15 Best Money-Making and Saving Apps to Help You Crush New Year, New You

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

2020.

Sure it’s a cool-sounding new year, but it’s also synonymous with perfect vision (which I sadly don’t have). Regardless of your prescription though, let’s make 2020 the year that you finally peep your financial situation crystal clearly.

It’s time to make more money and save more money now.

Forget calling it a resolution since we all know 80% of people drop out by February. Instead, start small and take your time but keep it consistent. Consistency is key. We’ve rounded up the best (and fun!) apps and services to help you start making and saving money now. Crush that new year and go you!

1. Get Paid to Try New Games. Every Gamer’s Dream.

Who would’ve thought you can play games to make some money?

All you need is Mistplay, a game platform where you can try new games to earn points redeemable for gift cards like Amazon, VISA, PlayStation Network, XBOX Live, and more.

In the app, all available free games are listed so just take your pick to try! The more time spent on each game, the more money you can earn.

You’ll only get paid for playing games if Mistplay is running so be sure to always install games from the Mistplay app!

BONUS: You’ll automatically get 200 welcome points upon sign up but use promo code Bonus_100 to get an additional 100 points for a total of 300 total points!

2. Get Paid in Gift Cards if You’re Chill with Lock Screen Ads

The average person unlocks their phone 110 times per day – that’s a lot of time spent looking at a screen for free.

With S’more you get paid every day you unlock your phone. It’s even easier than it sounds, and since you can cash out with as little as $1 there’s no waiting around for your rewards!

They partner up with brands looking for more impressions (aka your eyeballs) and you don’t need to click on anything to get paid either.

S’mores pays in gift cards so you can redeem for:

- Amazon.com

- AMC Theaters

- Best Buy

- CVS

- Target

- Domino’s Pizza

- Starbucks and more!

Just use your phone normally, and your earnings will apply daily. Pretty much the easiest thing to do.

3. Get Paid for Playing Free Digital Scratch-Offs

Don’t bother going to the liquor store to buy physical scratchers (they get expensive too).

Instead, play digital scratchers for free on Lucktastic.

There are a ton of different scratchers you can play, and you can earn both cash and tokens.

Scratched all of them for the day? Don’t worry, there are specific night-time scratchers that are available every night too!

When you want to redeem your earnings, you can choose from:

- Amazon gift cards

- CVS gift cards

- Dunkin’ Donuts gift cards

- Check mailed to you

- Visa gift cards

Lucktastic keeps things free by showing a few ads here and there plus it’s easy to play and multi-task at the same time. Get a chance of up to $1M in cash prizes!

Also until March 2020, their Crack the $1 Million Safe event will reward a lucky winner $1 million dollars!

4. You Gotta Eat! Get Up to $240 Cash Back in Grocery Savings

Did you know that it’s 325% more expensive to eat out versus eating at home*? Maybe it’s time to make more trips to the grocery store instead.

You’ll be aware of all the ingredients in your meal, in addition, you’ll get paid just for shopping!

It’s simple. All you have to do is take a picture of your grocery receipt and Ibotta will pay you cash.

Here’s how it works:

Before you go to the store, search for your shopping list items in the Ibotta app. After your store visit, take a photo of your receipt to get cash back.

Ibotta is free to download and you’ll also get up to $20 in Welcome Bonuses when you sign up!

Some offers we found:

- 25 cents back on any item

- $3 – $5 back on various wine

- $2 back on KIND Protein Bars

- 25 cents – $4 back on ice cream

- $2 back on Herbal Essence Haircare

Popular stores are Walmart and Target, but Ibotta also works at restaurants, online shopping sites, and at the bar! On average, active Ibotta users save up to $240 a year or more. What would you do with that extra money?

Welcome Bonus: Up to $20

Average savings a month: $20

What it could add up to in a year: $240

Additional Referral Earnings: $5 per referral

5. Affordable Car Insurance Exists – Here’s How You Could Save $610 This Year

You’re sharing the same roads with a lot of different people. Distracted people, oblivious people, road-rage people, etc. It’s best to cover yourself with insurance when everyone is operating a giant motor vehicle.

That’s why car insurance exists and is mandatory. You might be overpaying on your current insurance premium since it can be a hassle finding another provider.

However, you can search for quotes easily on EverQuote. They help match you among dozens of regional agencies and insurance carriers to filter the best matches to save on your car insurance.

It takes about 4 minutes to fill out the form and you’ll see a list of matches that show potential online quotes, email, and potential phone quotes.

