9 Financial Apps For 20-Year Olds to Level Up their Money Status

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.There are so many financial apps that it can get overwhelming. And besides your normal banking apps, you could be missing out on some unique apps that can really help level your financial status, especially when you’re in your 20s.

For instance, how does instantly adding 12 points to your credit score sound? Or never paying overdraft fees – ever – again?

We’ve handpicked a few of our favorites below that can give you a nice variety. They’re all free to download so try them out to see what works for you!

1. Investing is Your Money Making Babies. Here are 3 Apps to Try:

No rule says you have to only use one investing app. Try different portfolios on each!

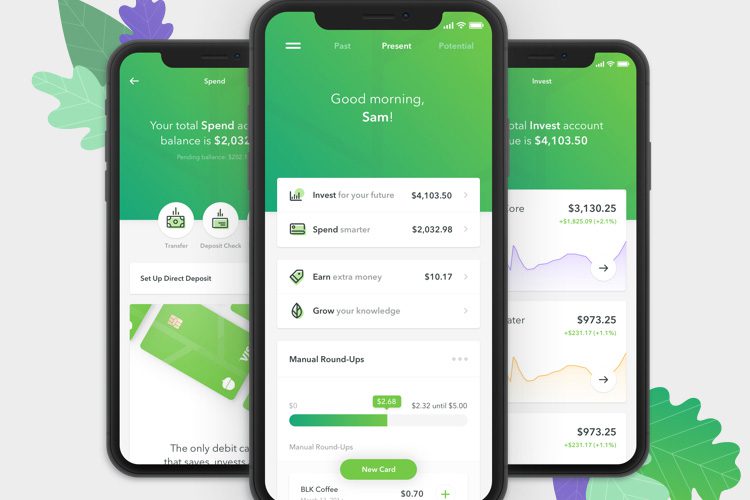

Stash lets you start investing with just $5! You can choose where to put your money (even in Google, Amazon, Tesla, Netflix, etc), and they’ll provide guidance and tools to help.3

With Stash Growth and Stash+, you can also choose the Smart Portfolio4 option which offers hands-off stress-free investing based on your risk tolerance.5 Plus claim bonus stock when you attend Stash’s virtual Stock Parties!

BONUS: Stash is giving new members $10 for any first investment so create an account to get started.2

Get free stock worth up to $200 with Robinhood, the free-trading app that lets you trade stocks, ETFs, and options, along with cryptocurrency all for free. No commission fees! It makes it really easy for new investors to get started with just $1.

You’ll also earn interest on any uninvested cash too. With a near-perfect 4.8 score from 2.3 million people, it’s a popular app that you should check out if you’re interested in investing.

Public is a social-investing app where you can buy any stock you want for as little as $1, all commission-free. Follow other investors on the app (financial experts, entrepreneurs, celebrities, athletes, etc.) and get a first-hand look at what they’re investing in and why. You’ll be able to buy the same stock or ETF with however much money you’re comfortable with!

Learn tips from the transparent community to build your financial literacy, invite friends and earn free stock, and see what Wall Street Thinks to buy, hold, or sell what you have.

2. A Legit Way to Earn $750 This Week

You can get $750 direct deposited into your bank account and all you have to do is try out some deals. The catch? You can only do this once a year!

Seriously, anyone 18+ can participate in Flash Rewards, a rewards program that’s been around since 2016 and has rewarded $11 million to members over time.

So how do you get the money? Answer: You just have to follow the instructions carefully!

Flash Rewards work by showing you “deals” they think you would like. This includes mobile apps and games, subscriptions, financial services, etc. Each type of deal you choose has its own mini task to complete.

- Head over to Flash Rewards and fill out basic info (Email, Name, etc.)

- Take a quick Survey (it helps figure out the optional offers & required deals to recommend)

- Complete deals by shopping Flash Rewards’ great brand name partners.

- Important: Follow the instructions on completing the specific number of deals for each level and get to Level 5 to get the maximum reward! (there are plenty of deals to try – some are free trials or app downloads, others require a purchase!)

- Claim the reward and get it in about a week!

You won’t get your reward if you don’t complete the required amount of deals. Sure, it takes a little more effort but it’s legit. Get your $750!

3. Ask This Company To Pay Off Your Outstanding Credit Card Debt

It’s 2024, and you want to body slam that debt down and keep it down. You just need a little help doing it.

MyLendingWallet can help if you have under $35,000 in debt. They’ll offer a personal loan that pays off all your balances and consolidate them into one balance to make it easier on yourself.

Regardless of credit status, you can quickly determine if you qualify for a loan with APRs ranging from 5.99% to 36% max. Since their network has over 100 vetted lenders, you’ll be able to compare with no obligation either.

You can get funds as fast as 24 hours, and they have flexible repayment periods (61 days to 72 months!). Even better? There’s no credit score impact to check, so see how LoansUnder36 can help now! It only takes 2 minutes.

4. The Money App Backed by Celebrities That Saves AND Invests for You

Acorns has caught the attention (and their investments) of Blackrock, Paypal, and major names like Dwayne Johnson and more. Plus, they have about 10 million all-time customers!

That’s because Acorns automatically saves and invests your spare change from every purchase with the Round-Ups® feature. You’ll get a diversified portfolio picked by experts based on your investment profile.

You only need $5 to start investing, and when you set up recurring investments, you’ll get a $20 bonus!

Get started in under 5 minutes with no financial experience or expertise needed. You’ll also get access to retirement, investing for families, rewards, and more based on your subscription plan.

With no hidden fees, Acorns makes it easy to invest in your future with your spare change!

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.