Your Horoscope’s Best Financial App for 2022

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Disclosure: We’re letting you know that this post contains sponsored links which The Smart Wallet receives compensation for, which may impact their order of appearance. This site doesn’t include all available offers.

Whether you wholeheartedly believe in astrology or think it’s just fun pseudoscience, there is an undeniable attraction towards any type of guidance or meaning in our lives.

It helps validate ourselves and paints a picture of where we fit in the world and why we act the way we do.

So hi, I’m a Taurus, nice to meet you. 🙂

Just like how certain relationships can mesh well with specific signs, there are financial apps that can speak to your inner astrological self. As everyone is unique, you’ll probably like more than one app on this list, so feel free to branch out!

1. Aquarius Are Conscious of How Their Spending Impacts the World So Ethical Investing is Key

Aquarians definitely like to have fun and spend money, but they’re cautious about it. They believe money can be a tool for good or evil and are conscious of how it can be spent that can impact the world.

They are particularly interested in brands that “do good” and would do well to consider ethical investing called ESG (environmental, social, and governance) or SRI (sustainable, responsible, and impact.)

You can easily find and support ethical companies in Stash, an investment app, that lets you start investing with just $5. You can choose where to put your money in and they provide guidance and tools to help you along the way. You can invest in some of the major companies that you use or buy from regularly to make a custom Personal Portfolio.

As a bonus, Stash is giving new members $10 for any first investment so create an account to get started.

2. Pisces Don’t Care Too Much About Money But This One App Can Help Keep It

Those born under Pisces are the most sensitive as well as the most artistic of all zodiacs. They’re practically born artists.

Because of this, they don’t necessarily care about money the same way others do since there are more important things in life to them. But it’s important to keep what you do have and not waste it on silly charges like overdraft fees.

Skip the bank fees and apply to Chime, a free online bank account with absolutely no monthly fees (yes, seriously) and savings at 1.00% APY1 — which is 12x2 the national average!

Their SpotMe feature lets you continue with a needed transaction even if you overdraft. That extra $20 you needed for groceries? No worries, Chime will spot you up to $200.3

No monthly fees, no minimum balance requirement, no foreign transaction fees, and FDIC-insured up to $250,000. Get paid up to 2 days earlier** too since Chime processes your employer’s deposit immediately, giving you access quicker than traditional banks.

3. Aries Can Be Compulsive Shoppers so Make an Extra $5,500/Yr to Supplement

Aries can be both compulsive and impulsive shoppers which means they can burn through a lot of cash. Instant gratification is in their wheelhouse.

To offset the spending, take a breather before hitting buy on that online purchase and make some extra side money for free with Steady since on average members make $5,500 a year more!

Find thousands of new part-time opportunities daily. Once you link your bank account (it’s secure!), the app’s Income Tools feature will give you personal insights into the extra money you’re making. It’s free to sign up!

4. Taurus Are Routine Creatures that Can Benefit From This Financial Check Each Year (Save $826/Year)

Tauruses’ core traits are appreciation for routine, hard work, and being realistic. They prefer the slow & steady approach.

Even though they can enjoy the finer things in life without breaking the bank, they can be lazy too. Preserve even more money with just an auto quote check-up each year since on average people spend $826/year more than needed on car insurance (but are too lazy to check).

But you can check how much you can save in literally 30 seconds. It’s easy:

- Head over to The Smart Wallet’s auto insurance portal and connect your current insurance (no long form to fill out!)

- We’ll instantly check for a better deal

- See your savings!

It’s the simplest and easiest way to get a refund on your overpriced car insurance policy.

5. Gemini Can Struggle to Save So Let This Finance App Do the Work and Save $720/Year

Geminis are responsible most of the time but are unpredictable, so the few times of making bad choices or other risky moves can set you back at square one.

It might be hard for you to see your “old age” self in the future and therefore it feels harder to save for that time. Use Truebill instead, a free money management app that’s like your personal finance assistant. It groups all your banking accounts together so you can see your earnings and spending in one spot. Plus, it helps you budget even if you don’t know how to.

It’s simple:

- Download Truebill for free

- Link your bank accounts and credit cards so Truebill can analyze transactions (it’s secure and read-only access!)

- You’ll get monthly reports of your spending and how it changes over time

Plus:

- The app will find all your recurring bills and subscriptions (even those you forgot about)

- Truebill can help lower your bills by 20% (they negotiate for you)

- The app also helps you start budgeting and set up auto-savings too

6. Cancers are Great at Building Nest Eggs So Invest in Real Estate to Build Even More Wealth

Caring Cancers’ happy place is the home. And naturally, they’re great at building nest eggs and in general, saving. Another way to build those savings?