EverQuote can save drivers $610 a year on average* compared to their current insurance premiums. Once you see your list of potential matches, choose the online ones you want or wait for more information via email or phone.

It’s a pretty simple process, so try it out to see how much you could be saving on the road!

6. Make Stupid Easy Money Trying and Playing Games

There are so many new games coming out on the daily that it’s hard to choose which to play.

My strategy? Only focus on the games that pay me for my time.

You can do it with AppStation, an app that pays you to try out new games.

When you earn coins from trying new games, you can redeem for:

- PayPal Cash

- Amazon gift card

- GameStop gift card

- PlayStation Store gift card

- Xbox Live gift card

- And too much more to list

Nab a 4,444 coin welcome bonus too, which is basically around 50 cents in value. And if you don’t like to wait, you can choose to payout as low as $1.

If your friends want to get it on the money action, introduce them to AppStation, where you’ll get bonus coins and 25% of all their earnings. To make it a supportive group, your friends will also earn 25% of your earnings too!

7. Make 1.61% Interest On Your Money with Fee-Free Banking

Traditional banks seem to take every opportunity they can to squeeze more money out of you. With everything from a monthly service fee to various hidden fees nibbling away at your account balance. Enter Varo which was founded to provide a fee-free banking service2.

Yep, Varo has no monthly service fees, no foreign transaction fees, and no ATM withdrawal fees. On top of having no fees, Varo lets you make more money on your money. Varo provides a high-yield savings account that starts at 1.61% Annual Percentage Yield (APY)1 that can move up to 2.80% APY1 based on qualifying activity. To put this into perspective, the average APY of the 5 biggest national banks is 0.09%.*

Varo has a few sweet extra features too:

- Get your paycheck up to 2 days earlier4

- No minimum balance requirement

- Over 55,000+ AllPoint® ATMs worldwide to use your Varo Visa® debit card

- Offers personal loans to pre-qualified customers who want to consolidate debt

- Varo will send any paper check to anyone in the U.S. on your behalf

- Varo Personal Forecast tracks your spending to manage your cash flow

- “Save the Change” rounds up your purchases to the nearest dollar and saves the difference to your Varo savings account

If you’re sick of being charged banking fees and want to make more out of your money, check out Varo. It takes less than 5 minutes to learn more and apply for free.

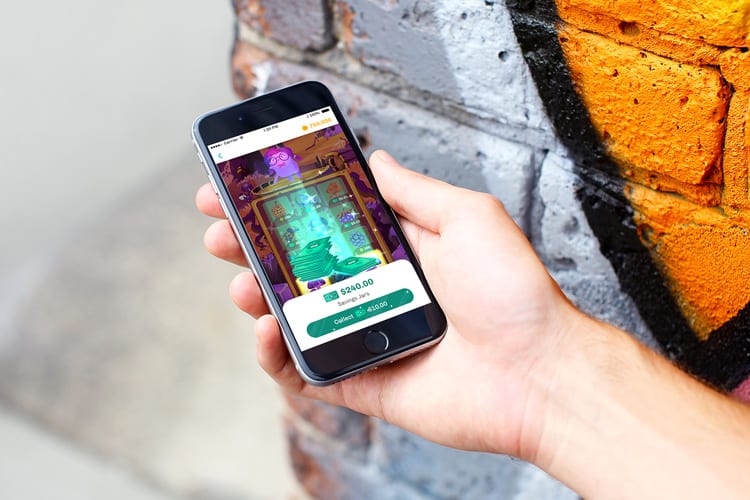

8. Play Games, Save Money, Win Cash. Saving is Actually Fun Now.

Look, we know saving money is boring, but it’s just one of those non-negotiables in life. 63% of Americans don’t even have enough to cover a $500 emergency. Yikes.

That’s why Long Game Savings is actually making saving fun by just playing free games on their app. Games are light and easy-to-play (think lotteries, scratchers, slots, and more) and you can win daily cash prizes up to $1M (yes, million) and crypto!

When you set up a savings account, you access the games. The more money you save, the more you can play and now, their new debit card lets you earn more rewards just by spending normally. It has a RoundUp feature that lets your purchases be rounded up to the nearest dollar with the change going towards your savings. So every time you’re buying a meal, getting stuff at Target, etc, you’re contributing to your savings and earning interest!

Long Game Savings is completely free-to-use as banks pay them, not you. There’s no way to lose money, but plenty of ways to earn and win! Plus you can withdraw your money at any time.

