How You Can Earn More with Yotta Prize-Linked Savings Accounts and Cards

How do you quickly make money in the bank multiply?

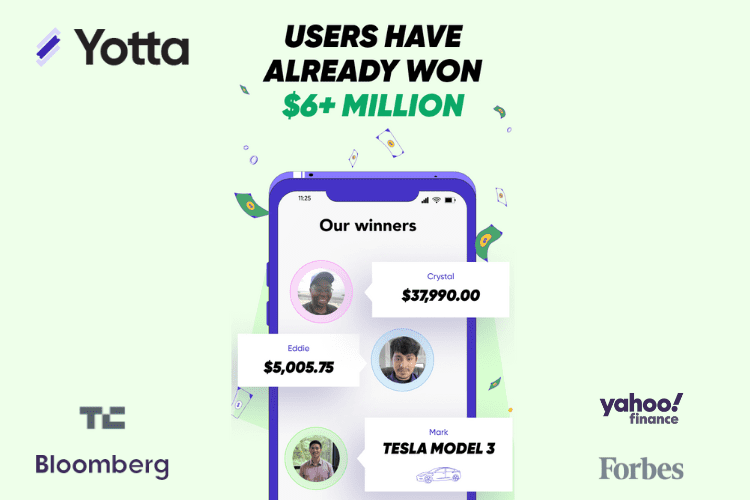

Yotta, a prize-linked savings account, will change how you view finances. This account pays out rewards of up to $1 million every day!

With over 700,000 members, an average 4.8-star rating on the App Store, an average 4.3-star rating on Google Play, and an average 4.8-star Trustpilot rating, Yotta is highly reviewed and trusted! The platform provides a myriad of financial benefits, from a no-risk lottery system to crypto buckets, I-bonds, paycheck perks, and even credit and debit card options. Yotta is changing the traditionally one-dimensional nature of savings and spending.

So, let’s jump right into the details.

How Savings Works with Yotta

At a base level, Yotta currently offers around 5% annual percentage yield (APY), meaning that just by saving with Yotta, you receive more than the national average for typical savings accounts of 0.01% to 0.04%. (Please note that interest rates can change at any time.)

There’s no minimum balance required to have a Yotta savings account, but for balances of $5.00 or below, there’s a monthly service charge of $1, debited from your Yotta account balance on the first of the month.

You can also withdraw from your savings account up to six times a month without any transaction fees, a perk that’s extremely useful during an emergency. In fact, 49% of Americans couldn’t cover a $400 emergency expense. Don’t be a part of the statistic! A Yotta savings account can be life-saving and can help you transform your financial future.

Yotta has 7 key features that set it apart from all the other savings accounts. Namely, the lottery system, paycheck perks, debit and credit card, crypto bucket, I-bonds, Pool Play, and Yotta pay.

How To Enter Weekly Sweepstakes with Yotta

The Yotta lottery system, unlike Powerball and Mega Millions, is paid out in weekly sweepstakes (sometimes called a “no-loss lottery”) with prizes ranging from $0.10 to $10 million! The lottery works by giving all users one ticket for every $25 they have in their FDIC-insured Yotta savings account.

This means that if you have $2,000 in your account, you’ll get 80 free tickets every week to participate in the weekly lottery as long as you don’t make a withdrawal. Earn more tickets when you save more.

On top of that, Yotta also balances tiers so that everyone has an equal opportunity to win. This is done by decreasing the number of tickets a user can receive for every red penny that crosses the tier line of $10,000. For example, if a user had $15,000 in their savings account, they’d receive one ticket per $25 on the first $10,000, and after that, they’d receive one ticket per every $150.

The winning numbers are generated completely randomly by a third-party “A” rated insurance company that’s not affiliated with Yotta, ensuring the security and integrity of the lottery system. On average, over 40% of Yotta members win a prize weekly!

Yotta’s New Lottery Pooling Feature

A new and innovative feature is Yotta Pool Pay, which functions as a part of the weekly lottery. The way it works is that friends and family can pool all their tickets together to play the lottery, increasing their chances of winning.

There are two options when it comes to pool play:

- Public Pools: You can share your pool with anyone who you choose to share your invite code with. It can really be anyone! Anyone who joins the public pool will have access to the pool’s invite code. So, the more you share the code, the more people join in and have a chance of winning the lottery.

