If Your Credit Score is Under 700, Make These 8 Money Moves

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Real talk. When was the last time you checked your credit scores?

And yes there are multiple. Since there are 3 major credit bureaus (Experian, TransUnion, and Equifax) you have more than 1 score as not all lenders report to all of them nor do they update their reports at the same time. That’s why it’s best to check your free reports throughout the year and see if there are any mistakes to easily fix.

Go ahead and follow these steps:

1. Check Your Credit Score for Free & Get Alerted If It Dips

Having a low credit score can actually affect your ability to get a phone plan, rent an apartment, and even get a car. That’s why it’s so important to stay on top of it.

You can get your credit score for free from Credit Sesame, a free credit monitoring service that helps you improve and maintain your score. There’s no credit card required either!

We like the easy-to-read user interface since it shows your total debt, payment history, and everything contributing to your current score. You’ll also get personal recommendations as well.

Even if your score dips, you’ll get alerted so you can fix it right away. It’s 100% free to use so check now to see where you stand.

2. Build or Rebuild Credit Safely Using a Debit Card

It’s a catch-22 when you need credit to build credit and a bad credit score can cost you thousands of dollars in the long run.

Safely re/build your credit with Extra, the first debit card that lets you build credit and earn rewards points like a credit card. There’s no need to switch banks, plus there are no credit checks and no interest.

Take it from Abhay A., a 24-yr old from GA: “My score is up almost 100 points since I first started using Extra!”

Here’s how it works:

- Sign up for Extra by linking your existing bank account (no credit check!)

- You’ll get a spending limit based on your bank balance

- Swipe your Extra debit card like normal, and they’ll spot you the money now and pay themselves back the next day

- They report all your payments to the credit bureaus to build your credit!

You’ll even earn up to 1% in reward points for stuff you already spend on like coffee, food delivery, and bills. And re/building your credit safely with Extra only costs as low as $7/month!

3. Earn More Side Money – This Company Paid Over $7 Million to Its Members Already

Credit scores can be affected by late payments, missed payments, as well as using too much of your credit limit. To help offset this, earn more side money!

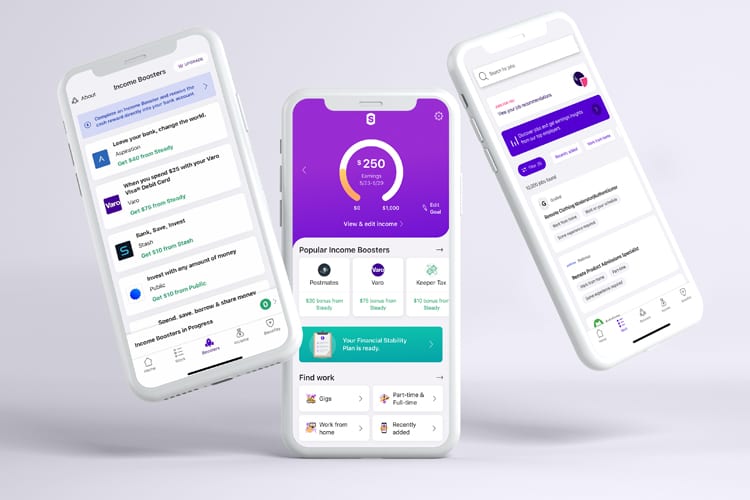

3 million people are already using Steady to find gigs and on average, members make $5,500 extra each year! Wouldn’t that help with bills and credit card payments?

Find thousands of new part-time opportunities daily, plus earn cash rewards through Income Boosters. Also, Steady is FREE to join so sign up and get your share!

4. Avoid Overdraft Fees at All Cost – This Bank Account Makes it Easy

While $37 overdrafts don’t directly affect your credit score, if you overdraft too often, your bank can close your account and report you to debit bureaus. Plus, whoever didn’t get the on-time payment from you could report you to credit bureaus and that will affect your score.

