19 Weird (but Totally Legal) Ways To Pay Rent This Winter

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Ahh, winter. Depending on where you live, you’re either miserable with the freezing temps or it’s just another chillier season.

It’s basically the end of 2021 though and we should be grateful for our health. And a place to live.

Even though every time that chunk of rent payment leaves your bank account and into someone else’s, it hurts just a little bit. But it’s the price to pay for having your own living space and basically, a non-negotiable.

Because no matter what, you gotta keep adulting when you don’t want to move back in with family. Seriously.

So keep making those rent payments and we’re making it a little bit easier by suggesting some things you can do to earn some side cash as well as manage your money more efficiently. Even better when you can get paid for doing stuff you already do!

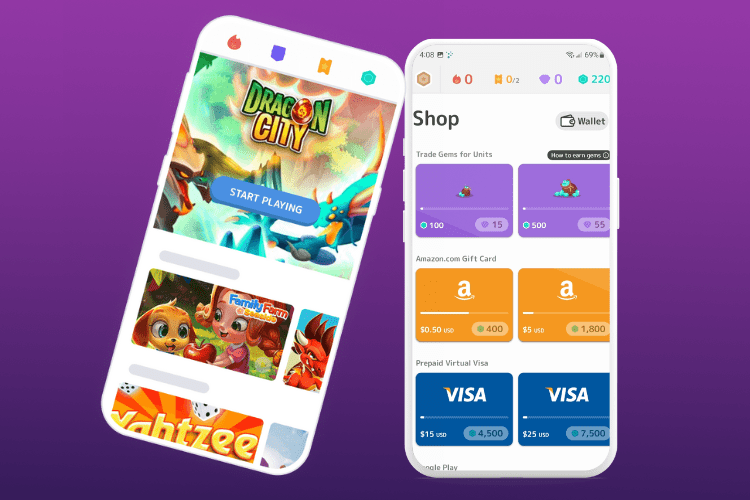

1. Play New Games and Earn Branded Gift Cards

The more you play, the more rewards and gift cards you can get. That’s the gist of Mistplay, an app where you can try out new Android games to earn units/gems and make optional in-app purchases. Redeem units/gems for real gift cards, including Uber, VISA, Spotify, and more!

Play as many games as you want since you can earn more gift cards that way. Plus, there’s nobody to compete against! New members get a BONUS of 200 points just for signing up.

And yes, it’s legit and already has 10M+ downloads. Download the app for free and start racking up those gift cards!

2. Earn a $10 Amazon Gift Card by Trying New Games

When you’re ready to add even more games to your lineup, then download Cash Giraffe, an Android app that pays you to try out new games for, yes, you guessed it, cash. All are free to download!

Just earn coins from trying new games, and then you can redeem them for:

- PayPal Cash

- Amazon gift card

- GameStop gift card

- PlayStation Store gift card

- Xbox Live gift card

- And more good stuff

“Payouts are faster than most apps. PayPal rewards are small, but hey, it’s free money 💰 🤑“- Cassandra McGuire

A 3,599 coin welcome bonus is yours immediately too, when you sign in! Plus, get 200 coins for every friend you refer and 25% of their earnings.

3. Take Surveys & Play New Games to Earn Extra Cash

There are a lot of survey programs out there, but none are as popular as Swagbucks, a free rewards program where you can earn cash for your time and opinion. Members can earn an average of $50 a month!

You get rewarded for doing surveys, searching the web, reading articles, and playing fun games but the one activity that earns you the most points is completing surveys. (Don’t skip out on those!)

Points can then be redeemed for free gift cards, cash, and sweepstakes entries. All just by completing fun activities and giving your opinions.

New members can get a free $5 just for signing up, so join the other 15 million members already part of Swagbucks and start earning free rewards!

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.