3 Unique Money Saving Challenges to Try This Year

Everyone has their own trick to save money. Some people stick to a strict budget, some cut expenses out of their spending entirely, and some have more creative ideas to save. What works best for someone else might not work best for you, and it can be hard to tackle saving plans head-on sometimes.

If you struggle with budgeting, saving or spending habits, there are other ways to try and save money. Here are some creative money challenges that can help you start saving right away.

Note: All these challenges are designed to be flexible. Find whatever savings system works best for you!

1. Pantry Challenge

Groceries are a necessary expense, but it’s likely you end up spending more than you need. The U.S. Department of Agriculture estimates that the average family throws out about a third of the groceries they buy without using them. Very often you can end up buying a bit more food than you actually need, and not finish everything before it goes bad.

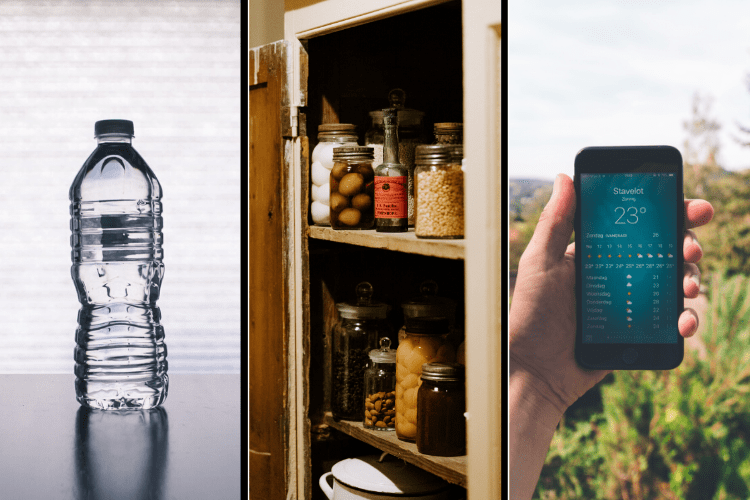

The Pantry Challenge is designed to keep your shopping budget and kitchen costs in check. The goal is to not go back to the grocery store until you’ve finished everything from your pantry (and fridge, etc.). Ideally, you’ll spend less at the store and waste less by eating food before it goes bad. You’ll need to get a bit creative with how you stock your pantry too.

If you challenge yourself with a once-monthly visit to the store, you’ll need to load up on non-perishables, and figure out what you need to freeze to keep for a month. You also might want to look into some specific recipes, so you know exactly what supplies to get and how much you’ll need to use. In addition to saving money, the Pantry Challenge can make you a more versatile cook too!

2. One Month Water Challenge

The One Month Water Challenge will not only save you a lot of cash, you’ll also come out a bit healthier. The name is pretty self-explanatory – you can only drink water for one month of the year. Tap water, filtered or otherwise, works best so you’re not spending on water bottles.

The average American household spends about $120 per month on alcohol and soda, so even a few weeks of only water can make a big difference. You can try doing the water challenge one month out of the year, or alternate every other month. Switching to just water can do a lot for your health too. There are tons of stories out there of people who kicked soda and alcohol for a month and felt much better after 30 days.

3. Weather Savings Challenge

While the first two challenges are still in your control, the Weather Savings Challenge is much more random and keeps you on your toes.

This idea was inspired by kacplanner on Instagram, who posted updates of their progress throughout the year. To complete the challenge, check the high temperature in your area every day, or one set day per week. Then, deposit that amount into your savings account, placing the decimal wherever you feel comfortable.

So hypothetically if it was 50 degrees in your hometown today, you’d deposit $50, $5, $.50, or $.05 into savings. What makes this challenge unique is that it adds extra variables to savings, so it’s not like you need to come up with a perfect system of what to deposit when. Plus, you’re in control of how much you save, and can constantly tweak your deposit amounts based on how financially stable you feel. And best of all, you’re making progress every day. It’s hard to see direct results with some money challenges, but with the Weather Savings Challenge, you can watch your savings grow immediately.

Read More: Save a $1,378 Emergency Fund & Have Fun Doing It!