9. Up To 40% Cash Back Automatically? Sign Us Up!

Saving money and getting cash back on purchases always sounds like a great idea – until you completely forget to take the steps to get the savings. There are SO many ways to save money while shopping, who can remember if it’s not automatic?

Rakuten (previously called Ebates) can help you get cash back on everyday shopping as well as apparel, beauty, restaurants, and more, automatically. With Rakuten, you don’t even have to upload your receipts after your purchases. They’ll send you simple push notifications when your favorite stores increase their cash back deals or have a good sale.

Offering simple one-tap savings with no points or fees helps ensure that you get the most out of your purchases. So, before buying anything, hop into the app to see if you can get up to 40% cash back at over 2,500 stores.

They also have an amazing referral program where you can earn $25 for each eligible friend. New members get a $10 bonus too!

10. Invest in the Legal Cannabis1 Industry with Just $5. No Experience Necessary.

If investing sounds complicated and expensive for you, it doesn’t have to be.

You know you should start, but where to begin? You don’t want to just pick randomly as you want to invest in an industry you believe in. Something that might really take off and make money.

So how about investing in the legal cannabis industry? It’s big business as retail sales are projected to hit $66.3 BILLION by 2025. And the legal cannabis industry could soon be worth more than the GDP of 9 US states!2

You can do it with Stash, a microinvesting app that lets you invest for as little as $5 and it takes less than 2 minutes to get started. They’ll even give you $5 to start investing.

They curate from over 250 investments which include stocks and Exchange Traded Funds and you’ll get to choose an investment blend that meets your goals and interests. Their newest feature, Stock-BackⓇ rewards3 lets you invest in brands you spend on with the Stash debit card.4 Purchased something at Amazon? Earn Amazon stock rewards. It’s like cash back but with stock!

So take the $5 that they’re giving you and start investing with Stash.

11. Budgeting Made Easy With This App – Even if You Don’t Know How

First things first, if you have trouble budgeting, you’re not alone as most people actually don’t know how to. When you understand how much money comes in and how much goes out, it’ll all start making sense.

Truebill easily helps you budget, even if you’re clueless. Their simple to follow budgeting pulls your historical spending, organizes it, and allows you to clearly see your spending so you can set a target budget with context. (Aka you can see where you’re wasting money on).

Truebill’s five-star reviews come from people formerly bad at budgeting. Nicole M. said Truebill “tracks spending and makes you accountable for every place your dollar is going. Shows you how a ‘few bucks’ here and there can really add up over time. Also gives you clues on how to save based on your spending. It’s like having a personal accountant tracking my money.”

Truebill will also alert you if you’re getting a little too spend-happy in your budgeted categories so you know when to curb it. Another user, Krystyna D. said, “This app is a lifesaver for budgeting. It lists your transactions in a minimalist and customizable way, has a spending graph that compares your current spending based on last month, and has a really great budgeting feature. I’ve been using the app for just about 7 months and they’ve done nothing but make a really great improvement to the service. I’ve tried some of the other services and they’re all cluttered and give you too much info without making what you want to see accessible.”

It’s simple but actionable budgeting that anyone can follow and it’s free to use! Join the many users today and control your spending with Truebill!

12. Buy Stuff Normally = Get Gift Cards You Actually Want

If you have room for 1 more app on your phone, then it needs to be this.

Actually, delete another app to make room for this one. It’s that good.

It’s called Drop, a free app that gives you gift cards on stuff you already buy from your favorite stores and brands.

Your everyday purchases from Amazon, Target, Trader Joe’s, and Walmart? You’ll get points for that. Points translate to gift cards so the more you collect, the more you can redeem!

The only thing you need to do is link any credit or debit card you usually use for buying stuff and that’s it! Drop will automatically recognize when you buy from your activated offers to reward.

There’s literally no downside to using this free app to get more gift cards. Use it on top of your loyalty points and credit card points for even more rewards!

LIMITED TIME OFFER: Use promo code SMARTWALLET to unlock 5,000 points ($5) automatically when you link your first card on Drop!

13. Get the Big Picture – Then Work on Fixing Your Score

It’s smart to keep an eye on your credit score to make sure it doesn’t fall too much due to unpaid bills. Did you know that a low credit score could affect your ability to actually rent an apartment or even get a car? Yea, let’s try to prevent that from happening.

Credit Sesame is a free credit monitoring service that helps you improve and maintain your score.

