WallyGPT: Your Own AI Financial Advisor At Your Fingertips

Have you always wanted someone to help manage your finances? Keeping track of your expenses is hard; having a qualified financial advisor can help you get everything in order.

But with an average consultation costing up to $55,000, personalized assistance is out of reach for many people who need it.

This is all about to change with WallyGPT, the world’s first GPT-powered personal finance app. Instead of shelling out your monthly salary for one meeting, you’ll have your financial advisor whenever you need it—free of charge.

So will this app end up being a legit alternative to a real-life finance guru? Learn more about how it matches up and if it’s the right choice for you.

What Is WallyGPT?

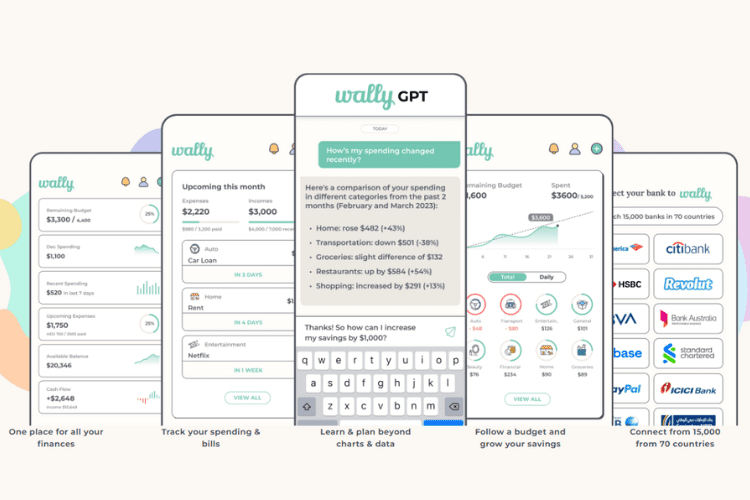

While Wally has been around since 2014, the GPT version has only been introduced in June 2023. It comes packed with features for anyone looking to improve their financial literacy by a simple “chat” with their robo advisor about specific questions. This is WallyGPT as your very own financial advisor that will get to know you as you use it, rather than the usual static data you’ll get from most traditional personal finance apps.

So far, the app has expanded to over 70 countries and partnered with over 15,000 banks worldwide. It’s also been highly recommended by The Guardian, Business Insider, and more.

How To Manage Your Money On Wally

After you sign up, you’ll need to connect your bank accounts to the platform for it to start keeping track of your spending.

The software can learn the more information you give it, so be specific with details like your income, expenses, savings goals, and spending habits. Based on your data, Wally comes up with tailored financial advice.

It also has many prompts and features that make it feel like the next generation of finance apps, including:

- Giving you detailed answers about specific spending habits

- Personalized guidance on savings goals

- Answering finance-related questions whenever you need it

- Being your personal “coach” that helps you with your investment decisions

- Giving you customized reminders when your monthly bills come up

With WallyGPT, your advisor will be right at your side, coaching you on your financial habits and giving you the resources you need when you need them!

Is WallyGPT Legit?

You have nothing to worry about with WallyGPT– it’s one of the most secure finance apps on the market. Wally has end-to-end encryption, and the platform does not sell your data or store your personal information. The platform also deletes your chat responses within 30 days.

If you’re still unconvinced, many happy users love the app’s features. It currently has a 3.9 rating on the App Store.

How To Sign Up For WallyGPT

Getting started with Wally is a piece of cake, and 100% free to sign up. Here’s what you need to do:

- Download the app from the App Store for iOS or Google Play Store for Android.

- Enter your personal information and your financial data.

- Once you’re verified, you’re all set to start budgeting!

WallyGPT: Pros And Cons

Pros

- User-friendly and intuitive interface

- Personalized advice that fits your needs

- Wally’s insights improve over time as it learns your spending habits

- Completely free to use

Cons

- Some banks do not sync with Wally’s system

- Not a complete replacement for more complex financial portfolios

The Bottom Line

WallyGPT’s AI software is making financial planning accessible to everyone. It’s free to use, and the software will “grow” with you as it learns more about your financial habits.

It has everything you need for everyday spending or simple financial portfolios.

But this software still has a long way to go before replacing a human advisor, especially for more complex portfolios.

No matter your financial situation, WallyGPT can give you practical financial advice whenever you need it. Download the platform at the iOS App Store or Google Play Store today to try it out!

Read More: