How Reddit Users Took Over The Stock Market

To put it lightly, it’s been a weird few weeks for the stock market. Stocks like GameStop, Nokia, and AMC saw massive surges in January, largely spurred on by investors from Reddit. In a matter of days, an internet message board rattled the market, shocked institutions, and nearly forced a multi-billion dollar hedge fund to dissolve.

If you haven’t heard by now, this is the story of how r/WallStreetBets turned the stock market on its head, at least for a week.

Wall Street Bets

Although it just went mainstream, r/WallStreetBets has been around for more than five years. The investment-focused subreddit slowly built up membership to around 1.5 million late last year, and now more than 6 million Reddit users follow the page. The page became known for the aggressive and risky trades users shared, creating some of the most insane, stomach-churning finance stories of all time. One user reportedly made $700,000 in less than two weeks – and immediately lost it all within another two.

The content on the subreddit is often vulgar, confusing, and sometimes downright offensive. On the flip side, a number of users have gone viral for sharing some of their investment earnings with charity and encouraging others to do the same.

In recent weeks, WSB investors have made ripples throughout the market and have come under fire from the media and financial institutions. Many investment platforms barred trades of popular WSB stocks, at least temporarily, and some have even called for Redditors to face legal consequences. But more on that later – let’s get into how a subreddit shocked the market in a matter of days.

The Short Squeeze

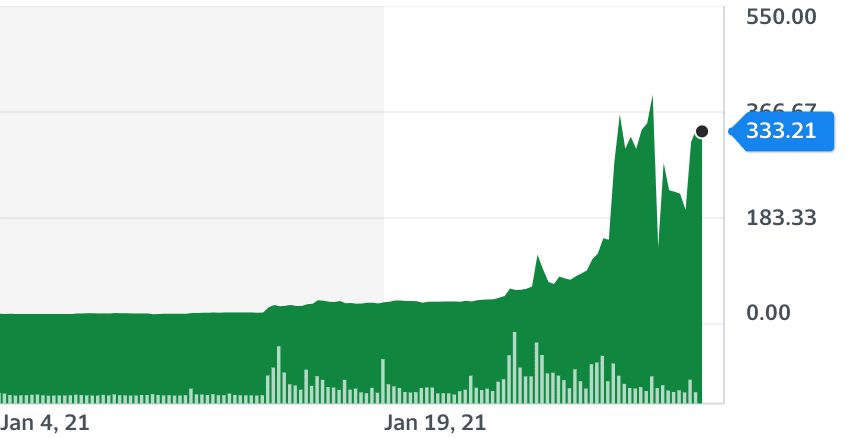

In August 2020, GameStop’s stock was trading at roughly $4 per share. By mid-January, the stock had climbed somewhat but peaked around $20. Fueled by investments from WSB users and other retail investors, GameStop rose as high as $494 a share and is still sitting above $300. GameStop’s price shot so high so quickly because of a short squeeze, a rare occurrence that can cause prices to climb dramatically.

Essentially, a number of institutional investments bet against GameStop by shorting the stock, setting themselves up to profit if GameStop’s share price dropped. The stock was heavily shorted, essentially ringing the death knell for GameStop.

However, WSB users began buying GameStop en masse, driving the price higher and higher. Many of those betting against GameStop felt pressured to sell out of their short position, and/or buy GameStop to help hedge against severe losses. As a result, demand for $GME continued to increase, driving the price higher and higher.

So those who were shorting the stock were “squeezed” out of their investments by pressure from retail investors. The more heavily a stock is shorted, the more susceptible it is to a short squeeze. GameStop, for instance, had 140 percent of its outstanding stock shorted. In some cases, shares were shorted twice. Even other stocks that Reddit users have attempted to squeeze haven’t come close to GameStop’s level of short interest, and strong companies like Apple and Amazon are less than 2.5 percent shorted.

Hold To The Moon

So, ultimately, thousands of Reddit users drove a stock price from the single digits past $400. And a handful who heavily invested in $GME has turned in some insane earnings. One user showed a screenshot of their investment account showed that they own 50,500 GameStop shares that they spent roughly $750,000 to acquire. Despite losing $14 million dollars in one day as $GME tumbled on January 28th, the user still owned more than $18 million in GameStop stock. One might think that with those kinds of margins, most Reddit investors will cut and run with their money. But, at least so far, that hasn’t happened.

Instead, r/WallStreetBets users have rallied around holding their positions for as long as possible. #HoldTheLine is popular on Twitter, and many users joke that they’re planning to ride their pick “to the moon.”

Many investors see themselves standing together like Robin Hood and his Merry Men, clashing with the wealthy against unfair practices. Ironically, Robinhood, a popular trading app named for the hero, froze purchases of $GME $AMC $NOK and other popular Reddit picks temporarily, only allowing users to sell while facing pressure from hedge funds.

There’s a sense on WallStreetBets that this is less about GameStop stock or earnings, and more about standing up to institutions that look down on them and try to kick them from the table. If nothing else, the WallStreetBets saga has shone a light on how unfair “free markets” can be to the average investor. And this is not some Reddit conspiracy – prominent politicians are raising the alarm as well.

It is not appropriate for Robinhood CEO Vlad Tenev to protect investors who shorted GameStop. Why would @RobinhoodApp help investors who thought the stock would fall & hurt investors who thought the stock would rise? @SEC_Enforcement should investigate Robinhood’s rigged actions. https://t.co/WxlavMP9ao

— Ted Lieu (@tedlieu) January 29, 2021

Inquiries into freezes should not be limited solely to Robinhood.

This is a serious matter. Committee investigators should examine any retail services freezing stock purchases in the course of potential investigations – especially those allowing sales, but freezing purchases.

— Alexandria Ocasio-Cortez (@AOC) January 28, 2021

The Bottom Line

For many commenters on WallStreetBets, whether or not they earn money on their investment seems immaterial now. Some have compared the anti-institution sentiment of the WSB trend to the Black Lives Matter movement, or even the Capitol Hill insurrection. Neither is a great analogy, but some have speculated that retail investors have enough momentum to keep making waves.

For now, they have the spotlight and the energy – we’ll just have to see where WallStreetBets rolls the dice next.

Read More – Stash Review: Invest in Amazon, Apple, Netflix, and More