Just avoid all that and sign up for Chime, a free online bank account with no hidden fees at all and savings at 1.00% APY1 (which is 12x2 the national average!) Their SpotMe feature lets you continue with a needed transaction even if you overdraft. That extra $20 you needed for groceries? No worries, Chime will spot you up to $200.*

You’re also FDIC-insured up to $250,000 and can get paid up to 2 days earlier** too!

5. This Free Personal Finance Assistant Will Save You $720/Year

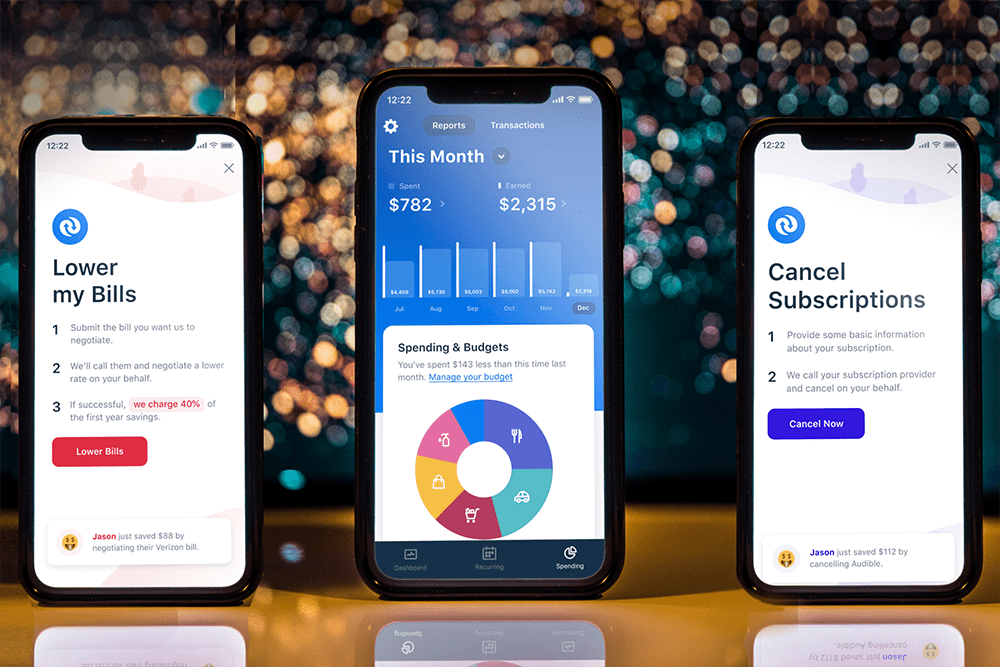

When you just want more help managing your finances, Truebill is like your personal finance assistant. It groups all your banking accounts together so you get a holistic view of your earnings and spending.

It’ll even help you with budgeting even when you don’t know where to start!

Hate it when services quietly raise fees? Truebill will alert you and will cancel your hidden and unwanted subscriptions too. Plus lower your monthly bills by 20%.

6. This Company Will Pay Off Your Credit Card Bill Up to $4,000

When you need a bit of extra assistance paying off credit card bills, OppLoans can help as they work to assist middle-income credit-challenged members to build credit history.+

“The rates were good, I have terrible credit and they were the only ones to approve me for a loan and they were very quick as well,” said James U. Even better, applying won’t impact your FICO credit score^ so it doesn’t hurt to check!

Qualified borrowers can borrow up to $4,000 depending on creditworthiness and state of residence.* And when monthly payments are made back on the loan, OppLoans will notify the 3 credit bureaus to build up your payment history!+

7. Get $5 to Invest in Google, Amazon, Tesla and More, Even If You’re Not Rich

You know you should start investing but maybe you never got around to it or don’t think you have enough money but Stash, an investment app, lets you start investing with just $1!

You can choose where to put your money, and they’ll provide guidance and tools to help. Invest in some of the major companies that you regularly use to make a custom Personal Portfolio.

