Chase Sapphire Preferred® vs. Chase Sapphire Reserve®: How To Get The Most Free Travel or Cash Back

Let’s be real: the cost of living is going up for all of us. Fortunately, it’s possible to use credit cards to your advantage to travel for free (with points that is) or if you’re just looking for some extra cash back in your pocket.

I know you’ve all been itching to book that next flight or finally plan your next getaway (trust me, I feel you!)

The truth is, there are so many credit cards out there, but they’re not all created equally. It can be complicated to navigate all of the best credit card offers, which card offers the most points or miles, and most importantly, determine which makes the most sense for your wallet.

And so, I want to take a deep dive and compare two of the most popular travel credit cards available: the Chase Sapphire Preferred® credit card and the Chase Sapphire Reserve® credit card. Both have distinct benefits, and both will undoubtedly help you maximize free travel; because travel is ALWAYS better when you get to pay with points instead of money.

Take a look at the Chase Sapphire Preferred® credit card and the Chase Sapphire Reserve® credit card to find out which works better for your wallet:

What are the Benefits of the Chase Sapphire Preferred® Credit Card?

I’m sure you’ve heard of this credit card by now: The Chase Sapphire Preferred® credit card has become one of the most popular travel rewards credit cards available – and for plenty of reasons!

Not only can you earn bonus points per dollar spent in categories such as travel and dining, the card currently comes with a 60,000 point sign-up bonus when you complete the minimum qualifying spend. With additional benefits such as an anniversary points boost, this card is excellent for moderate travelers looking to get a jump start on their adventures once again. Let’s break down the details:

Annual Fee: $95

Bonus Offer: 60,000 Chase Ultimate Rewards points after spending $4,000 within the first three months from account opening. That’s the equivalent of $750 worth of free travel (airlines, hotels, rental cars, etc.) at a point valuation of 1.25 cents per point. The Chase Sapphire Preferred® credit card provides 25% more per points when redeemed for travel purchases through Chase Ultimate Rewards.

If you’re looking for cash back, you can redeem that bonus for $600 at a point valuation of 1 cent per point (60,000 points = $600 in cash back).

Rewards Rates and Categories:

- 5X points per dollar on travel purchased through Chase Ultimate Rewards, excluding hotel purchases that qualify for the $50 Annual Ultimate Rewards Hotel Credit

- 3X points per dollar on dining, including take-out and delivery services

- 3X points per dollar on select streaming services (like Spotify, for example) and online grocery purchases (like Shipt, but excluding Target, Walmart, and wholesale clubs)

- 2X points per dollar on all other travel purchases

- 1X point per dollar on all other purchases

Additional Highlights:

- $50 Annual Chase Ultimate Rewards Hotel Credit: Earn up to $50 in statement credits each account anniversary year for hotel stays purchased through Chase Ultimate Rewards.

- 10% Anniversary Points Boost: You’ll receive an annual 10% points boost upon account renewal for all purchases made during the first year of account. So if you spend $10,000 on the card within the first year, you’ll get a 1,000 point bonus upon your account anniversary (I mean, who doesn’t love a free bonus!).

- Pay Yourself Back℠ Feature: Your points are worth 25% more when you redeem them for statement credits against existing purchases in select, rotating spend categories.

- Complimentary DashPass subscription through 12/31/2024 for a minimum of 12 months.

Credit Score Required: 670-850 (Check your credit score for free here)

Pros:

- A nominal annual fee gets you a nice points bonus if you can meet the $4,000 minimum spend requirement in the first three months

- A long list of extra “added value” incentives

Cons:

- No flat-rate number of points per dollar

- Charges an annual fee

What are the Benefits of the Chase Sapphire Reserve® Credit Card?

This card is for the serial travelers among us (yes, I know it’s you!) You’ll be able to earn up to 10 points per dollar (yes, really) in select travel categories and a large 80,000 point sign-up bonus when you complete the minimum qualifying spend. You’ll also receive luxurious travel perks like airport lounge access!

If you’re looking for a card with similar benefits to the Chase Sapphire Preferred® credit card but want to be sure you’re earning more points for every dollar spent on travel, then this would be the pick for you.

Annual Fee: $550, $75 for each authorized user

Bonus Offer: 80,000 Chase Ultimate Rewards points after spending $4,000 within the first three months from account opening. That’s the equivalent of $1,200 worth of free travel (airlines, hotels, rental cars, etc.) with a point valuation of 1.5 cents per point. The Chase Sapphire Reserve® credit card provides 50% more per point when redeemed for travel purchases through Chase Ultimate Rewards.

