8 Clever Ways You Can Save Up to $6,000 a Year

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance because talking about money should always be an honest discussion.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance because talking about money should always be an honest discussion.

Saving money is a mind game. You just have to understand how to play it, and saving won’t be as impossible as you might think.

Rule of thumb is 20% of your after-tax income should be going to your savings and/or debt repayment. But having a chunk of money moved out of your checking account can be intimidating. After all, you have bills to pay.

So we found other ways to play the savings mind game. Follow these 9 clever ways and you could save up to $6,000 a year. Now that’s a nice savings cushion.

1.

2. Get Free Money Back on All Your Shopping Hauls

Check your pockets; check your purse. And keep receipts for your iPhone.

Just grab all your recent receipts from your coffee runs, grocery trips, restaurants, and gas station fill-ups, scan them into Fetch Rewards on iOS, and earn points for free money! Connect your email account, as well, to count DIGITAL receipts from Amazon, Instacart, and more.

Basically, snap a pic of your receipt from anywhere, and that’s it; you’ve got points for money. There’s no minimum spend, no need to select items manually, scan in any receipt from any store or gas station, and it’ll automatically reward you.

It’s free and easy to use and is a must-have iOS app for anyone who buys stuff!

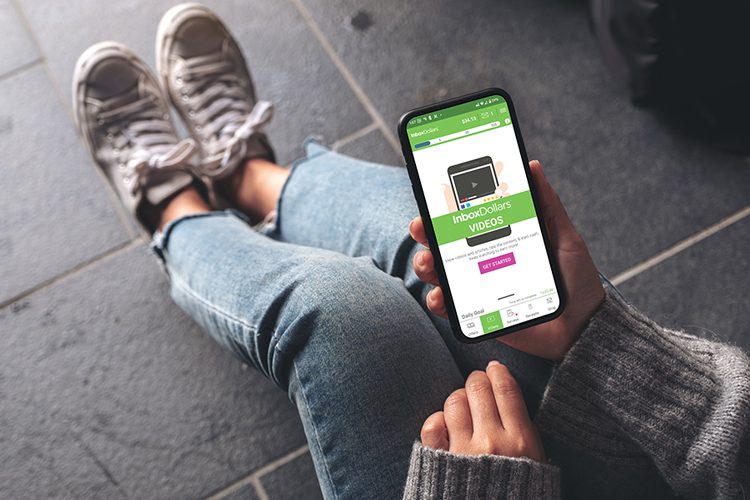

3. Get Paid Up to $225/Month While Watching Viral Videos and Taking Fun Surveys

Founded in 2000, Inbox Dollars has been paying customers for their opinions for over 24 years and counting! They are one of the most trusted survey sites with fun, multiple ways to earn extra cash that set them apart.

“Fast and easy. Love that I can cash out to my PayPal and easily transfer money to my bank account.” – Tefanie P

Take surveys, watch videos, play games, and even read emails for extra cash. Who wouldn’t want to watch viral videos for money and get paid up to $225/month?

Inbox Dollars is a great platform to make a little side money. It’s free to sign up, so give it a try today!

4. How to Get Paid $22/Hr Being a Grocery Shopper

When you’re looking for a legit side gig, consider grocery shopping for others, instead.

Shipt is an app where members can request same-day deliveries on grocery, household, and more. After browsing through millions of products from stores like CVS, Target, ALDI, Costco, and a lot more popular retailers, members create a shopping list.

This shopping list is then sent to a professional Shipt Shopper (potentially you!) who’ll head to the store, grab the items, and deliver. Shoppers are independent contractors and are paid up to $22/hr and more. Plus 100% of all tips are yours to keep!

So if you’re interested in a flexible side gig that helps out the community, have a valid driver’s license and auto insurance, a reliable car, know the difference between romaine and iceberg lettuce, apply here. Work whenever you want and get paid weekly!