4 Ways to Avoid Turning Into a Karen

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.1. Focus on Things That Matter: Smart Finances & Making Extra Cash

When you’re less preoccupied about getting offended by things, you’ll find yourself with a lot more time. Here’s a mix of interesting ways to make money and earn cash back for doing normal things.

Play these games both for free and for winning cash instead of wasting your breath on someone else.

Appstation: Try out new games, earn gift cards. It’s that simple with this game platform where you can redeem for PayPal Cash, Amazon, Game Stop gift cards, and more when you play their featured games!

Mistplay: The more time you spend playing their wide variety of games, the more money you can earn. You’ll automatically get 200 welcome points upon sign up but use promo code Bonus_100 to get an additional 100 points for a total of 300 total points!

Rewarded Play: Popular games include Yahtzee, Wheel of Fortune, Words with Friends, mystery games, fantasy games, puzzle games, and a lot more. The more you play, the more you can get gift cards from 20+ retailers including favorites like Target, Amazon, Walmart, Best Buy, etc.

Pro-tip: Install all 3 above and maximize getting paid to play mobile games!

Cash Back Opportunities? Yes, Please.

You’re already going to be grocery shopping, online shopping, getting deliveries, etc. Spend your time looking to maximize cash back opportunities instead.

Ibotta is a cash back app that pays you cash for your receipts and e-receipts and you’re literally getting free money back from your grocery trips, food deliveries, online shopping, and more. Just open the app, choose what you’re planning on getting, complete your purchase, and upload a picture of your receipt.

You’ll get $20 in welcome bonuses when you sign up and upload your first receipt. On average, active Ibotta users get up to $240 cash back a year or more but the highest saver got $13,000 in cash back last year!

Scan the Stuff You Buy, Get Free Gift Cards

National Consumer Panel (NCP) program lets you score free gift cards when you scan barcodes of stuff you already purchased like groceries, household items, etc. They’ve been around since 1987 gathering panel member’s opinions and shopping habits!

By scanning, we’ve seen members get about $100+ a year. Plus tablets, cool tech, and much more from their gift catalog. All panelists are also automatically entered into weekly, monthly, quarterly, and annual drawings to win extra points and gift cards – even a quarterly sweepstakes to win $5,000!

Register now to see if you’re eligible to be a National Consumer Panelist. Eligibility will be based on your location. If you don’t get accepted this time, don’t worry! They’re always expanding locations, so check back again.

Need an Actual job That You Can WFH With?

Instead of searching through irrelevant job boards, use FlexJobs, a 13+ year old company that specializes in finding only remote and flexible schedule jobs.

For a limited time, their membership plans are 50% off (with promo code JOB) so it costs just:

- $3.50 for a week

- $7.50 for a whole month

- $34.95 for a whole year (best value option) to search through a highly curated job board

Lori S. from Colorado Springs, CO said, “I would have spent hours trying to find these jobs on my own. I LOVE this website!! These are jobs that are not easy to find—I found the membership fee very reasonable and worth every penny considering I have found two wonderful jobs through FlexJobs.”

Non-essential workers are being asked to stay home during these times but making money is essential to everyone so take advantage of the 50% off membership plans to look at what could be your next new job! Remember to use promo code JOB.

2. Don’t Complain About Fees/Prices/Not Saving: Do Something About It

Before going on a rant about banking fees, why you can’t save, and overpriced things, how about taking steps to make it better?

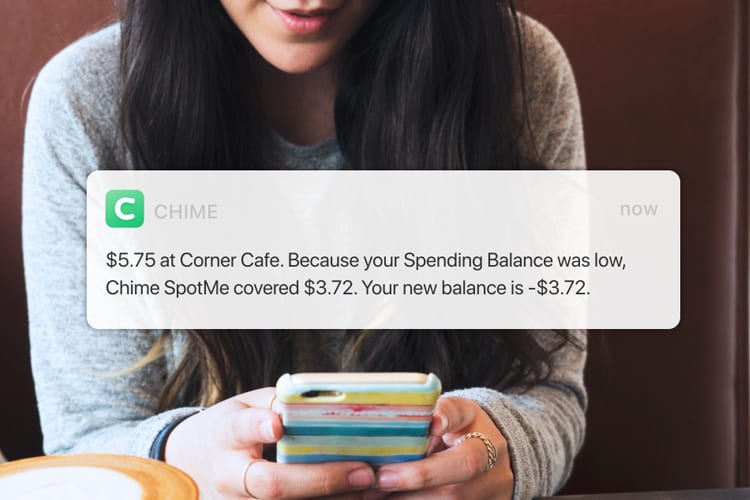

Chime is an award-winning mobile app that’s got your back when it comes to banking.