If you’re looking for cash back, you can redeem that bonus for $800, with a point valuation of 1 cent per point (80,000 points = $800 in cash back).

Rewards Rates and Categories:

- 10X points per dollar on hotel and car rentals purchased through Chase Ultimate Rewards (after the first $300 is spent on travel purchases annually)

- 10X points per dollar on Chase Dining℠ purchases through Chase Ultimate Rewards

- 5X points per dollar on flights purchased through Chase Ultimate Rewards (after the first $300 is spent on travel purchases annually)

- 3X on all other travel purchases (after the first $300 is spent on travel purchases annually)

- 3X points per dollar on dining, including take-out and delivery services

- 1X point per dollar on all other purchases

Additional Highlights:

- Annual $300 Travel Credit: Automatically receive a statement credit for travel purchases charged to your card by the account’s anniversary. This includes anything travel-related: tolls, parking, an Uber ride, and even public transit.

- Pay Yourself Back℠ Feature: Your points are worth 50% more when you redeem them for statement credits against existing purchases in select, rotating spend categories.

- Priority Pass™ Select Membership for VIP airport lounge access worldwide.

- A $100 credit towards Global Entry or TSA PreCheck® application every 4 years.

- Complimentary DashPass subscription through 12/31/2024 for a minimum of 12 months and a $5 in-app credit each month from April 2022 until December 2024.

Credit Score Required: 740-850

Pros:

- Many high-value points per dollar categories

- Card benefits can more than pay for the total annual fee if you are an avid traveler and high spender

Cons:

- Exorbitant $550 annual fee

- $75 fee per authorized user, and they do not get the $300 annual travel credit nor the Global Entry or TSA PreCheck® perk

If you think that this card suits your needs better than the Chase Sapphire Preferred® credit card, apply at the link HERE.

What is the Chase Refer-A-Friend Program?

The Chase Refer-A-Friend Program allows Chase Sapphire Preferred® cardholders and Chase Sapphire Reserve® cardholders to refer five friends annually. And get this: Chase is currently offering cardholders 15,000 bonus points per referral on the Sapphire card (up to 75,000 bonus points per year) and 10,000 bonus points per referral on the Reserve card (up to 50,000 bonus points per year).

When you share your referral link with a friend and they both successfully apply and get approved for the card themselves, you get bonus Chase Ultimate Rewards points added to your account.

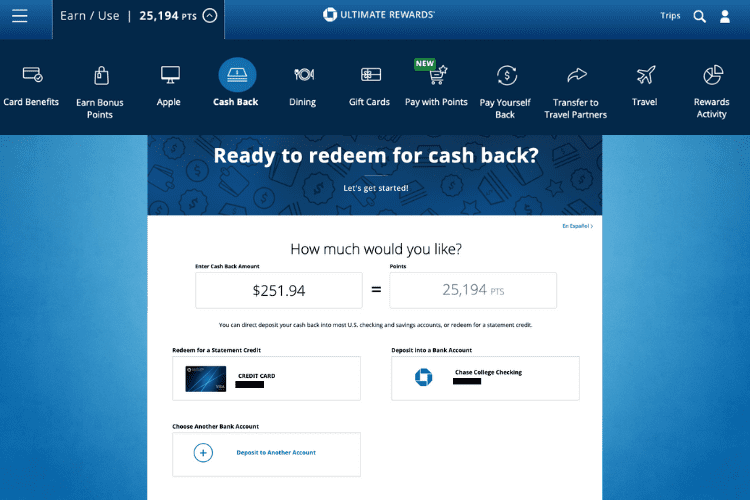

How to Redeem Chase Ultimate Rewards Points for Cash Back

While these points are worth more when redeemed for travel, you might want to redeem your intro bonus from either card for some easy cash back that can be sent right to your checking account. Let’s outline the steps on how to do this below:

- Log into your Chase Ultimate Rewards account and click the Earn/Use dropdown.

- Click “cash back.”

- Select the number of points you’d like to redeem for cash back.

- Choose which bank account you’d like to deposit the cash back to.

What Benefits do Both Cards Offer?

I’m glad you asked! While both the Chase Sapphire Preferred® credit card and the Chase Sapphire Reserve® credit card offer generous perks, there are benefits that both cards provide to you:

- 1X point per dollar on all other purchases

- Transfer Chase Ultimate Rewards points to all participating frequent travel programs at a 1:1 value.