Investing in commercial real estate. HappyNest offers the opportunity to invest in a REIT (real estate investment trust) with no platform or broker fees.

It only takes $10 to start because you’re investing in shares of the REIT, a growing portfolio of commercial real estate but not owning the actual property itself. Simply, you’ll be earning income from the guaranteed rent that’s collected from Fortune 100 tenants, like CVS Health, FedEx, and more!

7. Leos Love Spending Money So This Company Helps Pay Off Credit Card Debt (Up to $50,000)

Glamorous Leos love celebrations, buying on-trend gifts, and they have a desire to share the wealth. They don’t have issues making money, but that spending habit can get quite expensive. Because of that, there may be cases of credit card debt that can rack up pretty easily.

If you have credit card debt of $50,000 or less, then AmONE can help by matching you with a low-interest loan to pay off all your balances.

This will leave you with just ONE bill each month, making it easier to manage as well as benefiting from a lower interest rate. AmOne starts at just 2.49% APR compared to credit cards that can go as high as 36%!

The lower the APR, the less interest over time you have to pay back which means getting out of debt even faster. Plus using AmONE has no credit score impact and repayment periods are flexible.

It only takes 2 minutes to check and you can get the funds as quick as 1 business day!

8. Virgos are Always Looking at the Future so Maintain Credit Score With This

Virgos are detail-oriented, loves plans, and their tendency to look at the future makes it hard to be present to enjoy the money they have now. Make sure your financial future is intact with one of the most important numbers of your life – your credit scores.

Credit Sesame is a free credit monitoring service that helps you improve and maintain your score. No credit card is needed!

Get an easy-to-read view of your total debt plus everything that’s contributing to your current scores like credit usage, credit age, inquiries, and payment history. It also comes with personalized recommendations to help increase your score!

It’s free to use so this is definitely a must-have since low scores can affect your daily life.

9. Libras Are Balanced with Saving and Spending but Spends More on Social Activities

Libras are networking masters that have a good sense of balance in both spending and saving but they’re social creatures. This means they tend to spend more on going out with friends and on entertainment.

Since Libras tend to be indecisive, let this checking account handle it for you. With Acorns Checking, you’ll get a checking account that automatically saves and invests for you!

Invest spare change into an expert-designed, diversified portfolio of stocks and bonds every time you make a purchase. Acorn’s new Smart Deposit feature takes a portion of each paycheck and automatically sets it aside into your checking, investing, and retirement accounts.

For a limited time, get a $75 bonus when you set up a direct deposit and receive the first 2 deposits successfully. 9.75 million people already trust Acorns. Try it out and see for yourself!

10. Scorpios Can Strategically Make Money Off Their Neighbors

Scorpios tend to be single-minded when it comes to goals making them very ambitious.

Channel that ambition to utilize any unused space in the home to make money from. Basically turn an unused closet, room, garage, and more into passive income!

Do it by becoming a Neighbor Host, where it’s free to list unused space to earn extra money each month. Becca P., a middle school teacher makes an extra $10,000 a year being a host!

- List your space for free (describe the space you have available, upload photos, and how much you’d like to earn)

- Review renter requests (what they want to store/when) and approve

- Schedule a move-in time with your new renter for their belongings

There’s no extra paperwork and Neighbor automatically deposits money into your account each month, even if the renter doesn’t pay. Plus, there’s $1,000,000 property coverage for you and protection plans for your renters.

11. Sagittarius Entrepreneurs Can Save $1,700 a Year With This

Sags are all about growth which tends to make them great bosses. However, most end up working for themselves as entrepreneurs.

If you’re a freelancer turned small business Sag, you’ll know that tax time is never fun for side hustlers. And separating personal and business spending? Confusing.

That’s why Lili, (awarded best bank account for small biz owners!) helps you focus by offering mobile banking specifically designed for you.

Enjoy no account fees, no overdraft fees, no minimum balance, no foreign transaction fees, plus get paid up to 2 days earlier via direct deposit. Lili also provides tools like automatically generated Expense Reports, Expense Management swiping, and Tax Bucket to help you plan & prepare taxes all year long, instead of last minute.

They’ve even done the math and by using Lili, you’d save 60 hours and $1,700 per year. And yes, it’s free to sign up!