It helps you save money every time you make a purchase or pay a bill with the Chime Visa® Debit Card by moving your spare change from your transactions into savings. You can also set up automatic transfers from your paycheck too.

There are no hidden fees, you could get paid up to 2 days earlier1, and the fact that you don’t need to worry about any overdraft fees because Chime will spot you up to $1002 when you need it, makes this a no brainer.

How much you can save: Varies for each person on auto-saving but at least hundreds of dollars a year from no overdraft fees.

It’s also free to use so give it a shot to see how it can improve your banking life!

She Saved Over $1,000 in Car Insurance

Car insurance. You need it, you have it, but you’re probably overpaying for it. By how much? It depends on your car, location, age, and more, but on average you’re probably spending $826/year or more than you need to.

Take it from Johanna Brown who spent 25 years with Allstate before she finally found another company that could beat the price. It’s not exclusive either. Savvy saved her over $1,000 on her car insurance! Since there are no forms to fill out, the system can instantly check for a better deal. It literally takes 30 seconds.

Her tip? “A word of advice to doubtful potential customers, don’t act based on the initial quote if it seems low. You’d be missing out on potentially huge savings. Let the Savvy team do some research for you. I am thrilled and blown away at how I’m saving $1,000 a year when it initially quoted me $16!”

And when you’re ready, they’ll help cancel your old policy, enroll you in the better one, and get a full refund on the unused portion of your prior payments. It’s the simplest and easiest way to score major savings and a refund on your overpriced car insurance policy.

Get Paid To Save and Bank

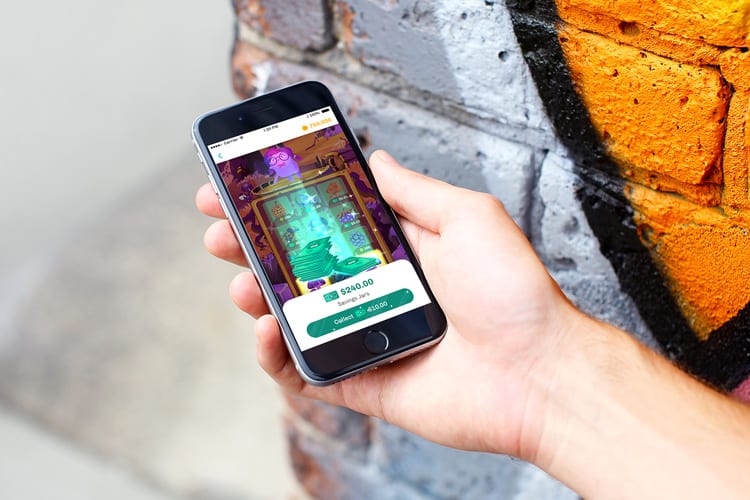

Long Game rewards its members for responsible saving and spending just by playing free games on their app and making banking fun.

When you set up a savings account, you access games where you can win daily cash prizes! You also get a full banking experience with all the bells and whistles; an FDIC-insured savings account earning interest, a Visa debit card for instant access to your cash, custom savings goals, and more.

Daily prizes go up to $1 million dollars! And you’ll never lose any money. Savings will vary for each person and interest earnings are a common 0.1%.

Long Game is completely free when you set up auto-deposit or direct deposit and use your debit card. Otherwise, it’s $3/month. There’s no way to lose money, but plenty of ways to earn and win! Plus you can withdraw your money at any time.

