U.S. Bank Altitude® Go Visa Signature ® Credit Card Review: 4X Points at Restaurants, No Annual Fee

The credit card market is flooded with new and emerging rewards credit cards from various credit card companies. But, only a few cards rise in the ranks and gain recognition: particularly the U.S. Bank® Altitude Go Visa Signature® Credit Card. This is an especially great card if you frequent restaurants and order take out often!

Let’s go through the highlights in this U.S. Bank Altitude® Go Visa Signature® credit card review so you can determine if it’s the right one for your wallet:

How Does the U.S. Bank Altitude® Go Visa Signature® Credit Card Work?

Here’s the breakdown for the U.S. Bank Altitude® Go Visa Signature® Credit Card:

Annual Fee: $0

New Member Bonus Offer: Earn 20,000 bonus points, equivalent to $200, just by spending $1,000 in the first 90 days.

Rewards Rates and Categories:

- 4X points per dollar on dining, takeout, and restaurant delivery services

- 2X points per dollar on grocery stores purchases and grocery delivery orders

- 2X points per dollar on streaming services

- 2X points per dollar on gas station purchases and EV charging stations (this is a great added perk if you drive an electric car, especially with high gas prices nowadays.

- 1X point per dollar on all other purchases

Credit Score Required: 700+ (Check your credit score for free here.)

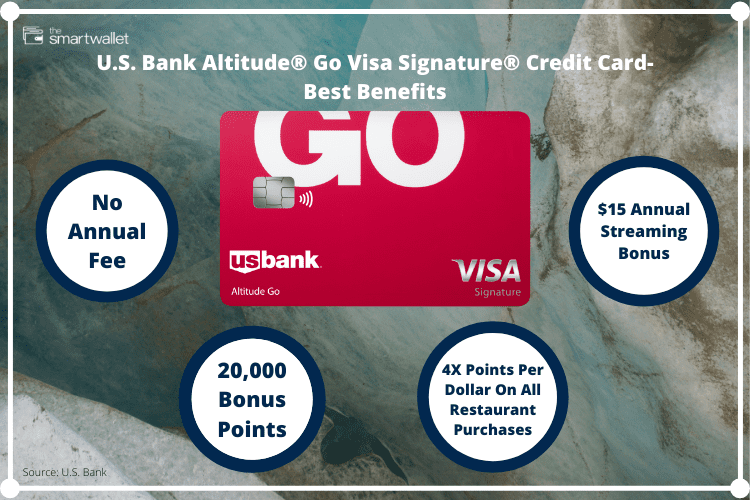

What are the Best Benefits of the U.S. Bank Altitude® Go Visa Signature® Card?

- No Annual Fee: A card of this caliber is an excellent value for its high point per dollar categories, considering there’s no annual fee.

- A Sizable 20,000 Point New Member Bonus Offer: Earn 20,000 bonus points (equivalent to $200) when you spend $1,000 within the first 90 days of your account.

- A High 4X Points Per Dollar On All Dining Purchases: This is a significant number of points per dollar for all your dining and eating out expenses. This is even higher than some of the most popular credit cards out there like the Chase Sapphire Preferred or Reserve cards, which only offer 3X points per dollar on restaurants and dining, and each charges an annual fee.

- $15 Annual Streaming Bonus: Earn a bonus of $15 per year (on top of the 2X points per dollar) when you pay for popular streaming services such as Netflix, Apple TV+, Spotify, and more!

Some great additional benefits include:

- No foreign transaction fees

- Your points never expire

- Redeem your points instantly with Real-Time Rewards.

- Earn additional points when making purchases with your card through the Rewards Center Earn Mall.

- Contactless Feature: Use your card to “tap and go” wherever contactless cards are accepted.

How Can You Redeem Points with the U.S. Bank Altitude® Go Visa Signature® Credit Card?

Points are valued at 1 cent per point, regardless of how they’re redeemed. For example, 1,000 points = $10.

If you want to redeem points for cash back rewards or travel, there are minimums for redemption. Cardholders have several options when it comes to how to redeem their points:

- Cash back rewards (minimum of 2,500 points to redeem)

- Travel (minimum of 1,000 points to redeem)

- Gift Cards

- Merchandise

What Are The Pros and Cons of the U.S. Bank Altitude® Go Visa Signature® Card?

Pros

- You’ll save money with no annual fee.

- New member bonus after you spend the required minimum amount.

- Several bonus categories to earn more points.

Cons

- You’ll need excellent credit to qualify.

- It’s not the best card for earning points if you don’t dine out or order take out often.

The Bottom Line

The U.S. Bank Altitude® Go Visa Signature® Credit Card is great for foodies with excellent credit who don’t want to pay an annual fee. If you’re spending most of your budget on dining and restaurants, including takeout, this card is certainly your best bet! At 4X points per dollar, your points will quickly add up depending on how much you spend on restaurants each month. Its stellar rewards rate on dining — combined with solid returns on grocery stores, streaming services, and gas stations — add up to an impressive combo. If you’re convinced, go ahead and act now!

If you’re more of a traveler and comfortable with annual fee credit cards, check out my Chase Sapphire Preferred® vs. Chase Sapphire Reserve card comparison or my Capital One Venture vs. VentureOne comparison: one of these might be a better fit for you!

Read More: How People Earn Cashback With Capital One Credit Cards

The Smart Wallet has partnered with CardRatings for our coverage of credit card products. The Smart Wallet and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.