The Smart Portfolio option also offers hands-off stress-free investing based on your risk tolerance. BONUS: Stash is giving new members $5 for any first investment so create an account to get started!

8. Build or Rebuild Credit Safely Using a Debit Card

It’s a catch-22 when you need credit to build credit and a bad credit score can cost you thousands of dollars in the long run.

Safely re/build your credit with Extra, the first debit card that lets you build credit and earn rewards points like a credit card. There’s no need to switch banks, plus there are no credit checks and no interest.

Take it from Abhay A., a 24-yr old from GA: “My score is up almost 100 points since I first started using Extra!”

Here’s how it works:

- Sign up for Extra by linking your existing bank account (no credit check!)

- You’ll get a spending limit based on your bank balance

- Swipe your Extra debit card like normal, and they’ll spot you the money now and pay themselves back the next day

- They report all your payments to the credit bureaus to build your credit!

You’ll even earn up to 1% in reward points for stuff you already spend on like coffee, food delivery, and bills. And re/building your credit safely with Extra only costs as low as $7/month!

Bonus: This Company Pays $40K+ Daily for Members Who Take Surveys (Free to Join!)

Survey Junkie pays cash to members who participate in surveys about their shopping habits, cell phone usage, and more. Basic stuff.

Completing a survey earns you 20 to 100 points and when you hit 500 points (or $5) you can cash out. Redeem for an online gift card, Paypal cash, or transfer straight to your bank.

Signing up for Survey Junkie only takes a few minutes and you’ll earn your first 100 ($1 value!) points just by creating an account, filling out an intro questionnaire, and verifying your email address. Easy.

After that, you’re free to dive into surveys. They have surveys with various durations (5 to 20 minutes) to complete and new ones pop up constantly so you’ll never be bored!

Survey Junkie won’t get you rich quickly (no survey sites ever do), but it’s an easy way to make some extra cash by doing nothing other than giving your opinions. Anything to help pay the bills!

*© 2021 Experian. All rights reserved. Experian. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures.

Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank or Stride Bank, N.A., Members FDIC.

*SpotMe limits start at $20 and can be increased to $200 or more based on factors like Chime account activity or history. When your next deposit arrives, Chime will apply to your negative balance.

1The Annual Percentage Yield (“APY”) for the Chime Savings Account is variable and may change at any time. The disclosed APY is effective as of July 13th, 2022. No minimum balance required. Must have $0.01 in savings to earn interest.

2The average national savings account interest rate of 0.08% is determined by FDIC as of June 1, 2022 based on a simple average of rates paid (uses annual percentage yield) by all insured depository institutions and branches for which data are available. Visit National Rates and Rate Caps to learn more.

**Chime’s Early access to direct deposit funds depends on the timing of payer’s submission of deposits. We generally post such deposits on the day they are received which may be up to 2 days earlier than the payer’s scheduled payment date.

Opploans available to residents of FL, AL, AR, AZ, CA, DC, DE, GA, HI, ID, IL, IN, KY, KS, LA, ME, MI, MN, MS, MO, MT, ND, NE, NV, NM, OH, OK, OR, RI, SD, TN, TX, UT, SC, WA, WI, WY, and VA

Opploans – Subject to credit approval and verification. Actual approved loan amount and terms are dependent on standard underwriting guidelines and credit policies. Funds are typically deposited via ACH for delivery for next business day if verification is completed and final approval occurs before 8:00 PM CT, Monday-Friday. Availability of the funds is dependent on how quickly your bank processes the transaction.

*Opploans approval is subject to confirmation that your income, credit history, ability to repay, and application information meet the minimum requirements established for this offer. Not all applications are approved.

^Applicants’ credit scores are obtained from Clarity Services, Inc., a credit reporting agency, which shows up as a soft pull on your credit report and is only visible to you.

+OppLoans reports customer payment history to the three major credit bureaus. On-time payments may improve credit score. Credit reporting not available for Texas customers.