Weird (but Totally Legal) Ways To Pay Rent in 2024

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Note: These suggestions are meant to help supplement your finances. If you’re in a more dire situation, we suggest speaking with your landlord immediately, calling 211 for organizational assistance, applying for industry grants, and asking friends/family for help.

Every time a chunk of rent payment leaves your bank account and into someone else’s, it hurts just a little bit. But it’s the price to pay for having your own living space and a non-negotiable.

So keep making those rent payments, and we’re making it a little bit easier by suggesting some things you can do to earn some side cash and manage your money more efficiently. Even better when you can get paid for doing stuff you already do!

1. Get Paid Up to $225/Month While Watching Viral Videos and Taking Fun Surveys

Founded in 2000, Inbox Dollars has been paying customers for their opinions for over 22 years and counting! They are one of the most trusted survey sites with fun, multiple ways to earn extra cash that set them apart.

“Fast and easy. Love that I can cash out to my PayPal and easily transfer money to my bank account.” – Tefanie P.

Take surveys, watch videos, play games, and even read emails for extra cash. Who wouldn’t want to watch viral videos for money and get paid up to $225/month?

Inbox Dollars is a great platform to make a little side money. It’s free to sign up, so give it a try today!

2. Over $55,000 Paid to Members Daily - Join for Free

It’s about time you got paid for your opinions, right? It’s free and fun with Survey Junkie, which pays you with PayPal, gift cards, or directly to your bank account. Members get paid every day, and they’ve already paid out $76 million so far, so join to get your share!

“It’s easy to use, and you can get paid the same day. I really like that you can make a little bit of extra money,” Gabe L.

Just follow these simple steps:

- Click here to sign up for a free Survey Junkie account

- Take surveys

- Repeat daily and get paid; there’s no limit!

It only takes a few minutes to join Survey Junkie but remember to verify your email address.

Completing each survey earns you 20 to 100 points. Each point is worth one cent, and when you hit 500 points (or $5), you can cash out, which is one of the earliest cash out points we’ve seen!

3. Ask This Company To Pay Off Your Outstanding Credit Card Debt

It’s 2024, and you want to body slam that debt down and keep it down. You just need a little help doing it.

MyLendingWallet can help if you have under $35,000 in debt. They’ll offer a personal loan that pays off all your balances and consolidate them into one balance to make it easier on yourself.

Regardless of credit status, you can quickly determine if you qualify for a loan with APRs ranging from 5.99% to 36% max. Since their network has over 100 vetted lenders, you’ll be able to compare with no obligation either.

You can get funds as fast as 24 hours, and they have flexible repayment periods (61 days to 72 months!). Even better? There’s no credit score impact to check, so see how LoansUnder36 can help now! It only takes 2 minutes.

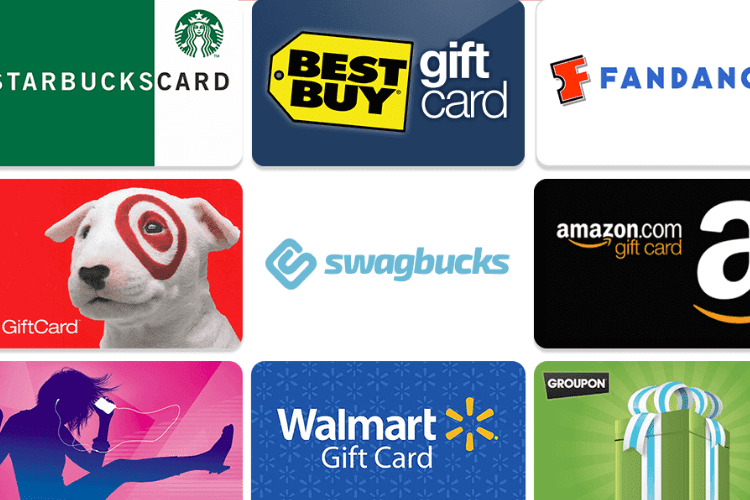

4. Take Surveys & Play New Games to Earn Extra Cash

Join over 15 million other members already completing surveys, playing games, and shopping from Swagbucks, a free rewards program where you’ll earn cash for your time. With consistent use, members can earn about $50 a day having fun! Plus, they’ve already paid over $600 million in gift cards and PayPal cash to their members.

Taking surveys is the best way to make money on Swagbucks. They can take 10 minutes or more and topics can revolve around food, beverages, household products, cars, and more. The next best way is to play new-to-you games! As you collect Swagbucks Points (SB) from completing tasks, redeem them for gift cards and cash!

New members can get a free $5 just for signing up, so join Swagbucks and start earning free rewards!

