10 Minutes on This Article Can Save & Make You Hundreds of Dollars

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

You blink and it’s already the end of the day and yet, you feel like nothing was accomplished. Yep, we get it. People are exhausted and just don’t have the mental capacity either.

That’s why we’re condensing the good stuff down so you can get the info quickly. Just spend 10 minutes skimming this article and you’ll find ways to help save and make you hundreds of dollars without too much effort.

Try them out, and build better habits that can work with your time-crunched life!

1.

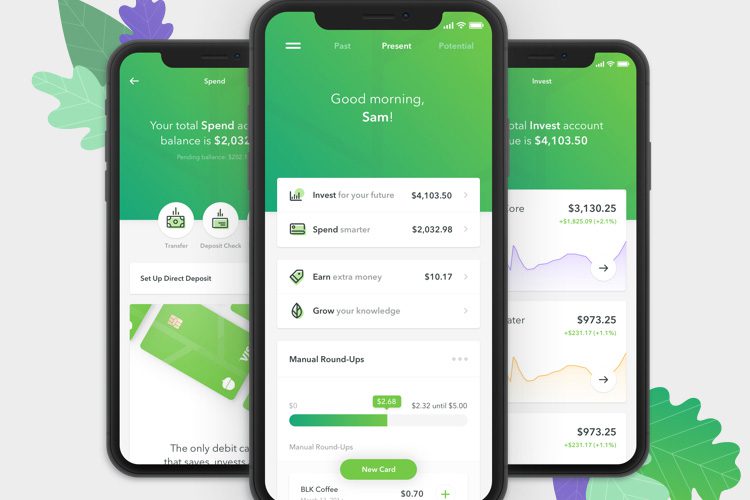

2. The Money App Backed by Celebrities That Saves AND Invests for You

Acorns has caught the attention (and their investments) of Blackrock, Paypal, and major names like Dwayne Johnson and more. Plus, they have about 10 million all-time customers!

That’s because Acorns automatically saves and invests your spare change from every purchase with the Round-Ups® feature with no hidden fees. You’ll get a diversified portfolio picked by experts based on your investment profile.

You only need $5 to start investing, and when you set up recurring investments, you’ll get a $20 bonus!

Get started in under 5 minutes with no financial experience or expertise needed. You’ll also get access to retirement, investing for families, rewards, and more based on your subscription plan.

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.