginia | Wisconsin |

Is It Worth Trying?

Like any insurance policy, you should shop around to find the best price before committing. There’s a good chance that Toggle will have one of the most affordable and inclusive policies available. Renters insurance is a necessity for non-homeowners, and Toggle’s mission is to make policies available for everyone.

They’re also under the Farmers Insurance family, whose been around for over 90 years serving the nation.

And while unpleasant to think about, a crisis can happen at any time. Getting a renters insurance policy is a smart move to protect your possessions, pockets, and peace of mind!

Easily get a free quote just to see what your options are and then decide from there.