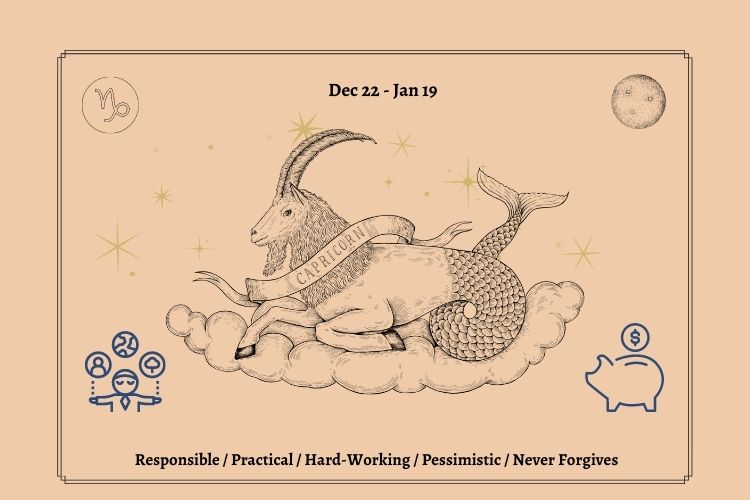

12. Capricorns Prefer Slow & Steady Making them Great Long-Term Investors

Capricorns do not get wooed by get-rich-quick schemes. They’re workaholics, practical, and grounded making them ideal candidates for long-term investing.

They can start investing with Robinhood which crushes the notion that you need to be rich to invest, and lets new investors get started with just $1.

This free trading app lets you trade stocks, ETFs, and options, along with cryptocurrency, commission-free! When your application is approved, they’ll give free stock worth $2.50 up to $225 for new members, with chances to get a high-value stock in Facebook, Microsoft, etc.

With a near-perfect 4.8 score from 2.3 million people, it’s a popular app that you should check out if you’re interested in investing.

All images created with Canva

Some of the sponsored links that appear on this page are from companies that offer investment advisory services. They compensate us; for details on our compensation arrangements, please click here.

Paid non-client endorsement. See Apple App Store and Google Play reviews. View important disclosures.

The paid partner received cash compensation of up to $150.00 (per cost per action) for providing this endorsement. Compensation creates an incentive for the individual to recommend Stash. Endorsements are not representative of the experience of all clients and are not guarantees of future performance or success. For a representative sample of client testimonials, refer to Apple App Store or Google Play reviews To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account (“Personal Portfolio”).

Promotion offer is subject to Terms and Conditions. *T&Cs.** You must complete within the specific time period included in this offer: (i) successfully complete (or already have completed, or re-apply for and complete) the registration process of opening an individual taxable brokerage account (“Personal Portfolio”), (ii) link a funding source to your account; AND (iii) deposit at least $5 from your funding source into your Personal Portfolio. *T&Cs

Nothing in this material should be construed as an offer, recommendation, or solicitation to buy or sell any security. All investments are subject to risk and may lose value. All product and company names are trademarks ™ or registered ® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

Stash Growth Plan starts at $3/ month. You’ll also bear the standard fees and expenses reflected in the pricing of the ETFs in your account, plus fees for various ancillary services charged by Stash and the Custodian. Please see the Advisory Agreement for details. Other fees apply to the bank account. Please see the Deposit Account Agreement.

Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank or Stride Bank, N.A., Members FDIC.

1Chime SpotMe is an optional, no fee service that requires $500 in qualifying direct deposits to the Chime Spending Account each month. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases initially, but may be later eligible for a higher limit of up to $200 or more based on member’s Chime Account history, direct deposit frequency, and amount, spending activity and other risk-based factors. Your limit will be displayed to you within the Chime mobile app. You will receive notice of any changes to your limit. Your limit may change at any time, at Chime’s discretion. SpotMe won’t cover non-debit card purchases, including ATM withdrawals, ACH transfers, Pay Friends transfers, or Chime Checkbook transactions.

https://www.chime.com/policies/bancorp/spotme_terms/

https://www.chime.com/policies/stride/spotme_terms/

2The Annual Percentage Yield (“APY”) for the Chime Savings Account is variable and may change at any time. The disclosed APY is effective as of July 13th, 2022. No minimum balance required. Must have $0.01 in savings to earn interest.

3The average national savings account interest rate of 0.08% is determined by FDIC as of June 1, 2022 based on a simple average of rates paid (uses annual percentage yield) by all insured depository institutions and branches for which data are available. Visit National Rates and Rate Caps to learn more.

4The average national savings account interest rate of 0.06% is determined by FDIC as of November 1, 2021 based on a simple average of rates paid (uses annual percentage yield) by all insured depository institutions and branches for which data are available. Visit https://www.fdic.gov/regulations/resources/rates/ to learn more.

*The Smart Wallet is a paid affiliate partner of Robinhood