16 Ways to Flex That Wallet for Summer

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Your summer plans may be shaky at this point but it doesn’t hurt to prep for potential “I deserve this” splurges. A new bike for the boardwalk? A road trip? Maybe you’ll just move some vaca plans to a later time or just have an extra lush trip next year!

Regardless of the timeline, extra ways to make some side money are always welcome so we rounded up some fun and productive ways so you can flex your wallet when you want to for the summer and beyond.

1. Take Surveys & Play New Games to Earn Extra Cash

Join over 15 million other members already completing surveys, playing games, and shopping from Swagbucks, a free rewards program where you’ll earn cash for your time. With consistent use, members can earn about $50 a day having fun! Plus, they’ve already paid over $600 million in gift cards and PayPal cash to their members.

Taking surveys is the best way to make money on Swagbucks. They can take 10 minutes or more and topics can revolve around food, beverages, household products, cars, and more. The next best way is to play new-to-you games! As you collect Swagbucks Points (SB) from completing tasks, redeem them for gift cards and cash!

New members can get a free $5 just for signing up, so join Swagbucks and start earning free rewards!

2. Play New Games and Earn Branded Gift Cards

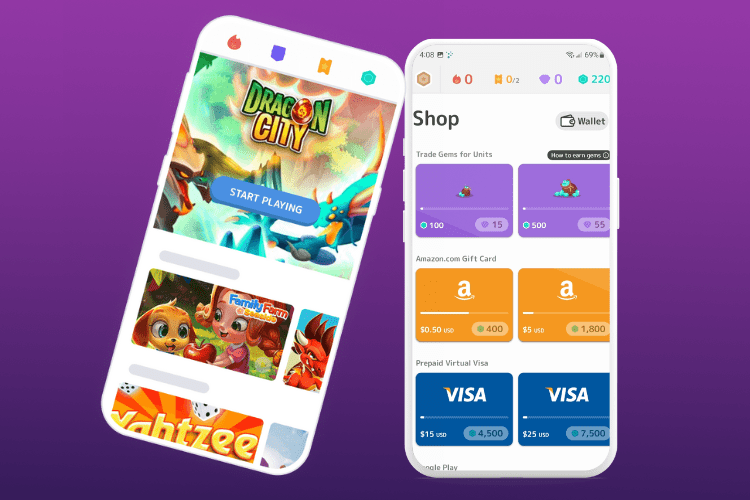

The more you play, the more rewards and gift cards you can get. That’s the gist of Mistplay, an app where you can try out new Android games to earn units/gems and make optional in-app purchases. Redeem units/gems for real gift cards, including Uber, VISA, Spotify, and more!

Play as many games as you want since you can earn more gift cards that way. Plus, there’s nobody to compete against! New members get a BONUS of 200 points just for signing up.

And yes, it’s legit and already has 10M+ downloads. Download the app for free and start racking up those gift cards!

3.

4. Take Surveys & Play New Games to Earn Extra Cash

Join over 15 million other members already completing surveys, playing games, and shopping from Swagbucks, a free rewards program where you’ll earn cash for your time. With consistent use, members can earn about $50 a day having fun! Plus, they’ve already paid over $600 million in gift cards and PayPal cash to their members.

Taking surveys is the best way to make money on Swagbucks. They can take 10 minutes or more and topics can revolve around food, beverages, household products, cars, and more. The next best way is to play new-to-you games! As you collect Swagbucks Points (SB) from completing tasks, redeem them for gift cards and cash!

New members can get a free $5 just for signing up, so join Swagbucks and start earning free rewards!

5. Find Curated Remote and Flexible Jobs With This Site

With a record 40 million people that filed for unemployment,* it’s crucial to be able to hold a remote or flexible full-time or part-time position in these still uncertain times.

Instead of searching through irrelevant job boards, use FlexJobs, a 13+ year old company that specializes in finding only remote and flexible schedule jobs. For a limited time, their membership plans are 30% off (with promo code SAVE30) making the plans only:

- $4.95 /week

- $9.95 /month

- $23.95 /three months (most popular!)

- $44.95 /year (best value)

Memberships include access to jobs as well as resources like Career Coaching, Resume Review, 170 expert skills tests to better assess and promote your skills, and more.

Lori S. from Colorado Springs, CO said, “I would have spent hours trying to find these jobs on my own. I LOVE this website!! These are jobs that are not easy to find—I found the membership fee very reasonable and worth every penny considering I have found two wonderful jobs through FlexJobs.”

Non-essential workers are being asked to stay home during these times but making money is essential to everyone so take advantage of the 30% off membership plans to look at what could be your next new job! Remember to use promo code SAVE30.

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.