- Private Pools: You can invite your close friends and family to an invitation-only pool, with each member contributing as many entries as they’d like.

The more you add to the pool, the bigger the cut you get, should you all win. This means no more arguments about how to split up the prize. If you put 70% in the pool and your friends only add the remaining 30%, you’ll be entitled to 70% of the rewards while the remaining 30% gets split between your friends and vice versa.

The Perks of Banking with Yotta

The first perk of Yotta banking is the ability to receive your paychecks up to two days in advance when you set up direct deposit. You can unlock a tax refund boost with each paycheck and even earn bonus tickets. You’ll earn 20% bonus tickets on your first direct deposit paycheck and 5% on every subsequent paycheck. Not only does this give you more financial flexibility, but it also increases your weekly tickets and provides you with 25% better odds in the Yotta swipes!

Yotta Debit and Credit Cards

There are fun perks to using the Yotta debit card, the only debit card that could make you a millionaire:

- Lucky Swipes: Get a 1 in 150 chance of getting your next purchase paid for by Yotta for free! You can even increase your odds to 1 in 100 for 30 days with each and every successful referral or by using your card to pay for dining purchases. When you use your card at one of Yotta’s partner Lucky Deal Merchants, your odds shoot up to 1 in 5!

- You’ll earn 10% back in tickets: A bonus ticket into the following week’s $10 million sweepstakes for every $10 you spend.

- 1,000 bonus tickets when you spend $2,000 in the first four months

- Access to 55,000+ free ATMs

- No foreign transaction fees

- Apple and Google Pay capable

- Purchase Liability Protection

In addition to all of the above, every meal purchase you make is rounded to the nearest dollar: Yotta partners with Feeding America to turn this extra change into a donation to feed families in need. So, you’ll be doing a good deed each and every time you go out to eat.

Oh, and after you successfully refer 10 friends, you get a shiny metal debit card!

Prefer a credit card instead? Here are the perks of using the Yotta credit card:

- Lucky Swipes: Get a 2% chance of getting your next purchase paid for by Yotta, for free, including on dining purchases. When you use your card at one of Yotta’s partner Lucky Deal Merchants, your odds shoot up to 20%!

- 20% back in tickets

- Build your credit score

- No Interest or Fees: uses your Yotta account balance as its upper limit. What this means is that it’s impossible to overdraw on your credit card, meaning you’ll never accrue any debt, or be forced to pay any fees.

- 2,000 bonus tickets when you spend $2,000 in the first four months

- Purchase Liability Protection

While both the Yotta debit and credit card have their advantages, each one offers a slightly different deal, as you can see above. But the best part? No other card could make you a millionaire.

Yotta Buckets

Another great feature of Yotta banking is the bucket system. You can split the money into different categories within your bank account. You can section one part for your mortgage, and another for saving up for a night out with your significant other. What happens is that you can assign how much you want to add to each bucket per pay and Yotta will automatically allocate your earnings as you make deposits.

Within these buckets is the option for crypto buckets, that convert your deposits to a stablecoin. The crypto converts back to USD automatically, making growing your money with each deposit even easier.

Yotta also provides you with an easy way to invest in I-bonds, which are government bonds that protect your money against inflation. I-bonds currently have a 6.89% annual interest rate on up to $10,000. All you do is transfer money to your I-bonds bucket and Yotta will do the rest!

What is Yotta Pay?

It’s really simple: Yotta Pay is a peer-to-peer payment system that allows you to send and receive money from anyone with no fees, whether or not they have a Yotta account. It’s important to note that users still need a Venmo account to receive money. If you send money to someone that doesn’t have Yotta, they have 7 days to create an account to receive the money.

The Bottom Line

There are a plethora of ways to manage your finances. Still, Yotta simplifies this reality and even awards those who attempt to better manage their money with their unique prize-linked savings and no-loss lottery system.

It’s important to note that Yotta is covered under the Federal Deposit Insurance Corporation (FDIC), up to $250,000 per account. With Yotta, not only does your money grow, but it grows without the risks commonly associated with the investing world.

Read More: Prize-Linked Savings Accounts 101: How To Save And Win!