Budgeting Made Easy, Even if You Don’t Know How

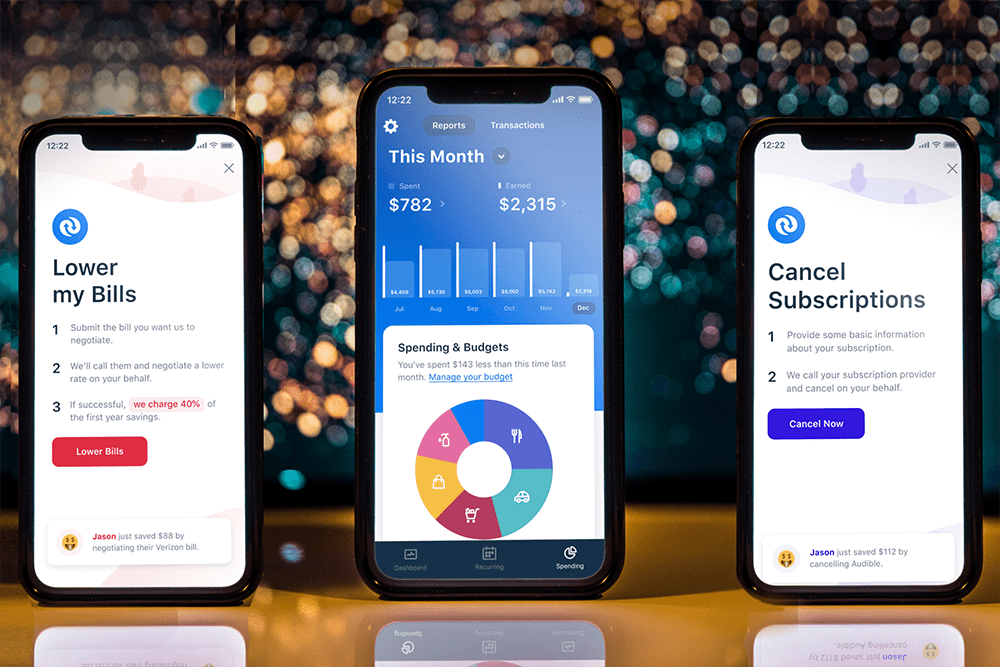

Truebill is a free finance app that easily helps you budget, even if you’re clueless. It also negotiates down your bills and finds recurring subscriptions you may have forgotten about.

It pulls your historical spending, organizes it, and allows you to clearly see your spending so you can set a target budget with context. (Aka you can see where you’re wasting money on). You’ll also save money on your cable, internet, and cellphone bills when they can negotiate it down and get you credit back for any outages.

On average, they can save you 20% on bills as well as hundreds a year based on budgeting, subscription canceling, and outage credits.

It’s free to use, just link a bank account (security is their #1 priority) and follow simple but actionable budgeting advice to control your spending!

3. Pay Attention to Your Own Kids (And Keep them Occupied)

We get it. Parents are attempting to juggle multiple roles. They’re expected to be the breadwinner and uphold parenting duties, all while simultaneously homeschooling their children. That’s a lot!

A child’s learning style, age, attention span, interests can also complicate learning factors. That’s where ABCmouse.com can help alleviate the stress of creating and teaching lessons. This award-winning education curriculum guides kids ages 2–8 on a Step-by-Step Learning Path boosting key skills in reading, math, science, social studies, and more!

With over 10,000 engaging learning activities all accessible on computers, smart devices—some even offline—young minds are driven to learn through fun games, songs, videos, puzzles, as well as the program’s Tickets and Rewards System.

Start building the foundation for academic success now. Try ABCmouse free for 30 days! Elementary and middle school kids are also invited to expand their knowledge in an interactive, virtual world that brings learning to life at Adventure Academy — free 30-day trial!

Coin Master is a free casual game that’s amassed over 81 million downloads and has earned the rep of being one of the most interactive games on the market.

It’s an extremely fun way for anyone ages 12+ (even adults!) to kill time. Spin to earn coins, chances to raid other villages, and build up your own village to move to the next level. There are over 200 uniquely themed villages to build including Steampunk Land, LA Dreams, Magical Forest, and more.

Just download for free and start raiding!

4. Relax More & Learn a Skill

Are you getting enough “me” time? I’m talking about quality “me” time to help you relax and not worry about what anyone else is doing. Perhaps trying some meditation or learning a new skill or even language can broaden your horizons!

De-Stress and Boost Your Mood 5 Mins a Day

Mindfulness applies to everyone’s life. It’s being consciously aware of your present moment without passing judgment. And to practice mindfulness, is with meditation, which helps with:

- De-stressing

- Falling asleep easier

- Losing weight

- Saving money

You can do this with Breethe, an app that gives access to over 1,000 tracks of guided meditation, bedtime stories, hypnotherapy, sleep music playlists, and master classes from mindfulness coaches!

Take Guitar Lessons from GRAMMY Award Winners Without Leaving Home

TrueFire is the best way to learn how to play the guitar with their massive library of 40,000+ instructional videos. It’s also insta-hotness when you know how to play a guitar, right?

Made for all skill levels, the crystal clear HD videos are taught by GRAMMY award winners and world-renowned teachers. It covers all skill levels, beginner through advanced, and a range of styles including blues, jazz, rock, country, and more.

Access and learn from any device, anywhere, and utilize their progress tracking tools as well as slo-mo and looping to learn at your own pace!

If you’ve been wanting to learn the guitar or need to fine-tune, try out TrueFire free for 30 days and make staying-at-home fun.

1Early access to direct deposit funds depends on the timing of the payer’s submission of deposits. We generally post such deposits on the day they are received which may be up to 2 days earlier than the payer’s scheduled payment date.

2SpotMe limits start at $20 and can be increased to $100 or more based on factors like Chime account activity or history