You’ll get an easy-to-read view of your total debt plus everything that is contributing to your current score like credit usage, credit age, inquiries, and payment history. It also comes with personal recommendations to help increase your score.

Credit Sesame alerted me immediately when my score decreased because of a credit card and I was able to fix it right away. It’s free to use so this is definitely a must-have in everyone’s life.

14. Cashing Out on The Everyday Things You Do Online

The average American spends 24 hours online a week(*), but for me, I know I definitely surpass that. If it’s the same for you, capitalize on all that online time by earning points you can redeem towards gift cards, and even better, cash.

You can do it with Swagbucks, a free rewards program for the everyday things you do online.

Earn points by:

- Watching entertaining videos

- Shopping at your favorite retailers

- Searching the web

- Participating in surveys

- Playing fun trivia games

Then you can redeem for a large variety of gift cards (Amazon, Target, Walmart, Starbucks are popular) or my favorite, Paypal Cash and Visa Gift Cards. Cash out in as little as $3!

You’ll even get a $5 bonus when you earn 2,500 SB points within your first 60 days. While you obviously won’t get rich doing this, you can nab an extra $10-$20 a month on them.

Keeping your profile updated and doing the Daily To-Do List will also earn you extra SB. There are a lot of opportunities so you can cash out early and often!

More Surveys, More Cash

When you have the downtime, there’s nothing easier than answering some questions in return for cash. If you want more surveys in your life, head over to MyPoints to sign up for free and similar to Swagbucks, you can participate in surveys, watch videos, and even read emails for points!

Points turn into gift cards from Amazon, Walmart, Starbucks, as well as PayPal Cash.

Get a $5 bonus when you complete your first 5 surveys!

15. Never Wait 2 Weeks for Your Paycheck Again – Here’s How

“People should have their money once they earn it. That’s how businesses work. When you buy something, you have to pay at once. But when you work, you wait two weeks for your own pay.”

If you agree with this statement, then you’re on the same page with Ram Palaniappan, the CEO, and Founder of Earnin, an app that’ll fast forward your paycheck to today.

In order words, if you worked today, you get paid today with Earnin.

Not everyone is eligible, but most are. If you have the following, you’re golden:

- Direct deposits from your employer into a checking account

- A regular pay schedule (like weekly, biweekly, semi-monthly etc)

- A fixed work location OR an online timekeeping system at work

That’s it. And after you connect your bank and employment info, you’ll get immediate access to your earnings.

You then choose what portion of your paycheck you want to Cash Out. Then, when your normal paycheck arrives via direct deposit, Earnin will just debit the amount you had previously cashed out. Simple!

It’s like having an advance payday loan but without the fees or interest. There is no charge to use Earnin as the app runs on tips by the community. Pay what you wish!

Even if you have a side gig of on-demand jobs, like Uber, Grubhub, Instacart etc, Earnin will work!

*325% more expensive eating out vs home source: Investment Zen

*EverQuote’s individual savings, if any, and premiums will vary by customer. Savings amount based on countrywide survey of users from Nov 2018 to Apr 2019 who reported old and new premiums.

*0.09% national average APY: FDIC for the week of Feb 11, 2019- https://www.fdic.gov/regulations/resources/rates/#one

Investment advisory services offered by Stash Investments LLC, an SEC registered investment adviser.

1Stash does not endorse the illegal use of Narcotics. This material has been distributed for informational and educational purposes only, and is not intended as investment, legal, accounting, or tax advice. Investing involves risk.

2GDP of 9 US states – Markets Insider, 2019 | $66.3 billion legal cannabis projection – PR Newswire, 2019

3Stash Stock-BackⓇ rewards is not sponsored or endorsed by Green Dot Bank, Green Dot Corporation, Visa U.S.A., or any of their respective affiliates, and none of the foregoing has any responsibility to fulfill any stock rewards earned through this program.

4Debit Account Services provided by Green Dot Bank and Stash Visa Debit card issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. Account opening of the debit account is subject to Green Dot Bank approval. Green Dot Bank operates under the following registered trade names: GoBank, Green Dot Bank and Bonneville Bank. All of the registered trade names are used by, and refer to a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. Your debit account is insured to the regulatory limits by the Federal Deposit Insurance Corporation (FDIC). Green Dot is a registered trademark of Green Dot Corporation. ©2019 Green Dot Bank. All rights reserved. Investment products and services are not offered by Green Dot Bank and are Not FDIC Insured, Not Bank Guaranteed, and May Lose Value.

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.