How to Understand Credit Score Ranges

If interpreting your credit score feels like decoding a foreign language, that’s quite understandable. Though it’s easier than ever to access and review credit score information, the calculations that lead to that score are very complex.

Since your credit score influences your ability to borrow money in any form, it’s essential to understand what your credit score means to lenders.

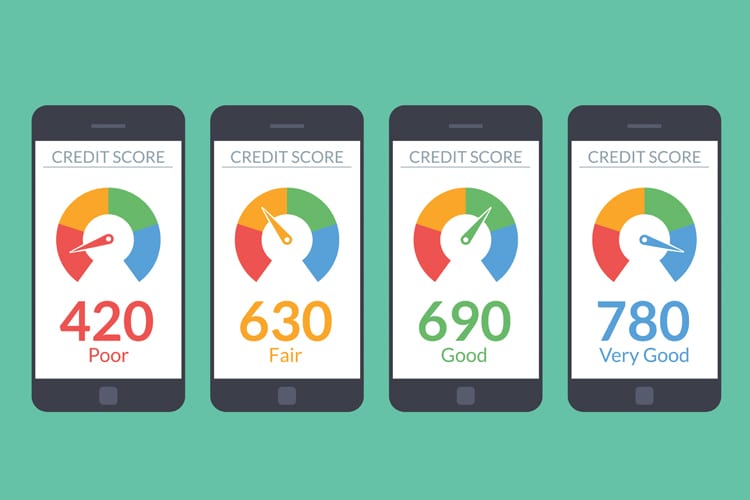

The most commonly used credit scoring models, VantageScore 3.0 and FICO 8, use a credit score range from 300 to 850. Wherever your credit score falls within that range determines if your score is labeled excellent, good, fair, or poor.

Excellent: 720-850

If your credit score sits in this range, you’re doing everything right! Lenders are falling at your feet to lend you money at competitive interest rates, and credit cards want to offer you the best rewards available.

Only about 1% of adults ever reach a perfect 850 credit score, though it will help you achieve and stay within the range of excellence if you have:

- Perfect payment history

- Light credit usage (balances are 7% or less of your credit limits)

- Long credit history (25 years or more)

- Multiple credit accounts

- Long periods between new accounts (you don’t open accounts frequently)

Keep in mind that your credit history only tracks late payments for seven years. Even if you mess up and miss a few payments, they’re forgiven with time and give you the chance to rebuild a higher score.

Good: 690-719

If you haven’t quite achieved an excellent credit rating yet, don’t sweat it. Good credit between 690 and 719 still opens countless doors of opportunity. You’ll still qualify for low interest rates, excellent credit rewards, and easy approval for a mortgage or car loan.

Get as close as you can to these credit factors to hit the “good” range:

- Pay all of your bills on time: This has the largest single impact on your score!

- Keep your credit card utilization (your balances) below 30% of your credit limits

- Keep your credit accounts open to improve the length of your credit history

- Don’t apply for multiple credit cards or loans in a short time frame

- Review your credit score regularly and dispute any information that is incorrect or too old to be included

Even though a 690-719 isn’t perfect, it’s still something to be very proud of!

Fair: 630-689

A fair credit score has room for improvement, but it doesn’t shut you out from the world of lending and credit entirely. Your options will unfortunately include higher interest rates and limited choices, but it’s always possible to refinance once your score improves.

If you have a fair credit score, you might have experienced some financial speedbumps in the past. Rather than aiming for perfection in the next six months, take small but powerful steps to increase your score a few points at a time:

- Pay your bills on time, without exception. If you’re in a difficult position and forced to pay late, do everything in your power to pay before an account hits the 30-day late mark. A 30-day late is literally a red mark on your score

- Pay down your credit cards as much as possible, even if it’s just $20 or $30 extra a month

- Keep your credit accounts open, but paid down, to lengthen your credit history

- Don’t apply for or open new lines of credit for the time being

Suffering the consequences of a less-than-perfect credit score is frustrating and disheartening, but the good news is that credit scores are ever-changing. Your past missteps can’t haunt you forever and you always have a chance to improve.

Poor: 300-629

If your credit score has fallen below 629, lenders consider you a high-risk consumer. Unfortunately, this means you’ll have very few options if you need to borrow money. Applying for a mortgage or car loan might be impossible with traditional lenders.

However, if you do fall into this category right now, you’re in the company of 20% of Americans. A low credit score doesn’t make you a bad person, it just means you have some financial work cut out for you. Perhaps you’re overcoming a serious financial emergency, illness, or divorce. Whatever the case, recovery is possible! The fair, good, and even excellent ranges aren’t out of reach.

Use these tips to increase your score and grasp onto better financial opportunities:

Make an initial cash deposit of $250 or $500 to open a secured credit card. Most secured credit card issuers accept anybody since it’s risk-free on their end. Use the card for small purchases and pay off your balance immediately. This builds a positive payment history and increases your credit limit.

Pay into a credit-builder loan. This type of loan works in reverse of a standard loan. Instead of receiving funds upfront and paying them back, you make monthly payments to build a loan. Once you’ve paid the full balance, you receive the loan amount back. This doesn’t just force you to save, it also reports to the three major credit-reporting agencies to boost your score.

The Bottom Line

You don’t need to be perfect to attain a credit score that keeps you qualified for the best financial opportunities. Pay your obligations diligently and avoid risky spending, and you’ll watch your score climb month after month, slowly but surely.

Read about micro-investing and how to get started with our complete guide: Micro-Investing: What It Is, Why It’s for You and How to Start.