Federal Student Loan Payment Pause Extended Until December 31st, 2022

Since March 2020, federal student loan borrowers have benefited from total forbearance on monthly payments due to the COVID-19 pandemic. Many borrowers have had more room to breathe (financially, that is) for more than two years. This has meant more time to save money, invest money and pay down other debt.

Fortunately, federal student loan borrowers can celebrate once again: the current student loan administrative forbearance has been extended through December 31st, 2022 – and seemingly for the last time. The original date for student loan payments to resume was September 1st, 2022. This means that borrowers have an additional 4 months to get their finances in order before payments resume on January 1, 2023 (woohoo!).

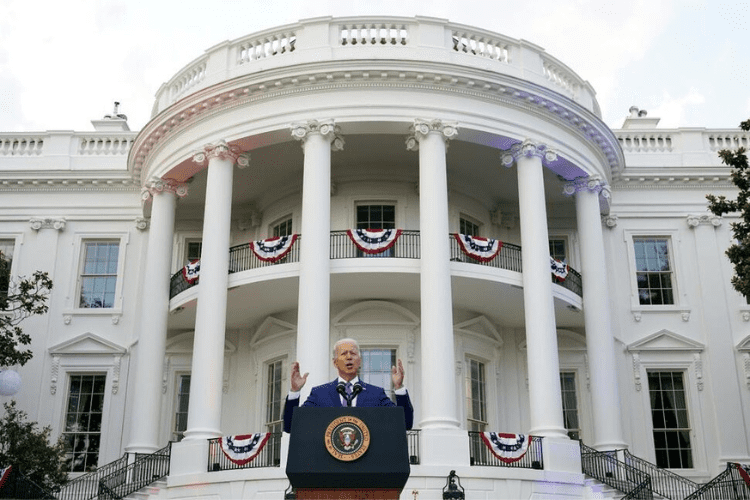

Citing the continued COVID-19 issue and the economic disruption it has caused as the reasons for the lastest extension, the Biden administration has decided to pause payments once again.

Millions of borrowers have been adversely affected by the pandemic as well as rampant inflation, which has sent the cost of housing, groceries, gas, and college tuition to skyrocket. Better yet, the Biden administration also enacted sweeping student loan forgiveness – read more about that here.

Let’s take a look at what updates have been circulating from Congress these past few months and how this led to the new extension on the payment pause.

Congress Puts More Pressure on Biden To Enact Student Loan Forgiveness

Fortune explains that three members of Congress had been petitioning the White House to make sure there would be sweeping student loan forgiveness.

Senate Majority Leader Chuck Schumer (D-N.Y.), Sen. Elizabeth Warren (D-MA), Rep. Ayanna Pressley (D-MA), and Rep. Alexandria Ocasio-Cortez (D-N.Y.) all petitioned for an additional extension on the student loan payment pause.

If student loan payments were to restart on September 1st, 2022 as originally planned, members of Congress have said that:

- Student loan borrowers are still not financially secure due to the COVID-19 pandemic, particularly with the emergence of new COVID variants and outbreaks.

- Nine million student loan borrowers in default could be subject to wage garnishment and other debt collection methods should they be financially unable to resume their payments.

- Black and Latinx households would face a disproportionate burden from quickly resuming student loan payments. In fact, black students are more likely to borrow for school and take out larger loans. The Biden administration hopes this round of sweeping student loan forgiveness will remedy some of the racial inequity that exists in the U.S.

Luckily, it seems like pressure on the White House from these key political figures may very well have played a role in the announcement of another payment pause.

Are Student Loan Borrowers Ready to Begin Repayment?

The short answer is no.

According to the Student Debt Crisis Center, a nonprofit organization focused on student loan debt, a whopping 89% of fully employed student loan borrowers said they are not financially secure enough to resume payments. Hopefully, this additional 4-month pause will allow borrowers to prepare for their monthly payments once again.

Here are some statistics about student loans and repayment from the nonprofit’s survey:

- 21% said they will never be financially secure enough to make any student loan payments again.

- 27% of respondents say that at least one-third of their income will go toward student loans when payments resume.

- 10% of respondents say at least half of their income will go toward student loan payments.

- 44% of fully-employed student loan borrowers said they cannot afford their monthly student loan payments or are in student loan default.

- 45% of respondents say their financial wellness is currently poor or very poor compared with 25% who said the same before the COVID-19 pandemic.

Is Total Student Loan Forgiveness Possible?

In short, probably not.

While there’s been some $16B of targeted student loan forgiveness these past few months and now an additional $10-20K per borrower, the buck might stop here. If you fall into one of the categories below, you might have already been eligible for student loan forgiveness:

- Borrowers who attended now-defunct schools.

- Borrowers with complete and permanent disabilities.

- Borrowers who are public servants, such as teachers, firefighters, or social workers, under the Public Service Loan Forgiveness program (PSLF).

It’s definitely a good idea to do some research and be sure exactly what student loan relief you qualify for so you can plan your finances and budget accordingly before payments resume next year.

The Bottom Line

With the uncertainty of the COVID-19 pandemic, record inflation, and economic instability as a result of the Russia-Ukraine conflict, an additional extension on the existing COVID-19 student loan payment forbearance is certainly welcomed by millions of borrowers.

There are many Americans who are still facing financial hardship from the onset of the pandemic in March 2020.

Our advice? Prepare yourself and your finances now for payments to resume on 1/1/23. We will be sure to update this article again should there be any additional payment pauses.

Read More: Maine Will Pay Your Student Loans If You Move There