FICO’s New Credit Score System for 2019

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance because talking about money should always be an honest discussion.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance because talking about money should always be an honest discussion.

FICO, Experian, and Finicity, three of the leading fintech (financial tech) companies, joined forces last quarter to announce a new type of credit score. For consumers, this means your credit score could look a lot better later this year.

The new score, called UltraFICO™, will include all information that goes into a typical credit score plus data from your checking and savings accounts. The goal, according to FICO’s press release, is to give consumers more ways to show responsible financial management.

UltraFICO™ will launch in early 2019, and consumers can opt-in to contribute any information they think would benefit their score.

How UltraFICO™ Can Help You

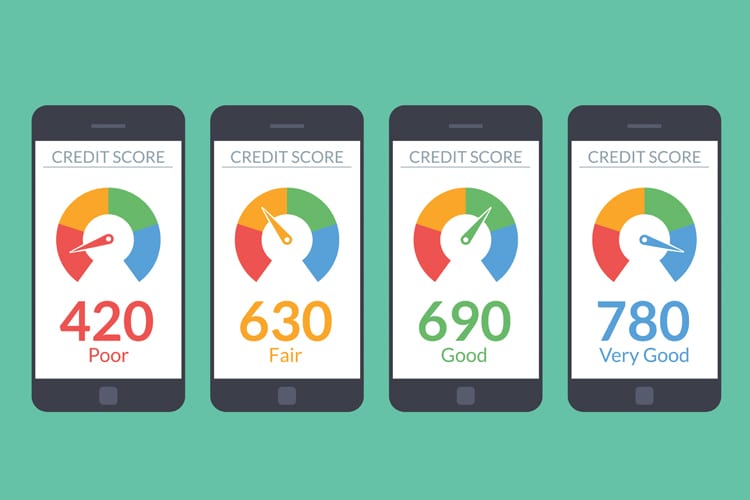

About 20% of Americans have a credit score between 550-650, and they stand to benefit the most from UltraFICO™. The new scoring system can help all consumers boost their score and get more access to credit, but especially those in the credit “grey area.”

In addition, consumers with little credit history or with past financial troubles stand to benefit greatly from the UltraFICO™ system.

“This approach allows Americans to benefit from positive financial behaviors,” said Steve Smith, the CEO of Finicity. “We are proud to have created a new way for consumers to share financial information, safely and securely so that a new UltraFICO™ Score can be created.”

The UltraFICO™ system will allow consumers to build a strong credit profile more easily. This gives them a chance to raise their score, or establish a high one.

UltraFICO™ will roll out as a pilot program early this year in an effort to assess the score and users willingness to submit more information. While it could end up being beneficial to consumers, it’ll have to catch on quicker than other credit-tracking tools.

For example, Vantage Score rolled out their 4.0 model last year, but every score provider they work with still uses 3.0.

Still, 26 million Americans do not have a large enough credit history to qualify for a score. UltraFICO™ presents a great step toward fixing that problem.