Why You Should Buy I-Bonds at a 9.62% Interest Rate before 10/28/22

I bonds currently have a record-high 9.62% interest rate, but only if you place an order by October 28, 2022! You’ll lock in these amazing returns for the next six months, making the Treasury a great place to park your money right now. Many people agree: the Treasury has sold 27 billion dollars worth of I bonds within the last year.

What Are I Bonds?

Series I Savings Bonds are designed to protect you from inflation. The interest rate is set twice a year, based on a rate that changes with inflation (currently 9.62%). The federal government sells them via TreasuryDirect.

I bonds earn interest monthly, but you “lock in” the interest rate for six months at a time. So if you buy now, you’ll accumulate money under the 9.62% interest rate until late May 2023, even if the interest rate decreases. This means that now is a great time to buy bonds! The interest rate on I bonds is slated to decrease for purchases made after October 2022.

You can’t cash in (redeem) them until at least one year has passed, so don’t put in money you’ll need in the near future. If you cash in the bond within the next 1-5 years, you’ll lose the last three months of interest. After five years, you can cash out the full amount at any time!

I bonds earn interest for 30 years. However, they’re likely not a better investment than stocks in the long run. It’s because inflation is off the charts, and a matching interest rate makes them an especially appealing investment.

Why Are I Bonds The Best Investment Option Right Now?

Amidst looming fears of a recession in 2023, Federal interest rate hikes, and June 2022’s record high inflation rate, experts say that the stock market will likely drop lower into 2023 or be highly volatile. This makes investing in stocks risky, so you might be tempted to keep your savings in a checking or savings account.

However, I bonds are a better option if you have money you won’t need to touch in the next year, perhaps money set aside for future education or a down payment for a house down the line.

Based on the last CPI report, the next I bond interest rate is estimated to be 6.48%. This means that you’ll earn an average of 8.05% interest in the first year!

Stock market S&P 500 returns usually average around 7% in the long run, so getting this rate guaranteed is unprecedented.

How To Buy I Bonds

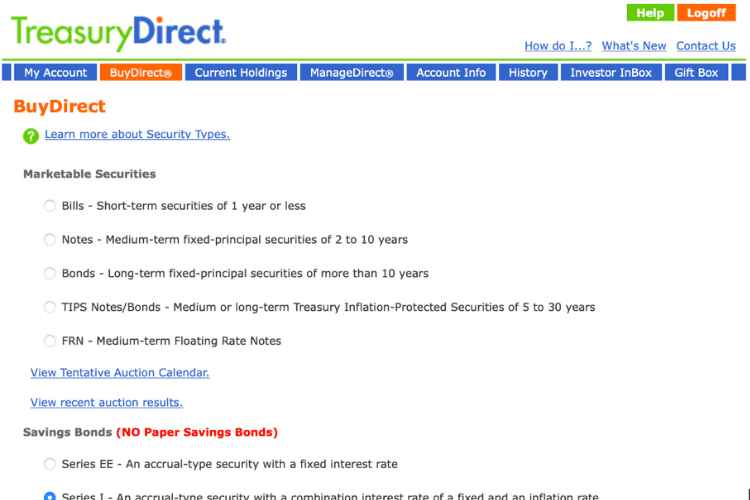

You can buy paper I bonds using your IRS tax return, but the best way to purchase them is online through TreasuryDirect. It takes one business day to process your payment, so you should buy I bonds by October 28, 2022, to ensure issuance by October 31, 2022 (the following Monday) and before the rate changes. This way, there’s no chance you will miss out!

My Experience With I Bonds

I bought I bonds just last week! It was a pretty straightforward process. First, I made an account on TreasuryDirect. The .gov website is slightly dated-looking but easy to navigate (it was recently redesigned due to high demand).

The website made me pick a complicated password and layers of security questions, so you can be sure your money and data are safe (though I do hope I don’t forget my password since I had to add more numbers and symbols than I usually do).

After my account was authorized, I linked my bank account. From there, I had to click in to buy bonds (double-checking that I selected Series I and not Series EE) and input the dollar amount!

You can deposit a minimum of $25 and a maximum of $10,000 per taxpayer, per year. If you accidentally buy so many bonds that your account exceeds the yearly $10,000 annual limit, they’ll cancel your purchase and take a while to refund you, so don’t type in the wrong number! There are multiple confirmation pages though, so it shouldn’t be a problem.

Now I’m just waiting for my first bit of interest to appear next month. Saving your money in strategic ways is very wise.

The Bottom Line

I bonds are a safe, secure, and reliable investment right now. With the economy in flux and the stock market more volatile than ever, it’s not a bad idea to park some of your cash savings in an I bond before the end of October 2022. This way, you’ll lock in the 9.62% interest rate for at least six months.