12 Things You Didn’t Realize You Could Do to Pay Off Debt

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

The most common are credit card debts, student loans, and hospital bills. Personal loans like cell phone bills, utility bills, auto loans, etc can also add up and get overwhelming.

Don’t let debt hold you back from living your best life though.

Here are 12 things you didn’t realize you could do to pay off debt:

1. When It’s 2024, and You Still Have Credit Card Debt Under $100,000

Stop the anxiety attacks by getting rid of your debt. If you owe $100,000 or less, AmONE can help by matching you with a low-interest loan to pay off all your balances. Problem solved.

Their interest rates start at just 6.40% compared to credit cards, which can go as high as 36%! Plus, it’s only one monthly bill, making it way easier to manage.

There’s also no credit score impact to check, and repayment periods are flexible. Take 2 minutes to check, and you can get funds as quickly as 48 hours to wipe that credit card debt!

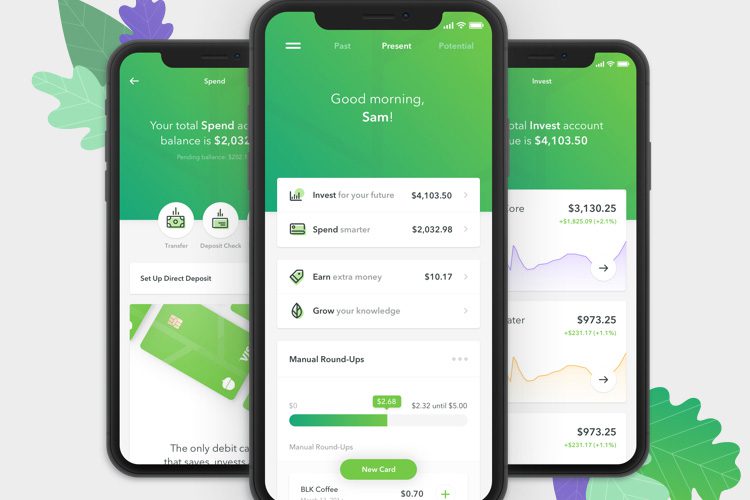

2. The Money App Backed by Celebrities That Saves AND Invests for You

Acorns has caught the attention (and their investments) of Blackrock, Paypal, and major names like Dwayne Johnson and more. Plus, they have about 10 million all-time customers!

That’s because Acorns automatically saves and invests your spare change from every purchase with the Round-Ups® feature with no hidden fees. You’ll get a diversified portfolio picked by experts based on your investment profile.

You only need $5 to start investing, and when you set up recurring investments, you’ll get a $20 bonus!

Get started in under 5 minutes with no financial experience or expertise needed. You’ll also get access to retirement, investing for families, rewards, and more based on your subscription plan.