- Break up purchases of $100 or more with no interest for a fixed monthly fee with My Chase Plan.*

- No blackout dates or travel restrictions

- No foreign transaction fees

- Travel Protection: including auto rental collision damage waiver, trip cancellation/interruption insurance, baggage delay insurance, etc.

- 24/7 customer service

*Eligible cardmembers only

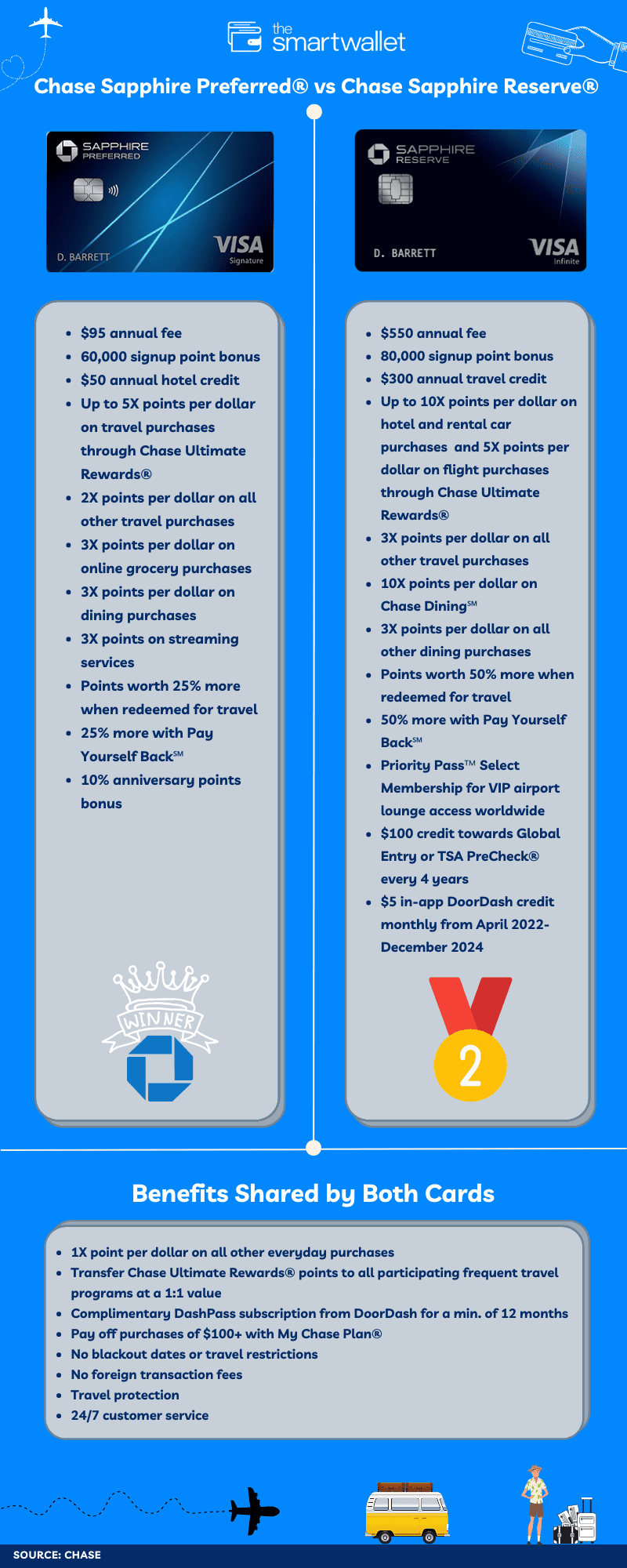

Check out this infographic below, which highlights what each card will offer you, side-by-side, plus what both cards have in common:

The Bottom Line

My takeaway is that the Chase Sapphire Preferred® credit card takes the cake. While it does not offer as many points per dollar on travel and dining purchases as the Chase Sapphire Reserve® credit card, it has a much lower annual fee and earns you 5,000 more bonus points per referral than the Reserve card.

The Chase Sapphire Preferred® credit card offers the most value in terms of a significant points bonus and provides up to 5X points per dollar on travel and up to 3X points per dollar on dining. It’s also the most cost-effective for those of you looking to shell out less money upfront for an annual fee. Overall, I recommend this card to anyone who wants to earn a serious points bonus for travel or a $600 cash back payday! So, what are you waiting for? Apply now!