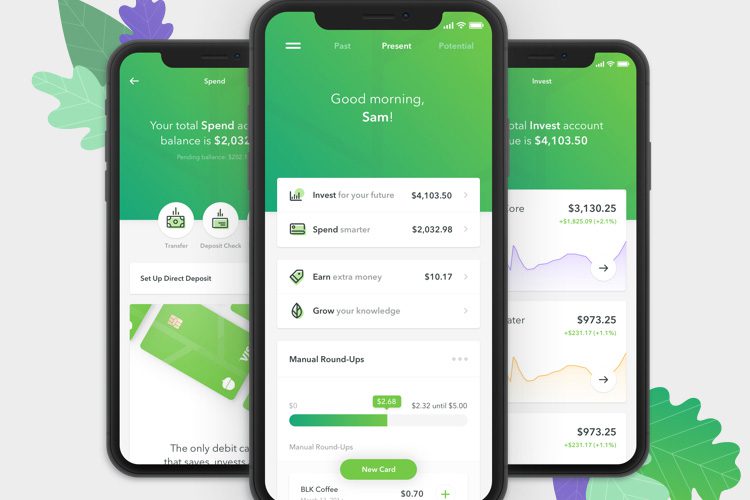

5. The Money App Backed by Celebrities That Saves AND Invests for You

Acorns has caught the attention (and their investments) of Blackrock, Paypal, and major names like Dwayne Johnson and more. Plus, they have about 10 million all-time customers!

That’s because Acorns automatically saves and invests your spare change from every purchase with the Round-Ups® feature. You’ll get a diversified portfolio picked by experts based on your investment profile.

You only need $5 to start investing, and when you set up recurring investments, you’ll get a $20 bonus!

Get started in under 5 minutes with no financial experience or expertise needed. You’ll also get access to retirement, investing for families, rewards, and more based on your subscription plan.

With no hidden fees, Acorns makes it easy to invest in your future with your spare change!

6. When It’s 2024, and You Still Have Credit Card Debt Under $100,000

Stop the anxiety attacks by getting rid of your debt. If you owe $100,000 or less, AmONE can help by matching you with a low-interest loan to pay off all your balances. Problem solved.

Their interest rates start at just 6.40% compared to credit cards, which can go as high as 36%! Plus, it’s only one monthly bill, making it way easier to manage.

There’s also no credit score impact to check, and repayment periods are flexible. Take 2 minutes to check, and you can get funds as quickly as 48 hours to wipe that credit card debt!

7. Earn Up to $750 Trying Out Offers

Try out offers and get rewarded. That’s the gist of Earn Big Rewards, a fun program where you can earn up to $750 (or even $1,000 if you’re ambitious) just by checking out sponsored offers from their partners.

Over 1 million members have gone through and got their rewards, and you can too! It’s simple.

Offers and deals vary, but the most important thing to know is that different levels have different rewards. Lower levels yield smaller rewards, while Level 5 will get you $500, $750, or $1,000.

You’ll be able to choose from mobile games, free trials, subscriptions, streaming services, and more after answering some quick questions.

Once you complete the levels you want, you can cash out and get the reward in a week!

8. Here’s How to Legally Bet On Games

If you can read this, it means you can legally bet on your favorite team and players.

Do it with FanDuel Sportsbook, America’s #1 online sportsbook, where you can safely, legally, and securely bet on sports.

It’s simple to get started:

- Create an account with FanDuel Sportsbook & deposit at least $10

- Find your game and the outcome you want to bet on

- New users get an amazing promo: bet $5 and get $200 in bonus bets guaranteed

Don’t be a sideline sitter; dive into the games with some bets. Just bet $5, and you’ll get $200 in bonus bets guaranteed, WIN OR LOSE.

21+ in select states. First online real money wager only. $10 Deposit req. Refund issued as non-withdrawable bonus bets that expire in 14 days. Restrictions apply. See full terms at fanduel.com/sportsbook. FanDuel is offering online sports wagering in Kansas under an agreement with Kansas Star Casino, LLC. Gambling Problem? Call 1-800-GAMBLER or visit FanDuel.com/RG (CO, IA, MI, NJ, OH, PA, IL, TN, VA), 1-800-NEXT-STEP or text NEXTSTEP to 53342 (AZ), 1-888-789-7777 or visit ccpg.org/chat (CT), 1-800-9-WITH-IT (IN), 1-800-522-4700 or visit ksgamblinghelp.com (KS), 1-877-770-STOP (LA), visit www.mdgamblinghelp.org (MD), 1-877-8-HOPENY or text HOPENY (467369) (NY), 1-800-522-4700 (WY), or visit www.1800gambler.net (WV).

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.