Weird (but Totally Legal) Ways To Pay Rent in 2024

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Note: These suggestions are meant to help supplement your finances. If you’re in a more dire situation, we suggest speaking with your landlord immediately, calling 211 for organizational assistance, applying for industry grants, and asking friends/family for help.

Every time that chunk of rent payment leaves your bank account and into someone else’s, it hurts just a little bit. But it’s the price to pay for having your own living space and, basically, a non-negotiable.

So keep making those rent payments, and we’re making it a little bit easier by suggesting some things you can do to earn some side cash as well as manage your money more efficiently.

1. Invest in Google, Amazon, Tesla, Netflix, and More

You might think that investing is complicated. Or that you’ll never get a share of these well-known brands like Google, Amazon, Tesla, etc., but you can. And you don’t have to be rich either.

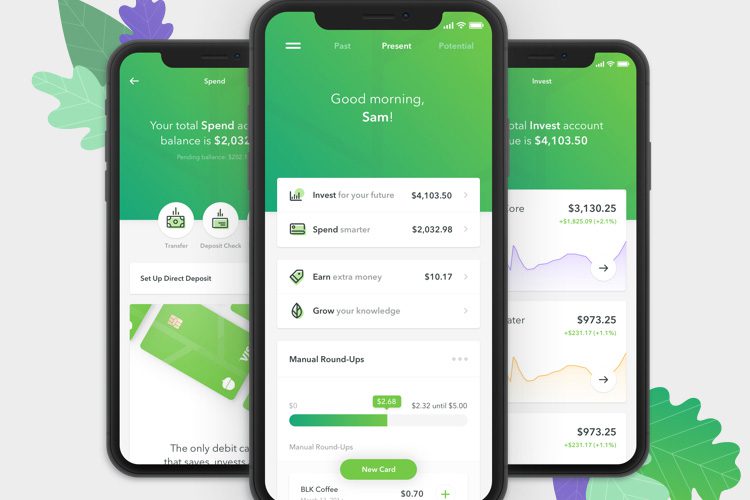

That’s because Stash, an investment app, lets you start investing with just $5. You can choose where to put your money, and they provide guidance and tools to help you along the way. You can invest in some of the major companies that you use or buy from regularly to make a custom Personal Portfolio.

With Stash Growth and Stash+, you can also choose the Smart Portfolio option, which offers hands-off stress-free investing since Stash will invest for you based on your risk tolerance.

Plus, Stash gives new members a bonus for any first investment, so create an account to get started.

Paid non-client endorsement. See Apple App Store and Google Play reviews. View important disclosures.

2. Fast Personal Loans For Any Type of Credit

Personal loans get a bad rep but if you use them for the right reasons like debt consolidation, house repairs, and unplanned major expenses like medical bills, it’s a valid option.

Save time and searching effort using LoansUnder36, a loan matching service for those looking to borrow $500 up to $35K. They’ll find loans regardless of your credit status, with APRs from 5.99% up to 36% max. Their network has over 100 vetted lenders and you’ll be able to easily compare side-by-side with no obligation.

There’s no credit score impact by applying for quotes and the repayment periods are flexible ranging from 61 days to 72 months (6 years)!

3. When It’s 2024, and You Still Have Credit Card Debt Under $100,000

Stop the anxiety attacks by getting rid of your debt. If you owe $100,000 or less, AmONE can help by matching you with a low-interest loan to pay off all your balances. Problem solved.

Their interest rates start at just 6.40% compared to credit cards, which can go as high as 36%! Plus, it’s only one monthly bill, making it way easier to manage.

There’s also no credit score impact to check, and repayment periods are flexible. Take 2 minutes to check, and you can get funds as quickly as 48 hours to wipe that credit card debt!

4. The Money App That’s Backed by Paypal, Dwayne Johnson, Ashton Kutcher, and More

Celebrities and leading investors can be particular about where they put their money, but Acorns has caught the attention (and their investments) of Blackrock, Paypal, and major names like Dwayne Johnson and more. Not to mention, they already have 4.7 million+ customers!

That’s because Acorns Banking does more than other types of accounts as it automatically saves and invests for you. Every time you purchase with your new metal debit card, the spare change gets invested into an expert-designed, diversified portfolio of stocks and bonds.

You can get started in under 3 minutes with no financial experience or expertise needed. You’ll also get access to retirement, investing for families, rewards, and more, all in one app.

With no hidden fees, Acorns makes it easy to invest in your future with your spare change.

5. This Company Will Help You Get Out of Debt

Debt happens, but don’t let it overwhelm you by not addressing it immediately. Ease that stress and resolve it with National Debt Relief.

They’re rated #1 for debt settlement on top consumer review sites and A+ with the BBB, so if you have over $10,000 in debt, you can get a free, no-obligation debt relief consultation. Whether the debt is from credit cards, medical bills, collections, etc., they’ll create an affordable plan that works with your budget.

Get out of debt faster than you think, and there are no fees until your debt is resolved, which can be as soon as 24-48 months. Check now since it only takes minutes to see if you qualify.

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.